- Yana Semeleva

- 14 510

The presence of remote bank account management services allows you to perform the vast majority of operations without leaving your apartment. Having a device connected to the network, a registered account and login information, a bank client will save himself from the need to wait, communicate with neighbors in line and other “delights” of visiting a branch. The largest bank in Russia offers to use the Sberbank Online service to pay taxes, make money transfers, currency and other transactions, without visiting the office. Receipts or forms are no longer needed; it is enough to know payment information or be able to use the services of organizations whose services require payment. If any difficulties or questions arise regarding the operation of the applications, the client can always ask for help by calling 900.

Pay a visit to the tax office

The easiest way to clarify the amount of the mandatory contribution and receive a receipt is to contact the tax authority at your place of registration directly. By presenting your passport and TIN, you will be able to obtain the necessary information. The tax officer will also print out a duplicate payment receipt for you, which can be presented at any bank.

Important! Since 2020, contacting the tax authority if a receipt has not been received is the responsibility of every payer.

According to clause 2.1 of Article 23 of the Tax Code of the Russian Federation, every citizen who has not received a receipt is obliged to report this to the tax office at the place of registration of the property. This must be done no later than December 31 of the current year. The application for the absence of notification must be accompanied by copies of documents confirming your ownership of the real estate. Two categories of citizens are exempt from this obligation:

- those who have already received a notice of tax payment for this apartment at least once;

- those who have applied for tax benefits.

That is, if you recently purchased real estate, in the absence of a receipt, you should contact the local Federal Tax Service to check whether they have made changes to the database. But if you have owned your home for more than a year and have already paid taxes on it, you will not have to write a statement about the absence of a receipt.

Payment of taxes in your personal account on the Federal Tax Service website

The bank will transfer the money to the desired treasury account. And the tax office, very likely, will not carefully study your payment slip. It will automatically post the payment data to your budget payment card - after all, you are indicated in the “Payer” field.

The above message, accompanied by copies of title documents, must be submitted to the Federal Tax Service in respect of each taxable object once before December 31 of the following year.

This is interesting: What does experience in a specialty mean?

When to start panicking

Notifications about property contributions begin to arrive to citizens in September. However, the law specifies exactly when property tax receipts arrive. The deadline for receiving a payment is 30 days before the deadline for payment. That is, if the treasured letter has not arrived by November 1, there is no need to panic, even if all neighbors have already received notifications. Perhaps the letter was delayed in transit due to postal service failures.

In addition, even in the absence of notification, you can still fulfill the obligation to pay tax. And for this you do not have to visit the Federal Tax Service.

Where can I find out the amount due?

You can clarify the amount of the property contribution due for payment remotely via the Internet. There are several handy resources for this:

- official website of the tax service;

- State Services portal;

- Sberbank personal account;

- FSSP data bank.

The last point concerns those taxes that are already overdue. But on the first two resources you can get data even on those deductions that are just awaiting payment. There you can print out a receipt, which you can then use to make payments in a convenient way for you.

How to work with the Federal Tax Service website

To clarify the amount of the property contribution through the Federal Tax Service website, you need to create a personal account on this resource. This will require the following steps:

- go to the main page of the site;

- Find the “Individuals” section in the top menu;

- click on the “Login to your personal account” link located next to the section name;

- on the new page on the right side, fill out the login form;

- Click the “Login” button.

Important! The citizen’s personal TIN number is used as a login for working with the Federal Tax Service account. The password is issued directly by the tax office at the place of registration after presentation of the passport and the corresponding application.

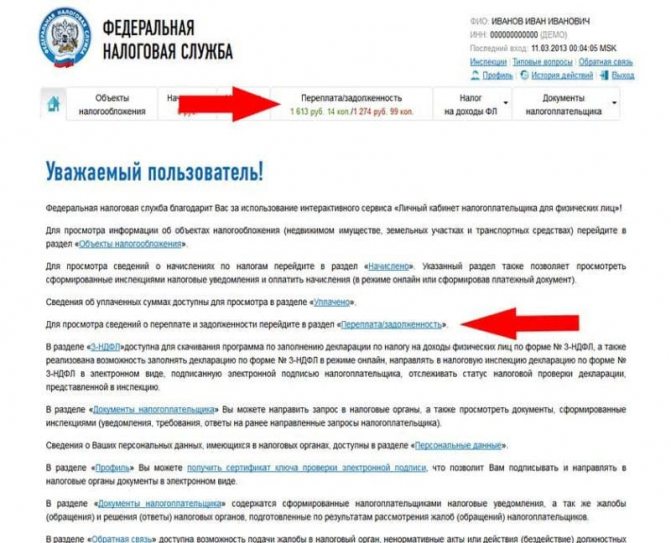

To find out what apartment tax you need to pay, after logging into the Federal Tax Service account, you will need to find the “Overpayment/Debt” item in the menu. The system will show you the amount to pay and also give you the opportunity to print the payment order.

Working with the State Services portal

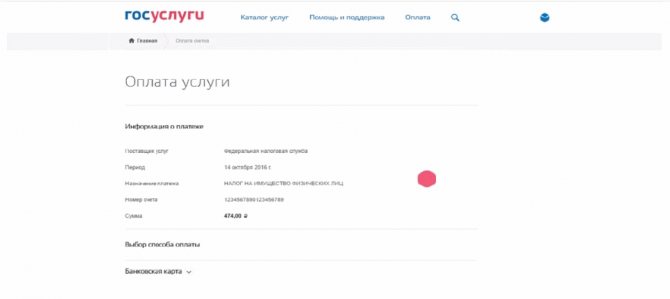

Users of the popular service gosuslugi.ru can use it to obtain information about accrued taxes and pay them immediately. To do this, you need to log in to the website and fill out an application to receive debt data in your personal account. In the application you will need to indicate your TIN; the system will take the rest of the data from your profile.

Information about invoices issued by the Federal Tax Service will not be immediately available. Typically, the State Services service takes about an hour to check. You can, after some time, look into your personal account again to read the answer. But it’s much more convenient when sending an application to indicate the method of notification of search results:

- via SMS to a mobile phone;

- via email.

Having received a notification from the portal, you can either print out a payment order to pay the tax in a way convenient for you, or make a payment directly through State Services. The portal makes it possible to make payments using MasterCard and Visa bank cards, as well as the Webmoney electronic payment system.

Why am I not receiving a receipt for electricity?

We explain what to do if there is no paper payment in your mailbox.

— For the second month, citizens have not received receipts for electricity in their mailboxes. Instead, Energosbyt sends SMS alerts to phones about the amount of debt. Yes, of course, anyone who wanted could register in their personal account to receive only SMS notifications and refuse to receive paper receipts. But many citizens do not want to receive SMS alerts or give up paper receipts. Tired of waiting for a paper receipt, I paid the amount indicated in the SMS without any supporting documents. But what about hundreds of other Kirov residents, especially those who do not know how to use ATMs?

In the second half of 2020, those registered in their personal account on the company’s website received payments in both paper and electronic form, Energosbyt explained. Customers had to choose the most convenient method and, if they did not need an electronic receipt, refuse it. If during this time Energosbyt has not received information about the refusal of the electronic receipt, from January 2020 the client will be sent a payment document only in electronic form. Notifications about this were sent by email.

You can change the receipt delivery method in several ways:

- in the “Settings” section of your personal account;

- through the “Feedback” section of your personal account or by writing a message to a specialist on the Energosbyt website;

- by calling the contact center daily from 8:00 to 20:00;

- in sales and customer service offices.

In addition to the receipt, there are other ways to find out the amount due:

- in your personal account on the website;

- on the official website in the “Find out debt” section;

- with a contact center operator by phone daily from 8:00 to 20:00;

- in sales and service offices.

If you don’t have a receipt on hand, you can pay for electricity using your personal account number in your personal account on the company’s website, through a payment acceptance agent (Sberbank, Khlynov, Rosselkhozbank, Russian Post).

— Penalties for late payment of utility bills are not applied to consumers who are late from 1 to 30 days (starting from the 25th day of the month following the billing month). Penalties are calculated in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation from 31 to 90 days of delay and in the amount of 1/130 of the refinancing rate from 91 days of delay, explained Energosbyt.

Briefly about the main thing:

1. Since January 2020, paper receipts have not been sent to those who have not opted out of electronic payments.

2. You can change the delivery method in your personal account on the Energosbyt website, in the company’s offices or by calling the contact center.

3. You can pay for electricity without a receipt - using your personal account number.

If you have questions that you can't find the answer to, ask us and we will try to answer them.

Photo: admkirov.ru

On this topic

2589

The garbage fee was charged for the whole year at once, but calculated at different rates. It is legal?

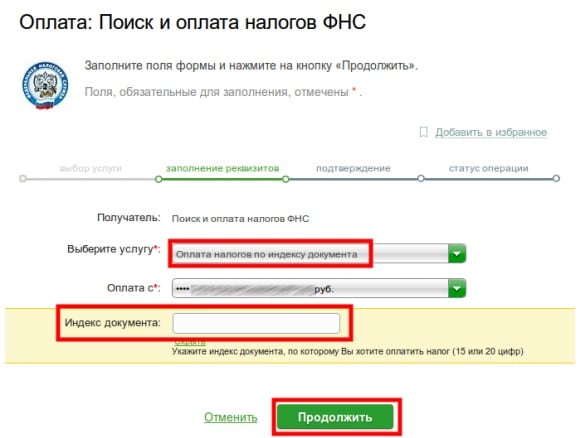

Method for Sberbank clients

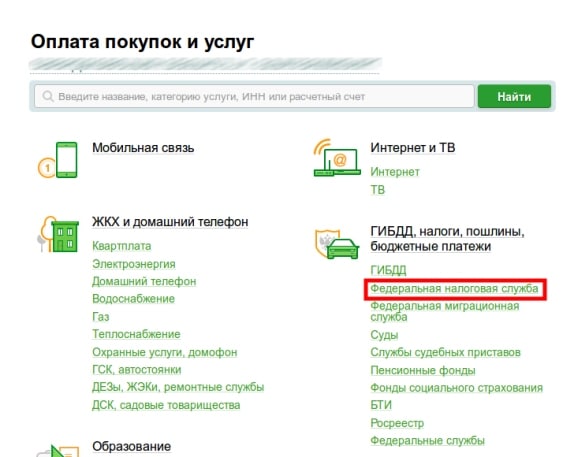

If you have a personal account in the Sberbank Online system, you can use it to pay real estate taxes, even if there is no receipt. To do this you will need to perform the following steps:

- Sign in;

- select “Transfers and Payments” - “Federal Tax Service” in the main menu;

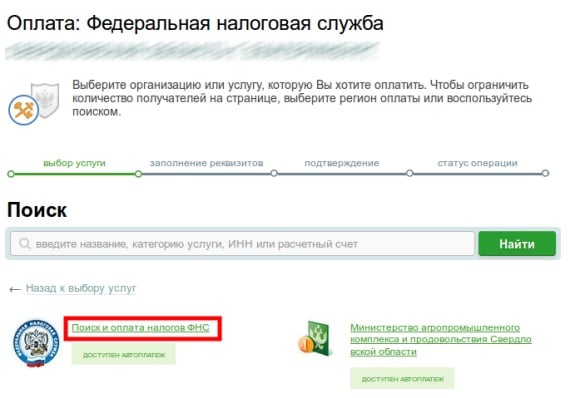

- in the section that opens, find the tax service icon and click on it;

- in a new window, set a search by TIN number in the drop-down list;

- Enter your individual taxpayer number.

The system will search its database and show you the taxes due. Next, all you have to do is follow the prompts in your personal account to create a payment order and make payment for it.

Important! You can make contributions to the budget through Sberbank Online@ain only from debit accounts. You won't be able to pay taxes with a credit card.

Please note that in this way you can pay a property contribution not only for yourself, but also for any person whose TIN is known to you. Sberbank provides this opportunity; it does not require that the TIN of the person to whom the tax is calculated matches the data of the owner of the personal account.

How to get tax receipts through your personal account

To save the new password for your personal account, you need to click on the “Save” button (number 7 in Fig. 2). By the way, the e-mail confirmation may be useful to you later, for example, for sending requests to the tax assessment office and receiving a response from it by e-mail. The email does not arrive immediately, you need to wait 10-15 minutes. However, here it is not necessary to do it once at a time and therefore different options are possible.

If you own any real estate, you are familiar with the annual “chain letters” from the IRS. Each owner is required to pay property tax, according to the notification received, until December 1 of the current year. Otherwise, a penalty in the amount of 1/300 of its part will be charged daily on the invoiced amount. But how can you pay your apartment tax if you haven’t received a receipt and neither the exact amount to be paid nor the recipient’s details are known? Let's look at the methods that exist today. Sberbank provides this opportunity; for it, it is not necessary that the TIN of the person to whom the tax is charged matches the data of the owner of the personal account. Method for clients of other banks Many financial organizations, following the example of Sberbank, provide their clients with the ability to search for information about accrued taxes by TIN number.

Method for clients of other banks

Many financial organizations, following the example of Sberbank, provide their clients with the opportunity to search for information on accrued taxes by TIN number. The main thing is that the bank itself has information about this number. Most often, by default this service is available to the following categories of persons:

- salary clients;

- borrowers of a banking organization.

If you simply use your bank’s debit card, or keep a deposit with it, the bank may not have information about your taxpayer number. However, it's worth checking out.

Log in to the personal account of the banking organization whose services you use. Find the section in it that allows you to make payments and transfers. Next, find the subsection “Fines and taxes”, “Payments to the budget” or with a similar name. Depending on the interface, subsections may be named differently. In case of difficulties, refer to the user manual of the personal account or call the hotline of the banking organization.

If the bank has information about you, a form will open in the required section asking you to search for outstanding taxes by TIN. If the banking organization does not have such information, a corresponding message will be displayed.

By the way! In this case, you can also call the hotline and ask the operator to add your TIN to the database or clarify how this can be done. Then next year you will already have access to a search and payment system through your usual personal account.

Well, if a search by tax certificate number is available, then everything is simple: enter the number in the search form and wait for the bank’s response. Next, select the one you need by name from the list of issued payments, create a payment order and finally make a payment from your account.

When making payments, take into account the processing times at your bank. It is possible that the payment will be processed within 3-5 business days and will be received by the Federal Tax Service after the deadline. Try not to delay payments until the last day.

Important! Unlike Sberbank, most banking organizations give their clients the opportunity to pay only their own taxes. Most likely, it will not be possible to search using someone else’s TIN.

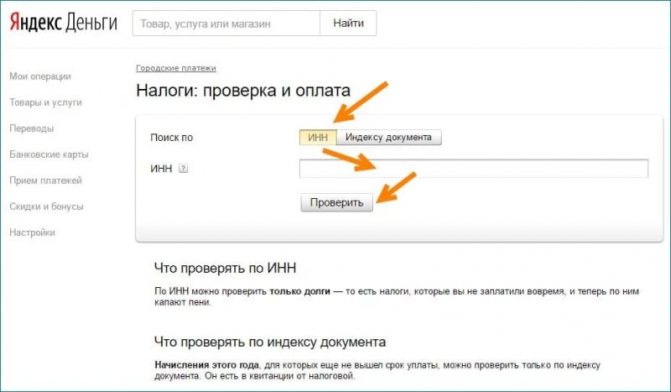

Method for clients of electronic payment systems

How to pay apartment tax if there is no receipt and you do not use bank services? Many people are accustomed to making financial transactions through electronic wallets, for example, Yandex.Money. This system also allows you to pay taxes using your TIN number. Moreover, it, like Sberbank, does not care whose number the user enters.

But there is one catch - when searching by TIN, Yandex.Money sees only overdue payments. That is, until December 1 of the current year, without a receipt, you will not be able to find a notice of property tax in them. The reason is simple - until this date you have no debts. In December, the data will appear, but a penalty will already be charged on the amount invoiced.

Other payment systems do not have a search function for invoices issued to the user from the Federal Tax Service at all. Payment can only be made using the receipt number or the details specified in it. Therefore, in this case, in order not to delay the process and not risk getting the reputation of a defaulter, it is still worth contacting the tax service to receive a payment document.

Local taxes are calculated by the tax service

In all regions of the country, the Russian tax service carries out mass calculations in October and sends consolidated tax notices (receipts) to individuals for payment of property taxes: transport, land and property taxes. Tax notices are sent by mail, and for those taxpayers who have access to the taxpayer’s personal account for individuals, notices are sent electronically. As everyone already knows, taxes for the previous year must be paid before December 1 of the current year. For each day of delay in payment, a penalty will be charged in the amount of 1/300 of the refinancing rate of the Central Bank of the Russian Federation of the tax amount. The refinancing rate is currently 8.25%. You may receive postal envelopes with receipts from other regions where equipment for mass printing of documents is installed.