Home / Purchase and sale of apartments / Resale and new housing / Agreement or advance agreement for the purchase of an apartment

Prepayment when purchasing an apartment is an opportunity to “secure” the property you like and give the seller confidence in the subsequent purchase at the agreed price on time. One of the possible ways to do this legally is to enter into an advance agreement.

What is an advance?

There is no precise definition of the concept “advance” in the legislative acts of the Russian Federation. The only mention is in Art. 380 of the Civil Code of the Russian Federation, which states that any amount of advance payment to the seller can be considered as such, if the agreement does not indicate that it is a deposit.

The need to make an advance payment arises if the purchase and sale transaction cannot be carried out immediately, since the parties need to carry out certain preparations:

- have additional time to receive money (for example, from third parties);

- collect missing documents;

- carry out alternative transactions.

In such cases, the buyer pays the seller a sufficient amount, after which the seller agrees to remove the property from sale and the parties can begin preparing for a future purchase of the property.

Thus, an advance payment agreement for the purchase of an apartment is a document that determines the amount and procedure for making an advance payment for the purchased housing. It is concluded for purchase and sale transactions or assignment of claims before the execution of the main contract as confirmation of the seriousness of the buyer’s intentions.

Differences from deposit

The concepts of “advance” and “deposit” should not be confused, which have different consequences if the main transaction is not concluded. The first is a simple prepayment for the apartment, the second is a condition for the fulfillment (security) of the main obligation, that is, the conclusion of a purchase and sale agreement. Unlike making a deposit, an advance payment does not oblige the parties to subsequently carry out a transaction and the legislative norms regulating the relationship when making a deposit cannot be applied to it. But the rules established for loans apply to it, that is, the actual return of the prepaid amount.

Read more: What is the difference between an advance and a deposit when buying an apartment

Expert opinion

Semyon Frolov

Lawyer. 7 years of experience. Specialization: family, inheritance, housing law.

There is no clear answer to the question about the optimal prepayment option - an advance payment or a deposit. If there is any doubt on the part of the buyer that the purchase and sale will be implemented. The latter will also be more attractive from the seller, since, if necessary, he can return the money paid without additional payments. This opportunity is relevant if suddenly there is another buyer who is ready to offer a higher price for the same property. The form of prepayment for each case is established during negotiations between the parties.

Possible sides

In most cases, transactions for the purchase and sale of an apartment and, accordingly, the transfer of an advance payment, are concluded directly between the seller and the buyer. But in some cases, the agreement may involve the participation of third parties interested in receiving their share:

- Jar. When purchasing a home using borrowed funds, the advance agreement includes a clause on compensation for the credit institution’s costs in the event of a deal failure. It is prepared according to a standard form by the lawyers of the bank where it is planned to issue a mortgage, so the parties only have to carefully study its provisions and sign. Negotiations on possible changes to clauses are not provided for in this case.

- Real estate agencies/realtors . Despite the fact that the agreement is also drawn up by the company's lawyers, usually the parties can adjust individual points during the discussion. The agency is often interested in selling the property as soon as possible, so it may make certain concessions.

How does an advance differ from a deposit - the pros and cons of each type of prepayment

There is no clear concept of “advance” in the Civil Code, but there is some mention. It is believed that if, when making an advance payment, the parties did not directly indicate in the contract or agreement that this was a deposit, then the law interprets this amount as an advance (Clause 3, Article 380, Civil Code of the Russian Federation).

It turns out that an advance is an advance payment amount that the buyer transfers to the seller against future payments under the transaction, but without a security function.

If you compare an advance and a deposit, you can highlight several advantages:

- If the transaction is terminated, the advance payment is returned to the buyer.

- There are no financial consequences. The parties will not pay damages and will not lose money.

How to correctly draw up an advance payment agreement for the purchase and sale of real estate

The disadvantage is the lack of a security function . Citizens participating in the transaction may refuse their further obligations. There is no guarantee that the seller will not look for other buyers, and the buyer will not refuse to purchase anything according to the contract or agreement.

In essence, an advance is the same as a deposit, but without harsh consequences for both parties.

How to apply for an advance when buying an apartment

The fact of transferring an advance payment when purchasing an apartment can be formalized in two ways:

- specify the terms and conditions in the preliminary purchase and sale agreement;

- draw up a separate advance agreement.

In this case, the first option provides the main emphasis on the details of the future transaction, for which the buyer contributes money, the second document, as a rule, describes only the points relating to the advance payment, the rights and obligations of the parties arising in connection with this.

The advance agreement is drawn up in the number of copies according to the number of persons appearing in it. It can be printed or handwritten. Another option is to print out the basic part with empty spaces for amounts, terms and other individual conditions, which you can then write by hand. Marks and corrections by hand are prohibited, otherwise the document loses its legal force. If such a situation arises, it is better to issue a new copy. Signing and deciphering it is allowed only with a pen.

Procedure for registration

When drawing up an advance agreement, the parties must:

- Discuss the amount and procedure for making an advance payment.

- Verify the seller's ownership of the apartment.

- To make an agreement. If the procedure takes place without the participation of a notary, it is important to ensure that the data provided corresponds to the information from official certificates and extracts.

- Check the points in the document and make adjustments if necessary.

- Sign the agreement and confirm the transfer of money with a receipt.

Required documents

In most cases, a minimum package of documents is sufficient to conclude an advance agreement:

- for the buyer : passport/power of attorney of the representative;

- for the seller : passport/power of attorney of the representative, confirmation of ownership of housing (Extracts from the Unified State Register or Certificate of Ownership) and title documents (Purchase and Sale Agreements, Certificates of Inheritance, etc.)

If the prepayment is made by bank transfer, additional bank account details will be required. In addition, for the buyer’s peace of mind and confidence in the “cleanliness” of the apartment, you can ask the seller:

- Technical passport to check the presence of redevelopments and their legalization.

- An extract from the house register to know the number of registered and discharged persons. Particular attention should be paid to the presence of registration of minors, since in this case permission to sell the apartment will be required from the guardianship and trusteeship authorities.

- A statement confirming the absence of debt for utility services (issued at the Unified Information and Settlement Center or the Management Company).

- An extract from the Unified State Register to check the property rights operations performed with this object.

Deadlines

Advance period – the period from the transfer of the advance payment to the signing of the main agreement for the sale and purchase of the apartment and payment of the remaining amount thereunder. This time is given to the parties to collect documents and complete formalities for finalizing the purchase of the apartment. For standard transactions it is usually 2-4 weeks , for alternative transactions (when another property needs to be pre-sold) - 6-8 weeks . But if the parties wish, they can specify any other terms, up to 12 months . When determining the time period, you should take into account the stage of collecting the necessary documents, the participation of minors, whether the buyer has the full amount to pay for the apartment and other nuances of the specific situation.

If the period specified in the agreement has passed and the parties are not ready to conclude a deal, two options are possible:

- conclude a re-contract with new terms;

- terminate the agreement and return the advance payment to the buyer (unless other penalties are provided for each of the parties).

Certification by a notary

Mandatory certification of the advance agreement by a notary is not required. But the parties can go through this procedure by mutual agreement, which is especially important when transferring large amounts of prepayment. In this case, the notary will help to spell out all the conditions in more detail and correctly, and will also witness the fact of transfer of money in the amount agreed upon by the parties and legally.

The cost of the agreement certification service will range from 1000-2500 rubles .

depending on the number of pages in the document, as well as tariffs for specialist services, which are often determined by place of residence. Thus, in the capital, the costs of a notary will be significantly higher compared to small settlements.

What to include in the agreement

There is no single sample advance agreement approved by law, so it can be drawn up in any written form. The following should be indicated here:

- Place and date of signing.

- Full name and passport details of the parties to the transaction.

- Information about the apartment (address, technical characteristics, price).

- The amount of the advance payment, the method of making it and an indication that it is included in the price of the apartment.

- Deadlines (before concluding the main contract).

- The procedure and terms of return (if the transaction does not take place) and penalties for violating them.

- Signatures of the parties.

The buyer can protect himself in case of detection of “suspicious” details in the documents or actions of the seller by a clause on the return of the full amount of the advance in such a case, for example, within 3 days.

If there are several people among the owners of the apartment, the best option is signatures in the agreement from each of them.

Amount of advance payment for an apartment upon purchase

Advance payment is a partial prepayment towards a future transaction for the purchase and sale of an apartment; accordingly, its size is calculated based on the value of the property. Its size is not specified at the legislative level, therefore it is established by the parties by mutual agreement. On the one hand, the seller is interested in receiving as much money as possible in order to “keep” the potential buyer. It is important for the latter to pay the minimum amount that may be lost in the event of unpleasant circumstances. This way, the parties can haggle until they agree on numbers that work for both.

The prepayment amount can be set as:

- percent of the property price (from 1 to 10%);

- fixed amount (often 50,000 or 100,000 rubles)

By mutual agreement of the parties, the advance payment can reach a significantly larger amount (50% or more of the cost of housing). For example, when the seller needs to pay off the mortgage using the funds received. But with a large advance payment, in addition to a receipt for receipt of money, a preliminary agreement is usually drawn up with a more detailed indication of all the details of the future transaction.

Procedure for transferring money

To transfer money, the parties can choose the most convenient method for themselves:

- cash against receipt;

- non-cash transfer (to a bank account or from card to card);

- through a safe deposit box.

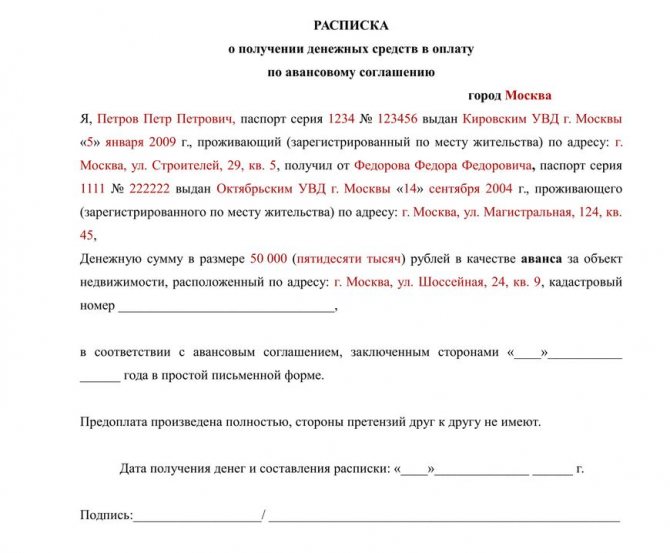

When transferring money in cash, a corresponding receipt is issued at the time of direct payment. It is written by the seller indicating the following data:

- dates and places of compilation;

- name of the document (Receipt);

- Full name and passport information of the parties;

- the amount of money received (under what agreement and for what obligations) in numbers and words;

- no complaints;

- personal signature.

The original copy is given to the buyer, the copy remains with the seller.

Documentary evidence of the transfer of money (receipt, bank statement) must be attached to the advance agreement, otherwise it will be considered only a statement on paper of the intentions of the parties. As a rule, money is transferred on the same day or up to 10 business days after. But for complex transactions, when it is necessary to verify all real estate documents, the time can take 1-2 months.

What amount of advance or deposit should I give to the seller when purchasing real estate?

determine the amount of the advance or deposit .

As a rule, the prepayment is a symbolic amount in the range of 20,000 - 100,000 rubles , no more.

Usually based on the value of the property . For example, if the cost of housing is within 1,000,000 rubles, then the deposit is left in the amount of 50,000-100,000 rubles. If the cost of housing is less than 1 million, then the amount of the advance payment is reduced.

Also consider the type of advance payment and the reason why the seller needs the funds. This way you can avoid the risk of non-refund.

If the reason is compelling, then it is worth drawing up a preliminary purchase and sale agreement with a security deposit , preferably in the presence of a lawyer or notary. This will give more guarantees that the sale will take place, or the payment will be returned in the event of termination of the transaction.

Is the advance refunded if you refuse to purchase an apartment?

The main mistake sellers make is substituting the concepts of deposit and advance payment. The latter is not a means of securing a transaction, but is only a form of preliminary settlements between the parties, when the seller is paid part of the amount before concluding the main contract. Accordingly, the conclusion of an advance agreement does not give the seller any grounds to withhold the money contributed in the event of a deal failure. Refusal to return money can be qualified as unjust enrichment, which must be returned to the buyer (Article 1102, paragraph 1 of the Civil Code of the Russian Federation).

If the matter has not reached the conclusion of a purchase and sale agreement, but the seller refuses to return the money at the request of the buyer, the latter has the right:

- Send a pre-trial written claim to the seller demanding to fulfill the obligation to return the prepayment. It is important to deliver it in such a way that you have proof of receipt by the addressee: a second copy with the seller’s signature, a postal receipt of delivery.

- Go to court for compulsory collection . In addition, you can additionally demand a fee for using your money (Article 395 of the Civil Code of the Russian Federation), the amount of which usually corresponds to the average interest rate of the Bank of Russia on deposits of individuals established for a given period of time.

Expert opinion

Dmitry Nosikov

Lawyer. Specialization: family and housing law.

During the trial, the seller usually seeks to have the advance recognized as a deposit, which he has the right to keep in case of failure of the transaction due to the fault of the buyer (Article 381 of the Civil Code of the Russian Federation). But the courts, when considering such disputes, believe that the application of such provisions contradicts Art. 421 and art. 422 of the Civil Code of the Russian Federation, and refer to Art. 487 part 3 of the Civil Code of the Russian Federation. The latter states that failure to fulfill the seller’s obligations to transfer the goods (in this case, an apartment) after receiving an advance payment gives grounds for the seller to demand a refund of the amount paid. Accordingly, in the absence of a concluded purchase and sale agreement, the obligations provided for in the advance agreement are terminated, and the money paid must be returned to the plaintiff (buyer).

However, in certain situations, it is impossible to obtain the return of the advance payment even by a court decision: if the advance agreement stipulates the conditions for withholding the deposited money or part of it as a penalty/moral damages for failure to comply with the conditions. In this case, the court will quite rightly rule in favor of the seller.

A well-drafted advance agreement when purchasing an apartment is an opportunity to protect your interests, as well as count on a refund of the amount if the purchase and sale transaction does not reach its logical conclusion.

Do you still have doubts about what points to include in the document in your case? At a free consultation, our lawyers will help you choose the right wording to minimize the risks associated with making an advance payment. Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- FREE for a lawyer!

By submitting data you agree to the Consent to PD Processing, PD Processing Policy and User Agreement.

Anonymously

Information about you will not be disclosed

Fast

Fill out the form and a lawyer will contact you within 5 minutes

Tell your friends

Rate ( 1 ratings, average: 5.00 out of 5)

Author of the article

Maxim Privalov

Lawyer. 2 years of experience. I specialize in civil disputes in the field of housing and family law.

Author's rating

Articles written

610

Deposit when buying an apartment - definition according to the Civil Code of the Russian Federation, advantages and disadvantages for the parties to the transaction

The concept of “deposit” is clearly regulated by the Civil Code of the Russian Federation. According to Articles 380, 381 of the Civil Code of the Russian Federation , the deposit is a certain amount of money that the buyer transfers to the seller as proof of the conclusion of the contract and to ensure its execution.

Collection of a penalty from the developer under the DDU - how to collect it if it is not specified in the contract

The transfer of the deposit occurs accompanied by supporting documentation - for example, with the execution of a purchase and sale agreement or a receipt.

The main advantages of the deposit lie in its functions.

- A deposit is a certain kind of guarantee. Earnest money usually ensures that the buyer is going to purchase something from the seller, and the seller, in turn, will not look for other buyers

- The deposit can also prove the completion of a purchase and sale transaction.

- The deposit can perform the function of securing the terms of the contract.

These are important advantages for the parties to the transaction.

As for the disadvantages, the following financial consequences can be identified:

- If the transaction does not take place due to the fault of the buyer, the amount of the deposit remains with the seller. Thus, the buyer will lose money, and no one will return it to him.

- If the transaction does not take place within the specified period due to the fault of the seller, then he is obliged to return the deposit amount to the buyer in double amount. This is evidenced by Article 381 of the Civil Code of the Russian Federation.

How to correctly draw up a deposit agreement for the purchase and sale of an apartment - a ready-made form for downloading and sample documents

It turns out that the deposit carries the function of actually securing obligations for both parties.

Negative consequences may occur for each participant in the transaction, depending on who influenced its termination.