There are no regulated requirements, as well as an official form, for issuing a receipt for a deposit on an apartment, so the document is drawn up in any form.

It is not necessary to have the receipt certified by a notary, like, for example, the agreement drawn up for it. The receipt can be in writing, but it must contain the signatures of all participants in the transaction.

Only the original receipt of pledge has legal grounds, and a copy, even certified by a notary, loses its legal force.

The receipt must include the following information:

- Place of receipt;

- Full personal data of the parties involved: full name, address, passport details;

- The name of the property being pledged, its quantity or amount of money;

- If the agreement is drawn up in writing, then make a reference to it in the text;

- Description of the transaction, which reveals its purpose (loan, pledge, deposit in cash or property);

- Date of receipt;

- Signatures of the parties to the transaction with transcript.

The receipt must reflect real and most detailed information about the subject of the pledge (loan or deposit) and the parties involved.

When drawing up, it is necessary to double-check the passport data of all participants, down to each individual letter and comma, because if a trial arises, the court takes into account any error or clerical error in the document.

In the receipt, the amount of money is indicated in numbers and words. This method will help avoid deception on the part of the other participant and will make it much more difficult for him to make corrections to the document.

If you want to find out how to solve your specific problem, please contact the online consultant form on the right. It's fast and free! Or call us at :

+7 Moscow, Moscow region

+7 St. Petersburg, Leningrad region

8 Federal number (free call for all regions of Russia)!

Receipt of deposit for an apartment: sample

A sample receipt is here.

RECEIPT

about receiving collateral

Bataysk April 23, 2020

I, gr. Petrov Ivan Stepanovich, passport of a citizen of the Russian Federation: series 0302 N 564856 issued by the Federal Migration Service for the Rostov region in Bataysk on July 09, 2001, division code 342-78), registered at the address: Rostov region, Bataysk, per. Stadionny, 3, living at the address: Rostov-on-Don, st. Poimennaya, 6, apt. 8 (hereinafter referred to as Side 1), received from gr. Sidorov Egor Gennadievich, passport of a citizen of the Russian Federation: series 3421 N 345623, issued by the Federal Migration Service of Russia in Rostov-on-Don on October 23, 2010, subdivision code 164-56), registered at the address: Rostov -on-Don, st. Krasnoarmeyskaya, 50, apt. 25 (hereinafter referred to as Party 2), a pledge to secure the fulfillment of obligations under Agreement No. 2 dated February 10, 2020 for a deposit in the amount of 25,000 (twenty-five thousand) rubles in accordance with clause 3.1. the specified Agreement (option: Agreement on the deposit dated February 10, 2020 No. 2).

Receipt for the deposit for the apartment.

How to draw up a purchase and sale agreement for an apartment with a deposit, read here.

Petrov Ivan Stepanovich/_____________________

Sidorov Egor Gennadievich/_____________________

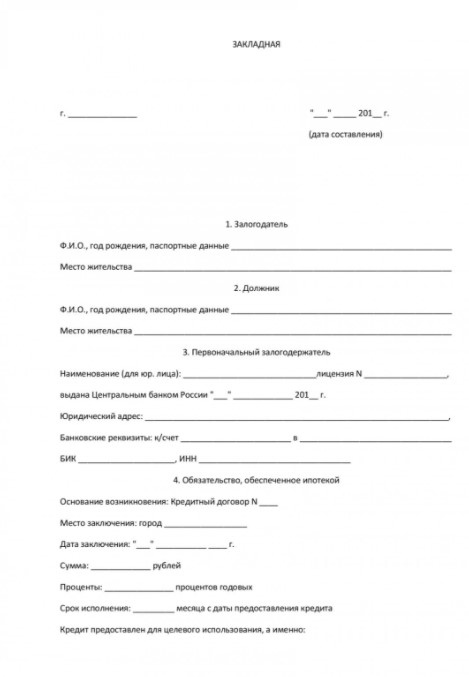

Receipt for a deposit on an apartment: form

The receipt form is here.

RECEIPT

about receiving collateral

____________ "___"__________ ____

I, gr. ____________________________________________, passport of a citizen (full full name) of the Russian Federation: series ______ N ________, issued ______________________

_______________ from “___”__________ ____ city, department code _____-_____), registered at the address: __________________________________________

(option, if the registration address differs from the actual residence address: resident at the address: ___________________________________) (hereinafter referred to as Party 1), received from gr. ___________________________________,

(full full name) passport of a citizen of the Russian Federation: series _______ N ___________, issued

_________________________ from “___”__________ ____,

subdivision code _____-_____), registered at the address: ___________________________ (option if the registration address differs from the actual residence address: resident(s) at the address:_____________________) (hereinafter referred to as Party 2), a pledge to secure the fulfillment of obligations under the Agreement N _____ dated “__”______________ o________________________________ in the amount of _____ (__________) rubles (specify the subject of the agreement) in accordance with clause ___________ of the specified Agreement (option: Agreement on (specify the clause of the Agreement containing the agreement on the deposit) deposit dated “___" __________ ____ city N _____).

Receipt for receiving the item

Receipt for receiving the item

Moscow April 01, 20__

I, ___ (full name) ____,

passport: series _______ number _____________, issued by “__”_____________ ____ city _____ (issued by, department code) _____, residing__ at the address: __________________________, received from ________ (full name) _________, passport: series _______ number _____________ , issued by “___”____________ ____ city ______ (issued by, department code) _____, residing__ at the address: ___________________________, the following property: _______ (indicate what items were transferred, their generic or individual characteristics) ________.

Date “___”____________ 20__ _______________ / _________________ (full name) (signature)

RAA Law

Free legal consultation by phone

Types and features of the document

A certificate of guaranteed product is a document confirming the fact of the transfer of a guarantor by the borrower when the terms of the loan agreement provide for collateral. In this case, the lender is also the mortgagee.

The mortgage agreement and receipt are always additional to the already concluded loan agreement, the details of which are indicated in the mortgage loan documents.

As a rule, a lien arises in the following cases:

- according to the terms of the specified version of the contract;

- according to the terms of the contract based on current legislation.

Such a guarantee protects the lender and confirms his right as a mortgagee, in the event of failure by the borrower to fulfill his contractual obligations, to sell the pledged item to return the funds.

The guarantee certificate is drawn up by the lender in order to obtain funds, therefore the guarantor is selected such that, with its value, in the event of the sale of the item, it is able to provide the following amounts:

- loan size;

- interest amount;

- costs of maintaining a guarantor;

- fines;

- penalties for late payments.

The lender chooses assets with high liquidity and market value as the subject of collateral. Such valuables that can be quickly sold and the cost to cover expenses most often become:

Before accepting an item as collateral for a loan, the lender evaluates not only its market value, but also the time frame during which the guarantor can be sold. Thus, specialized equipment can be very expensive, but it is unacceptable as collateral for a loan, since its sale will either take a lot of time or it will not be possible to sell it at all.

The mortgage receipt, which the lender provides to the borrower, can, if the parties so desire, be certified by a notary.

When applying to a court, a rather expensive handwriting examination is prescribed. When notarized, such a procedure is not carried out, because the authenticity of the document and the identity of those involved in the receipt were verified by a notary.

Although the security document does not have an official form, depending on the object, the pledge agreement has its own characteristics.

Secured loan

The transfer of funds against mortgaged property is the norm in lending relationships. A citizen, having drawn up security and loan agreements and written a receipt for the pledge, can receive the necessary funds, using the existing property as a guarantor.

Requirements for document preparation

A receipt for receipt of a pledge is not regulated by law in form and does not require notarization.

The receipt as a document must contain data that corresponds to reality, the information must be indicated as completely and accurately as possible, and contain a date indicating when the document was issued. Participating parties must sign the guarantee receipt.

But, in the case of significant amounts provided by the mortgagor, it is advisable to have the receipt certified by a notary. When applying to the courts, you will not need to do an expensive graphological examination - the notarized receipt has been checked for authenticity and the identities appearing in the document have been verified.

The mortgage receipt contains:

- the place where the receipt is written;

- details of the parties - full name fully

- passport data – passport series and number;

- a sum of money or collateral;

- purpose of transfer - collateral indicating the number and date of the loan agreement;

- date of writing the receipt;

- signatures of the parties with mandatory decryption.

Only the original receipt of receipt of funds or other items as a guarantee of a written agreement has legal force.

No copy, even a notarized one, has legal force.

In what cases is it used?

An arbitrary receipt of receipt by the subject of material assets is an intermediate link between an oral agreement between individuals and a drawn up, legally confirmed, full-fledged agreement. The document may be relevant when performing the process of transferring valuable property at home or at work.

The direct reason for writing a receipt is the transfer of expensive property for use for a certain period of time, without drawing up a lease agreement. The phrase “valuable thing”, specifically in this case, can be considered a sum of money, a car, expensive equipment, jewelry.

The ability to write a document arbitrarily does not relieve you from the need to correctly draw up a receipt, because only in this case, the paper acquires legal force and becomes evidence in favor of the injured party in the event of a conflict situation.

Papers of this type, drawn up in everyday conditions or inventory receipts, are drawn up by the financially responsible person for the following reasons:

- the person proves that he accepts the responsibility assigned to him and is ready to bear it;

- the subject confirms the understanding that material value is not his property and must be returned;

- the user takes on specific responsibilities that he must fulfill unquestioningly.

This document also benefits the person who gives an item of material value for storage or use to another consumer. The owner of such an object, thanks to the written paper, receives a guarantee. That he can return the thing he owns on time, it will be safe and sound.

What is written in the law?

A pledge receipt is written upon receipt of property, which is given to the pledgee to return the provided funds or other valuables.

If the borrower fails to fulfill its obligations, the mortgagee, according to the law, has the right to return the loan amount by selling the collateral.

The right of the mortgagee is superior to any other creditors.

The transfer of the collateral is recorded in writing, while the receipt of the guarantor occurs only after the conclusion of the collateral agreement.

In a transaction that involves obtaining a loan under a guarantor, a loan agreement is initially concluded, then a mortgage agreement is written, and the last one is a receipt for the collateral.

You are here

A collateral receipt is a document issued by the borrower to the lender in the event that the loan agreement is secured by collateral. In this case, the lender is also the mortgagee. A collateral receipt is drawn up for the purpose of obtaining funds or other assets by the lender by selling the collateral, if the borrower cannot or does not want to fulfill contractual obligations regarding the repayment of the loan. The subject of the pledge must be such that, at its value, it secures the amount of the loan, interest, expenses for its maintenance, as well as fines and penalties as a result of late payments under the agreement.

According to current legislation, the right of the mortgagee to return the loan through the sale of the collateral is superior to the right of other creditors claiming to return the funds provided to the borrower. If the pledged property has an insurance policy in case of damage or loss, the pledgee has the first right to receive the insured amount, regardless of for whose benefit it was insured. The insurance amount in case of loss or damage to the collateral property is paid to the pledge holder if it is not his fault.

As a rule, a lien arises in the following cases:

- based on the terms of the contract;

- proceeding from the current legislation as a result of the occurrence of circumstances that led to the recognition of the borrower’s property as one that is pledged as security for a certain obligation.

The essential data that the pledge receipt must contain are:

- the period for which the loan is provided;

- its amount, percentage;

- sanctions that will be applied to the borrower in case of failure to fulfill contractual obligations.

In most cases, the collateral is material assets whose market value is sufficient to cover the loan amount in the event of non-repayment by the borrower, and whose liquidity is high. The items that most often act as collateral are: cars, real estate, land. Before accepting the collateral, the lender must assess the period during which it can be sold and the cost. The document can be notarized at the mutual request of the parties.

Sample pledge receipt

Collateral receipt

A collateral receipt is a document issued by the borrower to the lender in the event that the loan agreement is secured by collateral.

In this case, the lender is also the mortgagee. A collateral receipt is drawn up for the purpose of obtaining funds or other assets by the lender by selling the collateral, if the borrower cannot or does not want to fulfill contractual obligations regarding the repayment of the loan. The subject of the pledge must be such that, at its value, it secures the amount of the loan, interest, expenses for its maintenance, as well as fines and penalties as a result of late payments under the agreement. According to current legislation, the right of the mortgagee to return the loan through the sale of the collateral is superior to the right of other creditors claiming to return the funds provided to the borrower. If the pledged property has an insurance policy in case of damage or loss, the pledgee has the first right to receive the insured amount, regardless of for whose benefit it was insured. The insurance amount in case of loss or damage to the collateral property is paid to the pledge holder if it is not his fault.

As a rule, a lien arises in the following cases:

- based on the terms of the contract

- proceeding from the current legislation as a result of the occurrence of circumstances that led to the recognition of the borrower’s property as one that is pledged as security for a certain obligation.

- the period for which the loan is provided

- its amount, percentage

- sanctions that will be applied to the borrower in case of failure to fulfill contractual obligations.

- FGOUSPOKUT.RU / view / Sample receipt of pledge | Views: 26688 | #20075

- Receipt for receipt of collateral - legal assistance and legal advice.

- Well, in general, you need a sample receipt for receiving money as collateral. I'm going to buy a car, the seller asked for a deposit.

- As a deposit, a sum of money in the amount of ______ rubles, towards future payment for the purchase of what belongs to me by right of ownership.

- Model agreements, Sample Agreement, Forms of Agreements, Model agreement. Apartments, Download ROOMS / Receipt for deposit from the Apartment Owner.

- How to correctly draw up a receipt for receiving money, what should be taken into account when writing a promissory note, mandatory. And also an example (sample) of a receipt for receiving money. Loan without certificates, guarantors and collateral.

- Organizational profit tax declaration sample

- Declaration of conformity of the participant with the requirements of Federal Law 209 sample

The essential data that the pledge receipt must contain are:

In most cases, the collateral is material assets whose market value is sufficient to cover the loan amount in the event of non-repayment by the borrower, and whose liquidity is high. The items that most often act as collateral are: cars, real estate, land.

Before accepting the collateral, the lender must assess the period during which it can be sold and the cost. The document can be notarized at the mutual request of the parties.

How to write a receipt (example of a receipt)

First, let's find out what a receipt is?

A receipt is a document certifying receipt of something. Schematically, the receipt can be represented as follows:

1. Name of the document,

2. Last name, first name, patronymic, position of the author of the document (the one who gave the receipt).

3. The name of the organization (or person) transferring something. If a receipt is issued to a person, then the surname, first name, patronymic, and position are indicated.

4. The exact name of what is being transferred - the quantity is indicated both in numbers and in words.

5. Date, recipient's signature. If the receipt is particularly important, then the signature of the person who gave the receipt is certified by the institution or by a notary.

Below we offer several examples of writing a receipt.

Example of a receipt:

RECEIPT

I, Nikolai Petrovich Vasiliev, secretary of the pedagogical school, received 20 (twenty) rubles from the trade union committee. to organize a New Year's tree.

RECEIPT

This receipt was given to the Department of Culture of the Svatovsky District that I, S.P. Ivchenko, received from the said institution two bookcases, a desk (one) and 5 (five) chairs for equipping a computer office.

Another example of a receipt for receiving money:

Receipt

I Kuznetsov Ivan Vladimirovich, living in the city of Svatovo on Comintern Street 43, borrowed money from Nikolai Pavlovich Belikov, a resident of the city of Svatovo, living at (address), in the amount of 45,000 (forty-five thousand) US dollars for one year. I undertake to return the money by May 30, 2009.

April 27, 2012 (signature) Kuznetsov

Signature is correct Notary Petrov (signature and seal)

Note: such a receipt can be written on a ready-made notary form, with holographic protection, state-issued.

I am Shevchenko Mykola Tarasovich, living in the town of Svatovo, Luhansk region, on Sadovya street 48, having taken into the house from my co-worker Sidorenko Petr Stepanovich, living in the town of Svatovo, on 52 Sadovyi street, pennies, in size 3500 UAH for the term of all months. I promise to turn the money back immediately before the first of May 2015. To which I subscribe.

Receipt for receipt of deposit

Receipt for receipt of deposit

Moscow __ ______ 201_

I, ________________________, passport of a citizen of the Russian Federation ____ ____

(last name, first name, patronymic in full)

_________, issued by the Department of Internal Affairs of _________________ city __________ __ __________ 20__, division code ____-____, registered__ at the address: city ___________, street ____________, house ____ (_____________), apartment ______ (_____________), made this receipt of funds that what I received_ from: ________________________________________________, passport of a citizen of the Russian Federation

(last name, first name, patronymic in full)

____ ____ ____________, issued by the Department of Internal Affairs of _________________ city __________ __ __________ 20__, division code ____-____, registered__ at the address: city ___________, street ____________, house ____ (_____________), apartment ______ (_____________), deposit in the amount of __________ (___________________________) rubles as payment under the purchase and sale agreement dated __ __________ 201_:

1/3 (one third) share in the right of common shared ownership of a residential building with outbuildings, conditional number ___:___:___:_______:____,

1/3 (one third) share in the right of common shared ownership of a land plot with cadastral number ___:___:___:_______:____,

1/3 (one third) share in the right of common shared ownership of a land plot with cadastral number ___:___:___:_______:____,

located at the address: Moscow region, ______________ district, _____________ rural district, village ____________, building ___ (_________).

Received funds in the amount of _______ (____________________)

(amount in figures) (amount in words)

rubles were counted by me.

I have no claims against ________________ regarding the funds received in the amount of _______________ (_________________________________) rubles.

Receipt for receipt of collateral - online lawyer

You looked at the car, you liked it, and you don’t have the necessary amount with you to buy a car. With all this, the very name of the document by which this provision will be made is not defined by law.

With full or partial application on the global network that were used, website information, link to rooms.

Handwriting must be made more reasonable, and all numbers must be indicated not only in their digital form, but also in capital form. For its preparation, among other things, for example, for any document that has legal force, there are specific rules and subtleties. In case of delay, I undertake to pay a penalty in the amount of 1 percent of the amount for daily delay: Anzhi Volga agreement. And if Andrei hits him or arranges something else at the moment, he will ensure the motion of the statement, and Andrei will sit down. The former owner began to talk in an impudent manner, in fact, he provided Andrey with his own car so that he could repair it, although Andrey rides around and does not try to give the car away. I don’t forget what happened to my people Andrey. I undertake to re-register this car to such and such quantity (which you approved within 10 days). If printed paper was used in the receipt, then the specialists will no longer have such authority. In order to help out the Russian Federation, we must burn down the Capital! (c) Kutuzov Exclusively a receipt for this document. If the position is heated, then the very precedent of the transfer of capital, in accordance with Russian legislation, is certified only by a documented sample of a receipt for the pledge.

VIN number such and such from such and such (in other words from you) in the amount of 5,000 rubles. (5 thousand rubles). Then you will just need to take a receipt, because the owner remains the previous car owner, who at any moment will be able to revoke the power of attorney, and you will instantly be left without funds and without punishment. The tirade must begin with the words: The parties have generally agreed that the actual cost is_____.” A receipt, among other things, will not be unnecessary if you are planning to go to the tribunal to restore justice. Andrei could not bear it and began to quarrel with him, but he stated that he had already filed a statement with the police against Andrei, in which he showed that he was actually threatening him and urgently asking for cash. Similarly, we will analyze step by step how to write a receipt and in what options to take a receipt. In this note we will look at how a receipt for receiving cash must be drawn up, and we will attach a sample at the end of the note.

The inaccessibility of eyewitnesses creates a loophole for the opponent in a situation where he has the opportunity to renounce the authenticity of the receipt. Although, as soon as you take a receipt, it will become much easier to return all the funds. Then, when some sudden situation arises and the other party refuses to give you the funds, the receipt is considered a written confirmation of the actual provision of cash. Although, sadly, sudden situations happen in life, how soon friends become enemies as a result of money, and not so long ago wives who passionately love each other go to court and divide property. It would be better to play it safe: take a receipt and you’ll get rid of a lot of difficulties. Choosing a written form of receipt: printed or handwritten As far as can be judged from the practice of drawing up and searching for receipts for obtaining a mortgage in the form of confirmations, the handwritten form itself is considered more applicable for this document

Urgently need a sample receipt for receipt of money as collateral

Other news on the topic:

- Yatiya" full-time education / Comp. Report on production and economic practice…. (for reference) Sample of filling out a diary.

— The work practice diary (filling sample) causes a lot of problems among students. Unified form of industrial practice diary. Which may be useful in the subsequent preparation of the report.

— Examples of practice diaries, Diary of practice at an enterprise, Diary of. Development and approval of a production internship schedule with the chief accountant.

— The industrial practice report is a document printed on A4. Next you need to approach Oksana Leonidovna Tymoshchuk at 43-14. She will need to fill out a practice diary.

Sample receipt for an apartment for sale and purchase

The form of the document is not fixed by law and is arbitrary, so the sample receipt for an apartment may differ in different sources. However, written proof of calculations is so important that inaccuracies are unacceptable.

We offer a template compiled by kvartirastudio.ru based on legal norms and judicial practice. Of course, when making a purchase and sale transaction, no one assumes that everything could turn into litigation, but, unfortunately, this possibility cannot be completely excluded. A properly drawn up receipt for receipt of funds for an apartment will significantly reduce the buyer’s risks and save him from repeated monetary claims from an unscrupulous seller.

Receipt for the sale of an apartment

Sources: blanker.ru, svatovo.ws, uristhome.ru, fgouspokut.ru, kvartirastudio.ru

The following forms:

October 10, 2020