What is this document and what is it for?

Article 861 of the Civil Code of the Russian Federation states that payments between individuals not related to business can be carried out in cash without restrictions on the amount.

However, the fact of transfer must be confirmed by something. And if a transfer and acceptance certificate is used to transfer the object itself, then a document such as a receipt is used to confirm that the buyer has paid the seller some amount.

The Civil Code of the Russian Federation does not contain a clear definition of this concept. However, based on the meaning of those articles in which the term “receipt” is used, the following definition can be given.

A receipt is a document that indicates exactly what funds (and for other contracts other than sales and purchases, other valuable property) one party transferred to the other. The receipt is drawn up in simple written form and certified by the signatures of both parties to the legal relationship.

In practice, a receipt is used precisely to record the fact of transfer of money from one person to another (read more about methods of transferring money here). For a purchase and sale agreement, it serves as confirmation that the buyer has fulfilled (in whole or in part) his obligations to the seller and transferred funds to him as payment.

Without this measure, the seller may claim that he did not receive any money and the funds already transferred will have to be proven in other ways (for example, by testimony).

Does it have legal force?

The question of whether such a document can be used as evidence in court, and whether it has any legal force at all, is not clearly resolved in the legislation. However, there are a number of factors to consider:

- The term “receipt” is repeatedly used in the Civil Code of the Russian Federation. Moreover, in Art. 808, regarding the loan agreement, expressly states that the receipt confirms the transfer of the amount. Similar rules are contained in relation to other types of contracts.

- Art. 408 of the Civil Code of the Russian Federation, regarding the termination of obligations, directly states that the creditor (which in the case of a sale and purchase is the seller) is obliged, at the request of the debtor (buyer, respectively), to issue him a receipt confirming that the obligation has been fully or partially repaid.

Thus, we can conclude: the receipt is a full-fledged document that has full legal force.

Important! A simple written form is sufficient for a receipt. However, if the parties decide to have it certified by a notary by transferring money and signing in his presence, they have the right to do so in accordance with the Civil Code of the Russian Federation and the Fundamentals of Legislation on Notaries.

Recommendations

In order for the executed document to have full legal force when drawing it up, the following should be taken into account:

- The receipt must be handwritten, using only blue ink.

- The receipt must be written by the participant in the transaction who, in accordance with the main purchase and sale agreement, acts as the recipient of funds from the sale of the apartment.

- If the text of the receipt was typed on a computer, the document will have to be certified by a notary, since in case of disputes it will be impossible to carry out a graphological examination.

- The heading must clearly indicate that the funds being transferred are an advance.

- The document must indicate the date and place of its signing.

- Personal data of the participants in the transaction must be indicated in full; abbreviations are not allowed.

- The text of the receipt must indicate information about the property, as well as the numbers and names of the seller’s title documents.

- Please note that the signature of the advance payment recipient must match the signature in the passport.

- The date of actual receipt of money must also be indicated in the document drawn up.

- It is better to transfer funds in the presence of two witnesses. Their details should also be indicated in the text of the receipt.

Reference. The amount of the advance is not established at the legislative level. As a rule, its value is 7–10% of the total cost.

Who should write?

Taking into account the content of Art. 408 of the Civil Code of the Russian Federation, we can conclude: the receipt is given by the one who received the money. Therefore, in the purchase and sale agreement, the seller must draw up this document, since the buyer pays him.

However, there is no direct prohibition against the buyer drawing up a receipt and the seller only signing it.

Nuances if there are several sellers

If the apartment is in shared ownership, then the question arises: which of the sellers should draw up a receipt? The Civil Code of the Russian Federation does not provide an answer, so we can conclude that a receipt can be drawn up by any of the co-owners of the apartment being sold.

However, here it is necessary to take into account the provisions of Art. 42 Federal Law “On State Registration of Real Estate”. She indicates that transactions with real estate in shared ownership must be notarized. Therefore, it would be more correct in this case if the receipt is drawn up by a notary (since the agreement still needs to be certified), and all parties just sign it.

This can be justified by Part 1 of Art. 452 of the Civil Code of the Russian Federation. It states that changes and additions to the contract must be made in the same form as the contract itself. Therefore, if we consider the receipt to be a mandatory annex to the purchase and sale agreement concluded in notarial form, then the receipt must also be certified by a notary. However, this issue is extremely debatable.

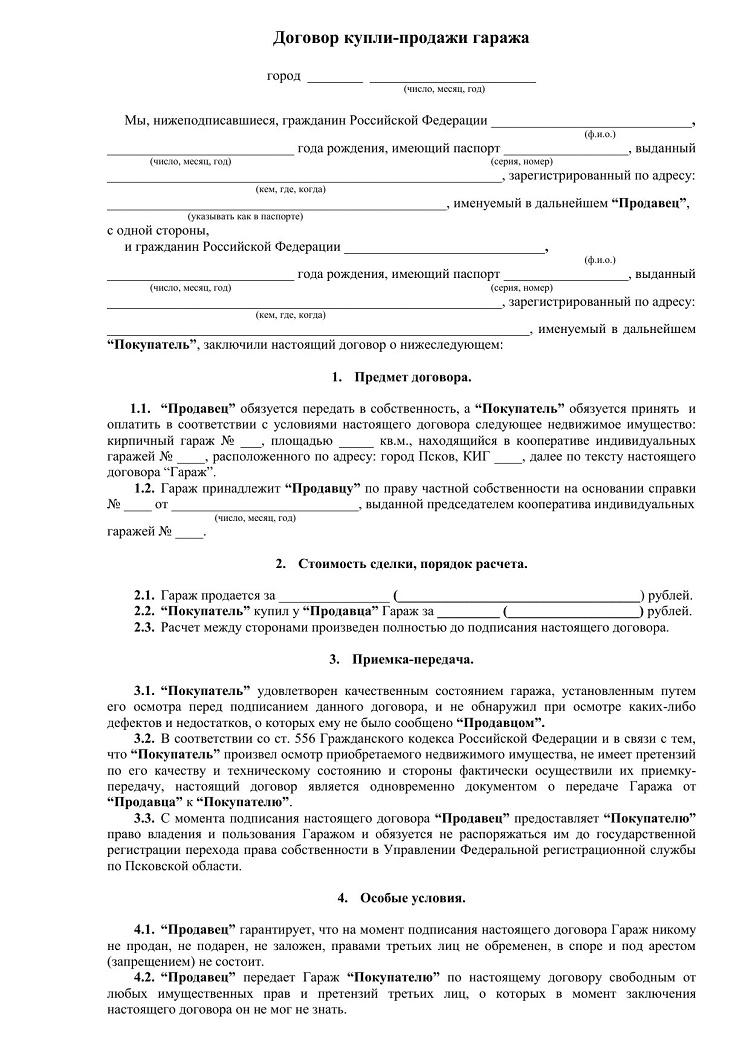

Receipt for receipt of money upon sale of garage

When two parties enter into a transaction to purchase or lease a garage, the buyer or lessee transfers a certain amount of money to the seller.

Often, a receipt is drawn up for receiving money for the garage. For what? To confirm that the buyer has fulfilled its obligations.

Although a receipt for receipt of money is a document, there is no single, approved standard for its execution.

Receipt for receiving money for a garage: sample filling

The receipt is written in free form strictly by hand. The document is necessary, first of all, for the buyer and protects his interests; therefore, he must make sure that all points of the receipt are spelled out correctly.

In order for the receipt to acquire legal force and, if necessary, become evidence in court, it must be certified by a notary or the signatures of two witnesses indicating their passport details and registration.

Full name, hereinafter referred to as the Buyer, on the one hand, and gr.

Purpose, goals

The purchase and sale receipt plays the role of a contract, its purpose is to document the owner’s intention to transfer ownership to another citizen, on the one hand, and the citizen’s desire, on the other hand, to receive ownership of a non-stationary, movable garage.

The purpose of the transaction is usually to quickly, without delays and problems, carry out the procedure for transferring the garage from one owner to another, as well as immediately pay off.

But there is one caveat: the transfer of rights is unknown to anyone except the participants in the transaction, and in order to give it legality, it is necessary to re-register the rights, that is, submit this sales receipt to the Unified State Register of Real Estate, so that on its basis the database will be adjusted and the title papers will be issued to the new one owner.

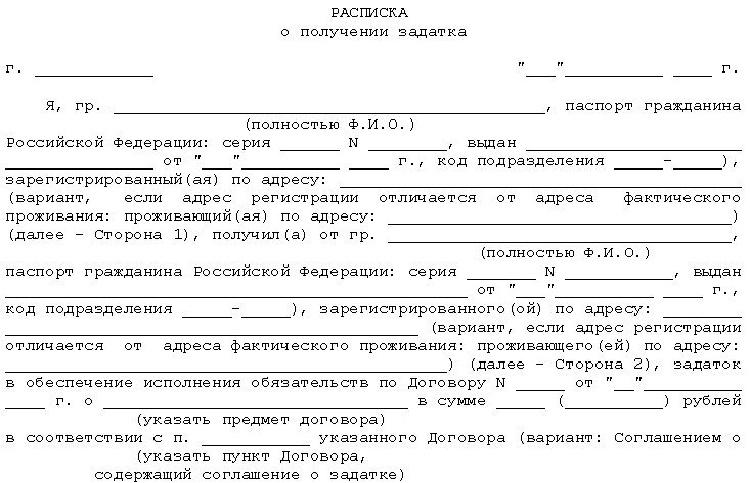

Below is a sample blank form:

The photo shows a sample form of a garage sale and purchase agreement:

Written by hand, preferably with a pen with blue ink, and corrections, blots, inaccuracies and abbreviations, this document has the weight of a contract, so everything must be accurate and clear.

Purpose of the deposit

In fact, the deposit agreement does not oblige the seller to sell the goods, or the buyer to purchase and pay for it. The purpose of the deposit agreement is:

- confirmation of the seriousness of the buyer’s intentions;

- assigning to the seller the thing he wants to buy, but, for one reason or another, he or the seller needs some time to prepare for the purchase and sale agreement;

- reimbursement of expenses of the buyer or seller in the event that the transaction does not take place due to the fault of one of them.

The amount of the deposit when concluding a purchase and sale agreement is included in the cost of the purchased item (item, object), that is, neither the seller nor the buyer gains or loses anything if the planned transaction takes place.

Is preparation required when selling?

In the event that a deposit, advance or pledge is received

Regarding the advance, based on the norms of Art. 408 of the Civil Code of the Russian Federation, we can clearly conclude: if the buyer considers it necessary to obtain a receipt, the seller is obliged to issue it. However, what about deposit or pledge agreements?

First of all, it should be noted: there is a fundamental difference between an advance and a deposit. It is as follows:

- In case of refusal to fulfill obligations under the contract, the advance payment is simply returned by the seller.

- If a deposit is used, it is returned in the same amount if the parties have entered into an agreement to abandon the transaction. If the fulfillment of the contract was disrupted by the seller, the deposit must be returned in double the amount, if the buyer - the seller keeps the deposit for himself (Article 381 of the Civil Code of the Russian Federation).

- If the deposit is not expressly specified in the contract, letter of intent (preliminary agreement) or in the deposit agreement, then the amount paid is considered an advance.

Thus, we can conclude: if the deposit is drawn up in the form of a separate agreement signed at the time of transfer of money, then you can do without a receipt. However, if the terms of the deposit appear only in the main or preliminary agreement, the transfer must be formalized with a collateral receipt.

Reference. Regarding the pledge, the rules established by §3 of Chapter 23 of the Civil Code of the Russian Federation apply. According to its norms, the pledge agreement is drawn up in writing.

Therefore, if, according to the terms of the agreement, the collateral is transferred at the time of signing (and these conditions are clearly reflected in the agreement), a receipt need not be drawn up. However, if there is no such condition, you cannot do without a separate document on the receipt and transfer of the pledged item.

Read more about prepayment here.

When transferring the principal amount

Regarding whether it is necessary to formalize the transfer of the principal amount with a receipt when using a deposit or advance payment, as well as when making a one-time payment for the purchase of an apartment, everything is clear: this is precisely the situation when you cannot do without it. Therefore, the receipt must be drawn up according to the rules that will be described below.

Rules for registration and a sample receipt for a deposit for an apartment

- Before drawing up a contract, the buyer must verify ownership of the apartment. View documents, collect additional information.

- Agree with the seller to obtain a certificate from the house management about the composition of the family. It displays the total number of citizens registered in this apartment.

- View the technical plan of the premises. Check with existing layout. This will help protect the buyer from additional fees for illegal redevelopment.

- Read the certificate from the Unified State Register of Real Estate about the number of applicants for the apartment.

We recommend reading: Sample of filling out 3 personal income taxes for 2020 when purchasing an apartment with a mortgage

Receiving a deposit is not an end in itself for preparing primary documentation. The seller needs to exclude a number of those persons who can claim their rights to the apartment. Indeed, in the event of termination of the contract with the buyer, after receiving the deposit, the seller is obliged to return the amount in double amount.

How to prepare the paper correctly?

About the received deposit, advance or pledge

The contract does not contain any mandatory requirements for drawing up a receipt in the case where an advance, pledge, or deposit is used to secure the contract. However, in practice, the following requirements are imposed on such a document:

- Full details of the parties must be provided. For citizens, this will be full names and passport details, as well as information about permanent registration, for organizations - name, organizational and legal form, registration data and personal information about the person who signed the document on behalf of the legal entity.

- The subject must be specified. For an advance or deposit - a sum of money, for a pledge - information about the property provided to the pledgee.

- There must be signatures from both parties. This is an optional requirement (according to the law, the signature of the person who received the money or property pledged is sufficient), but it is better to be on the safe side.

- For a deposit, there must be indications that it is a deposit and not an advance that has been transferred.

Important! The law does not require signatures and personal information of witnesses, but their use increases the chances of winning the case in the event of a legal dispute.

If the entire amount is transferred

In the event that a receipt formalizes the transfer of the entire amount under a purchase and sale agreement, the receipt must be executed as follows.

Should I go to a notary?

In any case, the receipt must be in writing. However, if a notarial form is provided for the purchase and sale agreement, then it is better to play it safe and draw up a receipt with the help of a notary.

Content

Based on practice, the following requirements for the contents of the receipt can be specified:

- Pointing to the sides. There must be complete information about who received the money and from whom. At a minimum, full names are required, but it is better to accompany them with passport information.

- An indication of the agreement under which money is transferred.

- The exact amount of the transferred amount. It must be written both in numbers and in words.

- Personal signatures of the parties. If the seller or buyer under the contract is a legal entity, it is best to certify the receipt with a seal.

- Information about witnesses who were present at the transfer. For them, you also need to provide full personal data and document the contract with their signatures.

Note! If the recipient of the money is an organization, a cash receipt order can be used instead of a receipt.

What are the consequences if there is no document?

If the transfer of money was carried out without drawing up a document, this means one thing: if a dispute arises and goes to court, the plaintiff will have one less piece of evidence. Without a receipt, it will be difficult to prove that the money was transferred. This means that in many cases the dispute will be lost.

In addition, procedural legislation in some cases prohibits parties engaged in commercial activities from referring to witness testimony. This means that in the absence of a receipt or other supporting document, the fact of transfer of money cannot be proven at all.

It will be useful for readers to learn about buying an apartment:

- to a mortgage;

- in a new building;

- at the expense of maternity capital;

- by proxy;

- on the secondary market;

- without a realtor;

- for "Young Family";

- by inheritance;

- buying a share of an apartment.

Advance agreement when buying an apartment: what you need to pay attention to

If the apartment is not purchased immediately, but after some period of time, the seller may insist on making an advance payment. As a rule, we are talking about fairly large amounts, so it is necessary to document the fact of the transfer of money. It is for such cases that the procedure for drawing up an advance agreement is provided.

A sample agreement for purchasing an apartment can be found in the public domain, but it would be best if a competent lawyer helps you with its preparation. As a rule, standard contracts contain only the main points listed above, while a real estate lawyer can tell you what additional points, taking into account the nuances of a particular apartment, it is advisable to take into account.