Where should the application be submitted?

When a loved one passes away, you need to properly formalize the acceptance of the inheritance. For this purpose, they contact the notary with a corresponding application. The notary must belong to the office at the last place of residence of the testator or testator or at the address where the bulk of the property being inherited is located. This depends on whether the inheritance is carried out by law or by will.

The heirs must find out whether a will has been drawn up, how many claimants there are for the inheritance, as well as prepare the necessary papers and pay the state fee. Once the certificate is issued, the relatives must register the title in their name.

What is the application deadline?

The legislation provides for a certain period for filing an application, which is six months from the date of death of the testator or testator. In some cases, it begins to flow from the day the court decision that the testator has died comes into force.

After six months have passed, the heirs will not be able to submit the corresponding application. The exception is cases where the absence was due to valid reasons. Then the heir goes to court with a statement of claim and provides evidence of the existence of good reasons for this omission. If the court considers the evidence sufficient, it will extend the period.

There are cases when a shorter period is initially envisaged. This happens if the priority heirs refuse their due share of the inheritance. Then the heirs of the next line can write an application for entry into their inheritance, a sample of which is presented below, before the expiration of six months. If there are less than three months left before the end of the period, it can be extended for another three months.

Rules and example of filling

Actual acceptance

Article No. 1153 of the Civil Code of the Russian Federation states that the acceptance of property occurs on the basis of a standard application for the issuance of a special certificate.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Article 1153 of the Civil Code of the Russian Federation.

The place of opening of the inheritance is the last address of permanent residence of the testator. This is also true in cases where the party to the transaction previously resided in the territory of a foreign state.

The document must contain the following information:

- personal information about the notary;

- passport details of the receiving party;

- grounds;

- owner's last place of residence;

- date of death of the testator;

- list of heirs;

- date of completion and signature.

How to write to a notary

Structure:

- A cap.

- Name.

- A set of clarifications.

- Main part. Personal data about the deceased citizen, and the will of the planned recipient of property assets.

- Final part. The signature of the direct applicant and the specific date of application to the NSO are affixed.

The text must be written briefly and concisely, without inaccuracies.

The legislation does not establish a single sample application to a notary. The main condition is the need to submit the document on physical media. Electronic transmission is not permitted.

Claim form

In practice, there are two ways of accepting property as an inheritance: actual and legal.

Under the first option, successors are required to file a claim in court within 6 months from the date of death of the testator. The application is drawn up in the prescribed form.

If no disagreements arise between the applicants, actual inheritance takes place.

The legislation recognizes this format, but the following problems may arise in the future:

- the heir receives the property left behind, but does not have supporting documents;

- the object cannot be sold or exchanged;

- the possibility of repeated inheritance or donation is limited.

Read How to enter into an inheritance

Circle of heirs by law

Application procedure

The application is only one of the actions that the heir must perform in order to receive the property left behind. Before this, they collect the necessary documents, pay the appropriate state fee, and also receive a certificate on the basis of which they can begin re-registration of property.

In order to clearly understand what the heir should do, it is advisable to describe the procedure step by step, where each step has its own significance.

- Preparation of documentation. To accept an inheritance, they collect a whole package of papers indicating death, the composition of the property, and the rights of the heirs. These documents include the following:

- a document indicating death or a corresponding court decision;

- document confirming the testator's residential address;

- identification;

- documents confirming the presence of a family relationship (which includes a document on birth, adoption, marriage and/or divorce, change of surname).

Papers confirming the presence of a family relationship are required if inheritance is carried out not by will, but by law. In this case, the heir expects to receive a mandatory share of the inheritance. When inheriting by will, it is enough to present only one will.

In addition to these documents, the notary has the right to require other papers, depending on certain circumstances of the case. An example of such documents may be technical documentation or documents establishing the right to property.

- Having collected the papers, they go to the notary. Moreover, a specific office depends on inheritance by law or by will. It is not always known that the deceased left a will. To figure this out, contact any notary. He will check the presence or absence of a will using a single database. If there is a will, it will be kept where the testator made it. If the document was not left, they contact the district notary at the last place of residence of the deceased or the location of his property.

- The notary draws up an application for acceptance of the inheritance. The applicant will be provided with a sample form. Therefore, as a rule, there are no problems with this. But even if questions arise, you can ask them to a notary who will provide the necessary information.

- Next, the state fee is paid. Moreover, you do not need to pay for the inheritance, but notary services are not free. The amount of the duty depends on the relationship between the deceased and the heir, as well as on the value of the property.

- If the deadlines are met, a package of documents is prepared and notary services are paid. The next time you need to contact a notary after six months to obtain a certificate of inheritance.

- After this, all that remains is to register the property with the state authority. This is required when inheriting land, real estate, or, for example, a car or other transport, as well as items that require a special permit to own.

Procedure for filing an application for acceptance of inheritance

There are no complications with the application process. It is enough to fill it out correctly and bring it to the notary. If difficulties do arise, the notary will politely correct errors and help with correct filling. However, you need to remember that filing an application is only part of the inheritance registration procedure. You will need to collect the necessary package of documents:

- a document confirming the death of the testator;

- an extract from the house register where the deceased lived;

- passport of the person who is going to receive the inheritance;

- documents confirming that the recipient of the inheritance is a relative of the deceased.

Perhaps, depending on the situation, the notary may request additional documents. However, here we are talking about a situation where the deceased did not leave a will. If it was nevertheless completed, these documents will not be required. It is enough to make a request to any notary to find out about the existence of a will. Using a single database, he will be able to find out whether the deceased drew up this document or not.

In addition to providing the necessary documents and application, you will need to perform a number of other actions:

- Pay the state fee. Moreover, you do not need to pay for the property itself that you are going to inherit. But you will have to pay for the management of your case and other notary services. The amount of the fee depends on the value of the property received and the extent of the family relationship with the deceased.

- Get a certificate. Having submitted all the documents, you just have to wait until six months have passed from the date of death. At the end of this period, the notary must provide you with a document confirming the fact of receipt of the inheritance.

- Property registration. By contacting the state registrar, you need to record the fact of receipt of the inheritance. Registration is necessary when the object of inheritance is vehicles, land plots, or real estate.

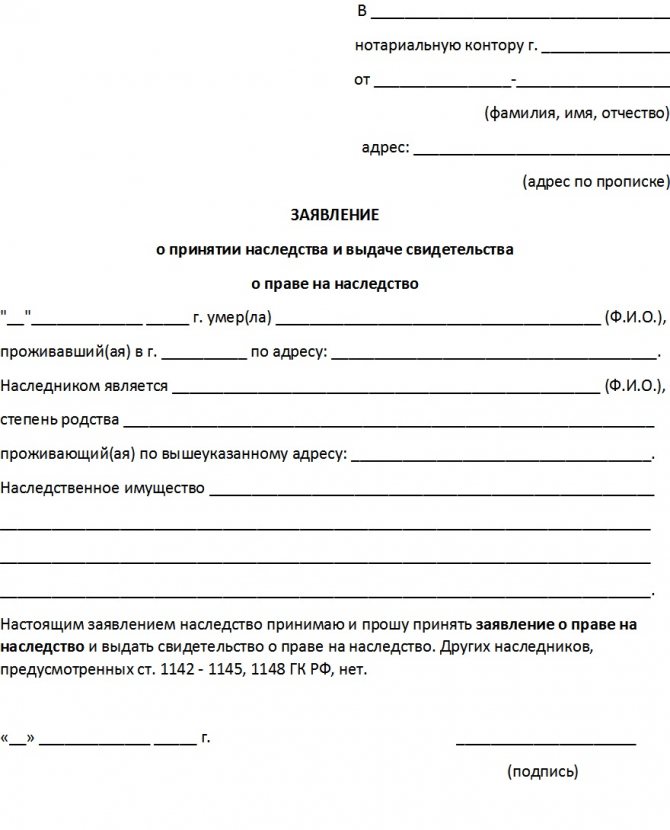

How to correctly write an application for inheritance? Sample

To avoid any difficulties and the applicant approximately knows what to indicate in the application, its contents are discussed below.

- The header indicates the name and address of the office where the application is sent. After this, information about the applicant (heir) is given, namely, his name, patronymic, surname, as well as his registration address.

- Then in the middle the title “Application for Inheritance” is written.

- The descriptive part sets out the essence. Available information about the hereditary mass is also indicated here.

- Date and signature are added.

Attention! An application for inheritance must be written only by the heir personally. Actions by proxy in this case are impossible.

A sample application for acceptance of inheritance can be downloaded here

Expenses of heirs

Notary services are provided on a paid basis. For example, you need to pay for submitting an application to a notary to enter into an inheritance (100 rubles, regardless of whether the applicant used the sample or not). The costs will mainly be incurred by persons interested in obtaining the relevant certificate. Tax rates in this case depend on the relationship with the deceased. Thus, the heirs pay the following fee:

- relatives – 0.3% of the value of the property, but not more than 100 thousand rubles;

- the rest - 0.6% of the value of the property, but not more than 1 million rubles.

Another significant cost when accepting an inheritance is the valuation of the inheritance. Tariffs vary depending on the type of property, region, and organization involved in the assessment. On average, the procedure will cost three thousand rubles. It is ordered before the notary reapplies. The calculation will show the amount that the heir will need to pay to obtain the certificate. The time frame within which the assessment is completed is typically between five and seven days. This expense item can be reduced when contacting government agencies, for example, the BTI. Since the inventory value is lower than the market value, the amount of duty as a result of calculations carried out by specialists of this organization will also decrease.

Notary services are paid separately. On average, this costs from 500 to 1 thousand rubles.

Registration of real estate ownership also comes with costs. Tariffs depend on the type of property inherited. For example, for registering a share in an apartment in an apartment building they pay only 200 rubles, but for the entire property - already 2 thousand rubles. The dacha plot will be re-registered upon payment of a fee of 350 rubles. Registration of a car costs different amounts. So, if you do not need to change the numbers, then you need to pay 850 rubles.

Attention! If the heir lived with the deceased, he will be exempt from paying state duty. You will not have to pay a fee even if the inheritance is transferred to a minor or incapacitated citizen. Heirs who are disabled people of the first or second group will receive a 50% discount.

Identifying other heirs

As a rule, relatives know about the death of the testator. It is very rarely necessary to look for other claimants to the inheritance. The notary does this if he knows that the deceased has other relatives. His responsibilities include informing them about the opening of an inheritance case. If the address is not known, he can publish the relevant information in the media.

Creditors, if any, can also take advantage of the application for inheritance. For them, the notary will provide another sample. Creditors will inform the notary about where the relatives live. If no applicants can be found, then he opens an inheritance case based on the requirements received from creditors. Debts are paid through the discovery of the deceased's assets.

Despite the fact that drawing up an application for acceptance of an inheritance is not particularly difficult, a number of questions may arise regarding the procedure that is accompanied by its submission. Therefore, before contacting a notary, it is advisable to study more information on this issue or seek help from a lawyer.

Deadlines for filing an application for acceptance of inheritance

The inheritance period is 6 months from the date of death of the testator. If the basis for opening an inheritance is the recognition of a person as deceased, then a court decision is taken as the basis.

The six-month period can be extended by 3 and 6 months if the property is transferred to legal successors by right of representation or on the basis of hereditary transmission. Each reason for extending the established period is documented.

The notary is authorized to suspend the deadline for filing an application to accept the inheritance if the testator has a conceived child who has not yet been born. The period is suspended until the birth of the baby, after which the procedure for dividing property is completed.

If the deadline has passed

The Civil Code provides for a mechanism for restoring lost time. To do this, the interested person prepares a statement of claim to the court with a request to restore the missed deadlines and re-divide the inherited property.

The basis for reinstating the deadline is compelling circumstances that prevent a person from submitting an application to the notary in a timely manner to accept the inheritance:

- long-term illness with hospital treatment;

- long business trip;

- long stay outside the territory of Russia.

The claim is supported by documents. After considering the claim, the judge sends the original decision to the notary, who resumes the inheritance proceedings and re-divides the property.

The interested heir can avoid legal proceedings if he receives from each candidate who received the property a handwritten statement confirming the absence of claims for the restoration and resumption of inheritance proceedings.