Features of DDU and other assignment agreements

Let's consider how to correctly carry out both stages in order to ultimately obtain a DDU in which each point suits the shareholder 100%.

How legal is this? Will this option lead to the possibility of challenging the transaction on the part of the developer or some third parties?

Is it possible to somehow check whether the owner of the apartment is really the one who appears to us? Will the notary check all this during the transaction? Can we contact any notary or only the one at our place of residence?

You will have to personally visit the office of the construction company and submit to the representative a statement that you are carrying out an assignment (assignment of rights). If you decide to ignore the developer, then the court may later cancel the deal and declare it illegal. It will be good if a representative of the legal department of the developer company acts as a third party in the assignment procedure.

To formalize the agreement, the notary must provide the following documents:

- Passport.

- Title documents for housing (purchase and sale agreement, participation in shared construction, etc.).

- A document confirming state registration of ownership of real estate.

- Marriage certificate.

- Birth certificates for all children.

- A copy of the notarial obligation to allocate shares to children and spouse.

Should I draw up a consent agreement or not?

The notarized consent of the spouse to purchase real estate, according to lawyers and specialists, will protect the seller and buyer from unnecessary problems.

To obtain consent you need:

- passport;

- Marriage certificate;

- real estate documents;

- application in the form of a notary.

After signing the document and its certification by a notary, registration takes place in Rosreestr.

A purchase and sale transaction can be canceled within the first 24 hours after signing the contract, if one of the parties did not give its written consent. In cases where the spouse cannot provide permission (imprisonment or incapacity), the transaction is drawn up with the involvement of a lawyer and a notary, which incurs additional financial costs, but only this will avoid the recognition of the transaction as invalid.

This is important to know: Buying an apartment through assignment of a mortgage

Considering that a lot can change in life, it is better not to save money on such procedures and draw up documents according to the rules, demanding the same from the other party.

Peculiarities of acquisition of housing under the DD by spouses

When registering an agreement for participation in shared construction (one of the spouses) in Rosreestr, the latter requires the notarized consent of the second spouse. The purchase of real estate within the framework of this DDU occurs through 1) a targeted housing loan provided by the state; 2) own funds received by one of the spouses (who is a participant in the DDU) under a gift agreement for the intended use.

The main thing that lawyers advise you to pay attention to when drawing up such an agreement is the presence of a clause on the preparation of the DDU itself and the timing of this action. Legally, the PDDU document is just an act of intent to conclude this document in the future. As a document, an equity participation agreement (EPA) has existed for a long time, but only in 2005 a bill was issued that protects the rights of citizens from legal fraud on different sides of the process. A summary of these “protective rights” is called an equity participation agreement 214 Federal Law.

I am planning to buy an apartment in a building under construction. The transaction will be carried out under an assignment agreement concluded in conjunction with the preliminary purchase and sale agreement.

Sample of spouse's consent for DDU

AGREEMENT

to conclude an agreement for participation in shared construction

I, full name, passport series No. __, issued by ____, registered at the address ______, married to the full name, passport series No. ___ issued, registered at the address___, marriage certificate series __ No. ___ issued by ______,

I hereby declare my consent to the conclusion by my husband of an agreement for participation in shared construction with LLC ____ in relation to the apartment ____, located at ____ (specify data from the DDU) with an area of ___ on the terms and at the discretion of my spouse.

The content of Articles 33 – 36 of the Family Code of the Russian Federation, Articles 253 and 256 of the Civil Code of the Russian Federation was explained to me by a notary.

This consent is drawn up in two copies, one of which is issued in person, full name, the other remains with the notary of the notarial district ____ full name.

/Signature with full handwritten transcript/

/Certification inscription of a notary/

Assignment of rights and the developer – is consent required?

To obtain consent from the developer, it is necessary to: pay the entire amount under the shared construction agreement; make sure that there is no corresponding clause prohibiting assignment in the DDU; familiarize yourself with the terms of the agreement - whether there is a fee for the assignment of rights and, if so, in what amount; send the developer a written notification of the desire to carry out the transaction.

When owning shared property, everyone receives a personal income tax deduction in their own amount, and there is no need to write any additional statements.

One of the very cunning tricks that lawyers often encounter is the presence in the contract of a clause on the timing of payment of utility services. If it is not specified, then the owner of the apartment may be required to pay from the beginning of construction of the house. It is necessary to have a line - “from the moment the housing is put into operation.”

If the property belongs to one of the spouses by right of ownership, then consent from the other family member to sell the apartment is not required. Such moments often cause controversy.

○ Notarization.

The purchase of an apartment must be notarized (in accordance with the amendments adopted by Article 2 of Federal Law No. 172), if you purchase it:

This is important to know: Tax deduction when buying an apartment with a mortgage for two spouses

- One or all share owners.

- The guardian of the owner who has not reached the age of majority.

- For a minor or a person declared incompetent.

- One of the spouses during the period of divorce and division of property.

To draw up a purchase and sale agreement you must:

- Personal presence or previously notarized consent to the sale of a share of the apartment owned by them.

- Consent of the guardianship authorities, if we are talking about interests relating to minors or incapacitated persons.

Property purchased during marriage type of property

Consent is not required in the following cases:

- The housing belonged to the spouse even before the official marriage.

- The apartment was inherited (by will or law).

- The property was gifted to one of the spouses (under a gift agreement).

- A marriage contract has been concluded (provided that it states the fact that a specific object belongs to the spouse).

- Both spouses are registered as title owners.

The contract may not provide for the consent of the construction company. But even in this case, the shareholder should send a written notification to the legal address of the construction company about the desire to hold an assignment.

In order to determine the extent of ownership of property by each spouse, during the joint purchase of an apartment, spouses can immediately negotiate and secure their shares in the real estate, that is, immediately sign an agreement on the division of property.

If the second spouse did not give his permission, then no later than a year from the date of discovery of the fact of deception, he can file a claim to declare the transaction invalid.

And in these cases it is not required

- The apartment was given to the spouse before marriage - the consent of the second spouse is NOT required

An apartment registered as a property before marriage is not jointly acquired property, therefore the consent of the second spouse is not required. It doesn’t matter whether the apartment was purchased, received as a gift, as an inheritance, during privatization, etc.

Example No. 1: Dmitry bought a one-room apartment in 2010. Later, in 2020, he married Marina. In 2020, they decided to sell their apartment and buy a small house. To sell the apartment, Marina’s consent is not required, because Dmitry bought the apartment before marriage. Therefore, the apartment is only his property, Marina has nothing to do with this apartment.

This is important to know: Buying an apartment from a contractor: risks

Example No. 2. Marina married Kirill in 2013. Then in 2015 she inherited an apartment from her grandmother. If she decides to sell it, then there will be no need to obtain consent from Kirill.

Example No. 3. Vasily married Daria in 2007. Then in 2017, he and his parents privatized the apartment in order to then sell it. When selling, Daria's consent is not required.

An apartment received by inheritance is not joint property. The heir has the right to dispose of his apartment without the consent of the spouse.

Oleg, being married to Oksana, inherited the apartment from his father. If he decides to sell it, then Oksana’s consent will not be required. This apartment is Oleg’s personal property, his wife has nothing to do with it.

Also, an apartment received as a gift is not joint property. The donee has the right to dispose of his apartment without the consent of the spouse.

Maria married Evgeniy in 2009. Later, in 2020, her parents gave her an apartment. When selling this apartment, consent from Evgeniy is not required.

If the apartment is privatized for one spouse, and the second spouse did not participate in the privatization or refused to participate, then his consent is not required. But it is worth remembering that anyone who refuses to participate in privatization has the right to lifelong use, i.e. live in the apartment for life and be registered in it. This is true even if the apartment is sold. In order for this right to cease, the spouse must simply be discharged from the apartment, or he can be discharged by court decision.

Spouses Maxim and Lyudmila lived in a municipal apartment. We decided to privatize it in order to sell it later. Lyudmila refused to participate in privatization, and only Maxim became the owner of the apartment. Maxim can sell this apartment without Lyudmila’s consent.

Sample of spouse's consent for 2020 amendments official website

Which floor is better to live on in a multi-storey building for health? Recommendations and opinions of scientists, doctors and Feng Shui specialists on the impact of a certain floor on health.

The assignment does not terminate the validity of the main shared construction agreement. Based on the assignment agreement, the parties to the obligation change - a new one takes the place of the original shareholder.

There is such a type of investment as investing free money in the construction of a new building at the zero stage. Square meters at the very beginning of construction cost much less than after the house is completed. It is on the difference in cost that the investor’s earnings are based: he resells the apartment he purchased to another buyer for 2-3 times more expensive under a contract of assignment of rights. The contractor may have rights to the apartment, for example, under an investment contract or offset agreement.

Spouses who have previously entered into a legal marriage can equally dispose of common property. Such relationships and property fall under the legally designated concept of joint property of spouses.

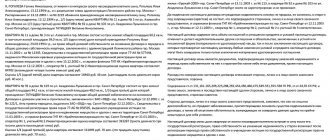

In addition, clarifications on this issue are contained in the letter of Rosreestr dated August 28, 2013 No. 14-ref/07892-GE/13. Below is an excerpt from this letter: Transactions on the disposal of the common property of spouses.

Most fraudulent schemes can be avoided by carefully reading the documents and consciously approaching the process of concluding an assignment. Notifying the developer in order to conclude an assignment agreement is a prerequisite for obtaining consent from the construction company to transfer the rights of claim from one person to another.

Even before the transaction is completed, the assignee (real estate seller) must repay all existing debt to the developer. With the buyer's consent, the debt can be transferred to him. This is done as follows: an agreement is drawn up to transfer the debt to the buyer. Such transactions can be carried out several times during the construction phase.

Hello! Here is a selection of topics with answers to your question: Is the consent of a spouse required when concluding an agreement for shared participation in construction?

Can people divide into shares an apartment that was registered as joint ownership? This possibility exists.