What subsidies are available to pensioners?

The priority areas in the formation of subsidies are assistance to pensioners in purchasing housing, as well as providing subsidies for paying for housing and communal services.

This is free help. Military personnel who have retired, are in need of improved housing conditions (and are registered for this issue), and have more than ten years of work experience are entitled to receive a housing subsidy.

Thus, you just need to figure out what documents are needed to apply for a subsidy for an apartment for a pensioner, and a person can receive a lump sum of money for the construction or purchase of housing. In families where there is no other cash income other than pensions, problems quite often arise with paying for housing and communal services. Subsidy systems are being developed for such categories of citizens. Any pensioner has the right to ask for a subsidy if he is unable to pay utility bills in full.

Before wondering what documents are needed to subsidize a pensioner for utilities, you need to understand a little and understand that:

- A subsidy is money provided to citizens by the state or local governments. In addition, subsidies can be paid to individuals or legal entities from various funds or from local budget funds.

- A subsidy for housing and communal services is assistance from local governments or the state that is provided to owners of living space. It is calculated on already paid utility bills.

- The amount of the subsidy is part of the utility bills that the state pays for the citizen.

After consulting with social services employees, any senior citizen can find out what documents a pensioner needs to apply for a subsidy and choose the appropriate way to receive it:

- apply for benefits for housing and communal services;

- receive a subsidy if the amount of payments for utilities exceeds 22% of the family’s income;

- receive monthly payments that cannot be spent on anything other than paying for utilities.

When choosing a method for receiving a subsidy, you will have to take into account existing local legislation, the amount of income the pensioner has, and various personal circumstances. All this is considered individually in each specific case by social service workers, taking into account the documents provided. ,/p>

Sometimes circumstances arise when a pensioner is awarded a significant subsidy, which is enough to cover 90% of the amount of utility bills.

Veterans of the Great Patriotic War, Labor Heroes and disabled people can count on a fifty percent discount on housing and communal services. In general, by submitting an application and a package of documents to the local MFC or the social security service, any pensioner can hope to receive a subsidy if he is unable to pay for utilities.

In large populated areas, you can find out what documents are needed to receive a rent subsidy for a pensioner at the City Centers for Housing Subsidies. It’s good if it is possible to submit an application to a special portal of Public Services. You can entrust the submission of documents to your representative (pre-execute a power of attorney), or send them by regular mail.

We recommend

“Private nursing home in Moscow: features, selection criteria, cost of living” Read more

Forms of assistance from the state

State assistance to pay off the cost of housing and communal services is provided in 2 forms:

- Monetary. The beneficiary receives a certain amount of money in his bank account.

- The pensioner is sent a receipt taking into account the current subsidy. The document already reflects the amount minus the benefit.

Subsidy payments can be assigned to either one person or the entire family if it meets the relevant requirements. For example, three citizens - a retired father, a daughter and her husband - live in the same apartment. Dad, an elderly disabled person receiving benefits, is a beneficiary and has the right to apply for a benefit. The monthly subsidy will be transferred only to him; the amount payable for utilities in the receipt will not change.

- Changes to OSAGO-2020

- How to remove stubborn stains from clothes - chemical and folk remedies for different types of stains

- Liquid blade for pedicure

Another example. A pensioner receiving a benefit in the amount of 12 thousand rubles is dependent on a grandson-student who has no income other than a university scholarship - 3 thousand rubles. The monthly amount of family income will be 15 thousand rubles. For the use of utilities, they are charged a rent of 5 thousand rubles, that is, 1/3 of the total budget. In this case, the subsidy is awarded to the family, and the recipients - grandfather and grandson - can choose the form of assistance: reflecting the reduced amount in the payment receipt or crediting the funds to a bank account.

What documents are needed for a subsidy for a pensioner?

You can find out whether a senior citizen is entitled to a state subsidy at the USZN in your area, city, region or region. The collected documents should be submitted to the department that serves the area where the living space is located. Employees of social protection authorities will advise the pensioner and, if necessary, provide assistance.

When contacting the Social Security Service, you must bring with you the originals of all collected documents (along with copies) so that social protection service employees can be convinced of the accuracy of the materials provided.

In different regions, the lists of documents that a pensioner needs to apply for a subsidy may be different, but the differences are usually insignificant.

The list of documents may look like this:

- Passport of the pensioner for whom the benefit is issued.

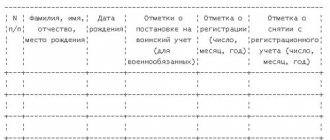

- A certificate confirming the composition of the family, or an extract from the house register.

- Receipt for payment of housing and communal services for the previous month.

- A certificate confirming the opening of a bank account for the transfer of subsidies.

If all close relatives of an elderly citizen have died, it is necessary to provide documents confirming this to the USZN services. After this, the pensioner will be asked to fill out an application in the prescribed form.

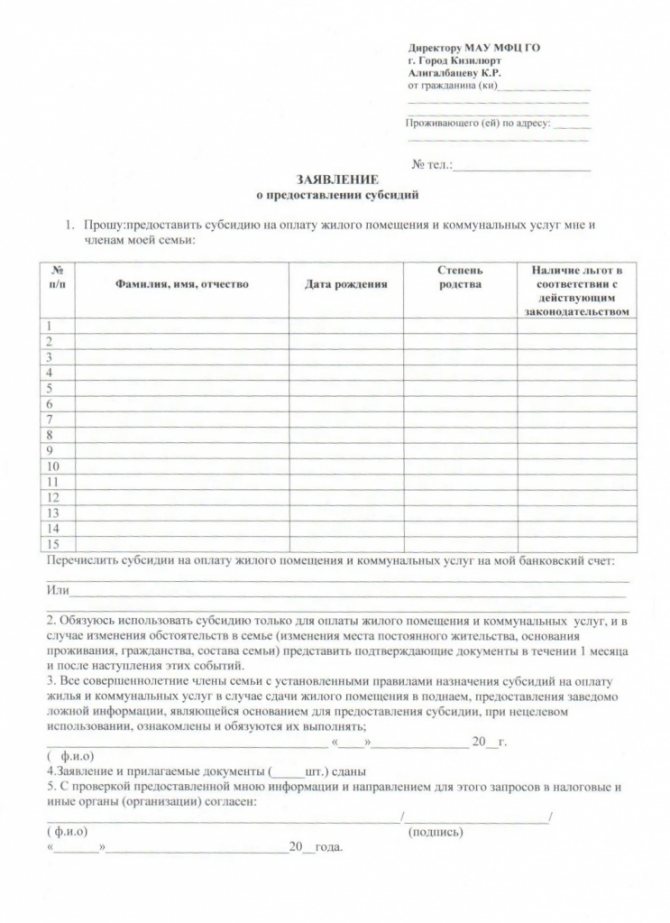

It must include:

- the name of the government body involved in the calculation and provision of benefits;

- Full name of the applicant;

- telephone for communication;

- legal name of the document;

- Full name of all people with registration in this living space;

- what kind of relationship they have with the applicant;

- passport number, series, benefit category (if any);

- address of the location of the living space for which the subsidy is provided;

- Bank details;

- a list of all documents that are needed to subsidize a pensioner, and notes in how many copies they are provided;

- a document prescribing the use of the subsidy only for payment of housing and communal services;

- a document confirming that the applicant is familiar with all the conditions for providing the benefit;

- date of application;

- Full name of the person who submitted the application.

The employee of the social protection authorities who accepted the application signs it, indicates his position, his full name, the number of documents provided and the date of registration.

We recommend

“Documents for caring for an elderly person: which ones and where to submit? » More details

How can a pensioner apply for benefits?

To receive financial assistance in the field of utility services, a citizen must collect documents and submit them to the authorities authorized to resolve issues regarding the provision of benefits.

Where to contact

Applications are submitted to government agencies depending on the type of compensation.

Thus, subsidies in housing and communal services are provided by an organization endowed with the corresponding rights by regional legal act. For example, in Moscow this is the City Center for Housing Subsidies.

To receive a tax benefit, an application is submitted directly to the Federal Tax Service inspectorate, in whose territorial area of responsibility the real estate is located.

To receive compensation for contributions for major repairs, an application is written to the local social security authority.

What documents are needed for registration?

In order to obtain compensation for housing and communal services, including contributions for major repairs, a pensioner must prepare:

- Application for subsidies for housing and utilities.

- Pensioner's passport.

- Notarized copies of documents confirming the grounds for classifying persons living together with the applicant as members of his family.

- An extract from the Unified State Register of Ownership of the apartment or another document confirming the grounds for ownership of the residential premises.

- A certificate of the composition of persons registered with the applicant at the place of residence.

- A copy of the pension certificate, as well as information about the income of family members living together (if any).

- Extracts from personal accounts for utility bills paid for the month preceding the submission of the application, as well as a certificate of absence of debt on utility bills.

- Documents confirming the applicant's right to receive compensation payments.

- Bank details for transferring funds.

In addition to the above, other documents may be required.

The appeal is considered within 10 days from the date of registration, after which a decision is made to provide or refuse a subsidy (clause 42 of the Rules approved by Decree of the Government of the Russian Federation of December 14, 2005 No. 761).

To receive a tax benefit, you need to submit to the Federal Tax Service at your place of residence:

- a citizen’s application along with a certified copy of the pension certificate;

- an extract from the Unified State Register of Real Estate for a taxable property with information about the type of permitted use.

What income can I receive a subsidy for?

If more than 10% of your family's income is spent on utility bills, you may qualify for a subsidy - the state will compensate for part of the costs of housing and utility services.

Calculate your family's average total income. To do this, add up all sources of income (before taxes) for the last six calendar months and divide the resulting amount by six. The income of all family members registered with you, their and your spouses, parents or adoptive parents of minor children, minor children, including adopted children, is taken into account, even if they are registered at a different address.

Compare the result to the maximum pre-tax income for your household to qualify for the subsidy. You can see the maximum income for your family on the website of the City Center for Housing Subsidies.

What documents can confirm lack of income?

- certificate of absence of a scholarship - for students studying full-time at a university or college or technical school;

- certificate of education - for school students from 16 to 18 years old;

- certificate of absence of wages indicating the reason for its absence;

- a document confirming that the woman is being observed in a medical institution due to pregnancy;

- a document confirming that the citizen is being held in custody for the period of preliminary investigation or trial; is wanted until he is declared missing or declared dead; is undergoing long-term hospital treatment; cares for a child until he reaches 3 years of age and does not receive a monthly allowance or compensation for the period of parental leave; cares for his minor child in accordance with the conclusion of the medical institution; has 3 or more children under 16 years of age or older if they are in school; is studying on a correspondence or evening basis with a full-time course of study.

Be sure to read it!

How to get free timber to build a house in 2020: legal norms, features, documents You can see the full list of documents confirming the lack of wages on the website of the City Center for Housing Subsidies.

Documents confirming income level

Information about the monetary support received by the pensioner is contained in the certificate of the paid pension. Such paper can be obtained from the Pension Fund at your place of residence.

Persons living with a pensioner can confirm their income with the following documents:

- for unemployed citizens of working age - a certificate from the employment center or unemployment benefits;

- income tax return in form 3-NDFL for an individual entrepreneur;

- for persons with official work - a salary certificate in form 2-NDFL.

Compiling and submitting an application

The form for applying for subsidies for housing and communal services was approved by order of the Ministry of Construction of Russia No. 1037/pr, Ministry of Labor of Russia No. 857 dated December 30, 2016 (Appendix No. 1).

The application must contain a request for the appropriate benefit. It also indicates the persons (family members) registered at the applicant’s residential address and the method of transferring the subsidy (to bank details).

Next, the number of documents (copies) submitted, special circumstances, as well as the obligation to use subsidies only to pay for housing and utilities are indicated. After which the applicant needs to sign, decipher and date the application.

An application for a tax benefit for an apartment is drawn up on a form approved by Order of the Federal Tax Service of Russia dated November 14, 2017 No. ММВ-7-21 / [email protected] (Appendix No. 1).

When applying to the inspectorate, indicate:

- tax authority code;

- applicant's passport details;

- phone number;

- method of sending a response to the application (by mail, through the MFC, by courier);

- Full name, signature.

Applying for a subsidy for a pensioner

The procedure for completing documents to receive a subsidy is as follows:

- The citizen submits an application to the social security service and attaches to it all the documents that are needed to subsidize the pensioner.

- The package of documents is checked for authenticity and correctness of execution (do they comply with current legislation).

- USZN employees assess each specific situation and determine whether the citizen really needs help.

- A decision is made on whether the benefit will be provided or not.

- The formula calculates the amount of the subsidy.

- Preference is provided.

You can submit an application through the government services website, or in person through the USZN. From the moment you apply, expect a decision to be made within ten days. If you provided documentation in the first half of the month (before the 15th day), then this month will already be taken into account in the calculations when calculating the subsidy. If you submitted an application after the 15th, you will begin to receive funds only from the next month. The assistance provided can be listed in different ways:

- for a specially designed demand deposit;

- transfer via mail;

- to an account in one of the Russian banks.

You can choose any bank, the main thing is that the following points are observed:

- Try to find a reputable bank that will not “burst” with your money. Maybe someone they know can recommend a reliable option that they themselves have used.

- The bank you choose should have enough branches so that there are no problems with withdrawing money.

If all the documents that are needed for a subsidy for a single pensioner or an old person with poor health or limited mobility have been prepared, reviewed and approved, then delivery of the money to the place of residence is arranged at the post office. If you need such a service, you should contact, again, the USZN.

Important note: There is no tax on money given as assistance.

If certain conditions are not met, social protection authorities may temporarily stop providing benefits; there are cases of its complete cancellation.

When collecting the documents that a pensioner needs to apply for a subsidy, ask the USZN in your area, maybe some of the information is already available to them thanks to common electronic databases.

A positive or negative decision on each specific case is made by the relevant authority within approximately 14 days from the date of application. In case of refusal, the citizen receives a letter by mail explaining the reasons.

The procedure for calculating and receiving subsidies is such that after six months it is necessary to renew them. In cases where the subsidy has already been assigned, USZN cannot independently cancel it and pay it until the agreed period ends.

To extend payments, you must re-submit all the same documents that are needed for a subsidy for a pensioner after 70 years of age, or for any elderly person. After this, wait again for the allotted time until a decision is made.

Re-registration is not required for single elderly people, or for those families in which there are no other sources of income other than pensions.

As a rule, money is issued monthly on the 1st or 16th. Because it takes about two weeks to review newly received applications, and then payments are made.

None of the documents can be old or expired, otherwise this may become a reason for refusing to provide financial support.

We recommend

“Physiological and psychological characteristics of elderly people” Read more

How to properly apply for a subsidy for housing and communal services for a pensioner

One of the ways to apply for a subsidy for utilities is a personal visit to the territorial social security office.

Please note that if a pensioner cannot visit the social security department on his own, his representative can do this for him if he has a power of attorney.

The algorithm of actions consists of the following stages:

- Collect the necessary package of documents.

- Appear at the territorial social security office.

- Complete an application for a subsidy, attaching the prepared papers.

- Transfer the entire package to a specialist, and the co-defense worker must make a note about the receipt of papers in a special journal or program.

- Wait for the decision to be made.

On the State Services website

For pensioners registered on the electronic portal of government services, it is possible to submit an online application:

- Log in to your personal account by entering your username and password.

- Select the appropriate section.

- Fill out the attached form.

- Attach copies of prepared documents.

Please note that if the decision is positive, to apply for a subsidy, the citizen must appear at the social security authorities or the Multifunctional Center (MFC) and provide the original documents, copies of which he attached when filling out the application.

Through MFC

Registration of subsidies for pensioners is possible at the MFC. To do this, you must adhere to the following steps:

- Collect the necessary package of documents.

- Appear at the center in person or submit the prepared papers through a legal representative.

- Fill out an application.

- Wait for the decision to be made.

- Braided hairstyles

- Photo shoot love story

- 5 ways to lower blood pressure without drugs

Refusal to provide a subsidy

All collected documents that are needed to subsidize a pensioner must meet the requirements prescribed by existing law. Otherwise, the citizen may be refused.

Most often, the reason for a negative answer is the insufficiently large amounts of expenses for utility bills. They, as mentioned earlier, must be more than 22% of the available income for each family member (the average value is taken). In addition, they may be refused for other reasons:

- the person who applied is not a citizen of the Russian Federation;

- There are debts on utility bills.

But, if a positive decision has already been made, then by law the social security authorities are obliged to pay all amounts in full until the period for assigning the benefit expires. In the case when changes have occurred in the life of an old person, and the information in the documents that are needed to subsidize the pensioner must also change - this must be reported to the social security service.

For example, if the average income has increased, the benefit will most likely have to be abandoned.

There is no need to try to hide any circumstances that may lead to the cancellation of the subsidy. Because sooner or later everything will become clear, and the money received illegally will have to be returned. Moreover, a fine may also be assessed.

Who is considered a pensioner living alone?

According to the law, non-working pensioners, men aged 60, women aged 55, can be considered living alone if there is no one to support them, provide assistance, and they live separately from relatives. This category of citizens often does not have close relatives, they are not married, and run their own household. In some cases it is possible to have:

- minor children;

- disabled spouses with disabilities.

To receive preferences, people who live alone must document their status. This requires:

- be a citizen of the Russian Federation;

- be registered in the region where benefits are provided;

- not be a debtor for utility bills;

- confirm family composition with documents;

- have proof of the right to reside in the premises;

- provide data on income below the subsistence level (low-income status).

- How to survive sudden weather changes

- The genome of the coronavirus COVID-19 has been deciphered in Russia

- 5 Best Herbs to Kill Parasites Naturally

What factors influence the size of the subsidy for pensioners?

The amount of subsidies is calculated using a special existing formula.

Subsidy = generally accepted standards of payment for utilities X number of residents registered in a given living space (utility costs/100) X amount of income for each family member (its average value is taken).

It turns out that regional standards for payment for housing and communal services, the average income for each family member, the number of people registered in a given apartment or house, and the actual amount spent on utility bills are taken into account.

Legislative regulation of the issue

Federal Law “On State Social Assistance” dated July 17, 1999 N 178-FZ (latest edition) determines the list and procedure for calculating social assistance to citizens of the Russian Federation. According to the law, it is permissible to pay no more than 22% of income for housing and communal services. Otherwise, you can count on additional assistance from the state.

Regions are allowed to reduce this percentage at their discretion, based on budgetary capabilities. In addition, at the local level it is permissible to expand the list of preferential categories of citizens and determine individual services that are subject to subsidies.

Therefore, what subsidies are available to pensioners depends on the region in which he lives. The state determines only the upper limit for spending on utility costs.

Not only homeowners, but also members of their families, as well as members of housing cooperatives living in state apartments can receive benefits for housing and communal services for pensioners.

Additional benefits for pensioners and their relatives

Now, having information about what documents are needed for a subsidy for a pensioner, you can safely use it, but you should not think that this is the only type of assistance provided to the elderly by the state. There are a number of other measures to support older people.

Here is a list of possible preferences for the elderly:

- If one of the family members had to leave work in order to care for an elderly family member, such a relative can count on receiving a care allowance.

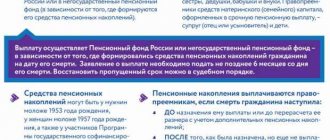

- A one-time payment of part of the pension that is subject to accumulation. Moreover, such a payment applies even to those who have not yet left work.

- If a pensioner is in the care of a dependent, a student, or a sick relative (who is not able to take care of himself), then such an old person is also entitled to assistance from the state.

We recommend

“Holiday home for the elderly: types, living conditions, registration procedure” Read more

How to determine the amount of compensation in 2020

When calculating subsidies for housing and communal services for pensioners in 2020, not only the income of family members of an elderly person is taken into account, but also the right to other benefits in this area. If a pensioner is a disabled person, a participant in the Second World War, a survivor of the siege, a victim of radiation, and is awarded medals, then he has the right to benefits on electricity and other utilities in the amount of 50%.

After taking into account all the benefits, the social service worker adds up all the family’s income, divides it by the number of residents and determines the average amount per person. Depending on the norms in the region, the amount due for payment is calculated. Then the overpayment that is generated by the pensioner is determined, and it is returned to him in the form of a subsidy to an open current account.

For example, a pensioner has an income of 10,000 rubles, but pays 4,000 rubles for utilities. Based on the federal threshold of 22%, it turns out that the payment limit for him is 2200. This means that the difference (4000-2200) of 1800 rubles will go to the account.