Elderly people often find it very difficult to pay utility bills. Their fees increase every year, making the fees exorbitant. Therefore, support measures are being developed at the state level for these segments of the population. One of them concerns the law on paying for major repairs to pensioners over 80 years of age.

Should pensioners after 80 years of age pay contributions for major repairs?

The legislation of the Russian Federation provides benefits for pensioners when transferring money for major repairs. But to obtain compensation, you will initially need to pay all the resulting debt. In the future, citizens will be able to claim a 100% refund of the money paid. That is, all bills for major repairs sent to pensioners over 80 years of age are subject to monthly payment in full, after which all money will be returned.

The automatic return scheme for the transferred amount is not used; certain conditions must be met.

Should pensioners after 70 years of age pay contributions for major repairs, and at what age do they not pay?

So, the question arises, should pensioners pay contributions for major renovations?

Federal law states that after age 70, a pensioner makes payments for major repairs in the amount of 50% of the total amount.

The provisions of the new law allow for complete exemption from payment of payments upon reaching a certain age. The question arises: at what age do pensioners not pay such contributions?

The law established that in cases where a pensioner over 80 years of age lives in an apartment, payments are not collected.

Please note: if a person who has not reached the specified age lives with a pensioner and this person is the owner of the premises, then the benefit will not be provided!

At what age do you not get paid?

Payment for major repairs by pensioners over 80 years of age provides for a full refund of costs. For elderly people who have reached the age of 70, half of the amount paid is due to be reimbursed.

But in both cases, a refund can be issued subject to a number of conditions:

- the senior citizen must live alone or in a marital union;

- Receiving benefits is possible if one of the spouses has reached above the specified age;

- lack of place of work;

- only the owner of a residential premises that meets certain requirements can apply for compensation;

- the fundamental factor determining the possibility of obtaining assistance is the absence of unpaid fines and other debts to the state. If a pensioner has debts for any utilities and other services, including major repairs, then a refund of these deductions is impossible.

If you have a debt, it is recommended to pay it off or enter into an agreement with the organization on debt restructuring and pay it in installments.

Should pensioners after 70 years of age pay contributions for major repairs, and at what age do they not pay?

So, the question arises, should pensioners pay contributions for major renovations?

Federal law states that after age 70, a pensioner makes payments for major repairs in the amount of 50% of the total amount.

The provisions of the new law allow for complete exemption from payment of payments upon reaching a certain age. The question arises: at what age do pensioners not pay such contributions?

The law established that in cases where a pensioner over 80 years of age lives in an apartment, payments are not collected.

Please note: if a person who has not reached the specified age lives with a pensioner and this person is the owner of the premises, then the benefit will not be provided!

Law on capital repairs for pensioners

Based on Art.

169 of the country’s housing legislation, from the beginning of 2019, pensioners over 80 years of age are entitled to full benefits for major repairs. Part 2.1 of this article gives regional authorities the authority to determine specific parameters for providing compensation for major repairs, for example, living space standards per citizen. All categories of beneficiaries fall under the same section of the code. Expert opinion

Mironova Anna Sergeevna

Generalist lawyer. Specializes in family issues, civil, criminal and housing law

But in accordance with the provisions of the Federal Law of the Russian Federation “On Major Repairs”, all homeowners must transfer a certain amount monthly. Therefore, 80-year-old citizens are required to pay money to the capital repair fund. The basis for payment is a receipt for payment of the monthly fee.

Law on overhaul

As already mentioned, the law was adopted on December 25, 2012. But as for benefits for pensioners, they were determined and assigned only in 2020. According to it, pensioners who have reached the age of 80 years and older are exempt from paying contributions for major repairs.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

The percentage of benefits also depends directly on age, that is, the older the person, the greater the amount of the contribution made. This was done with the aim of freeing low-income people from extra monthly payments for housing and communal services.

Also, housing and communal services fees are not paid in the following cases:

- The house is in disrepair.

- The housing is not subject to major repairs.

- There is a decision to demolish the building.

- The building has been transferred to the management of the municipality, and there is an order to evict the residents.

How does the benefit for pensioners work in different regions?

The method of social protection of citizens aged 80 years began to operate at the beginning of 2020, the required amount of money was allocated. But many subjects are faced with the problem of implementing the program, which is why representatives of social protection and operators in the regions constantly receive claims and complaints.

For example, in the Tambov region, it was decided to calculate the number of pensioners after 80 years of age with benefits for major repairs in advance.

In Kostroma, all the necessary bills concerning compensation to beneficiaries, including compensation for major repairs to pensioners over 80 years of age, were signed on time and are currently being implemented.

In the Kaluga Region and Khabarovsk Territory, the bill on reimbursement of capital repair costs for pensioners is currently in effect, and its validity has been extended.

The Belgorod region initially lagged behind in reimbursing the costs of major repairs for pensioners, but now everything has returned to normal.

The Kursk and Vladimir regions have been at the forefront of reimbursing the costs incurred by older people, and continue to successfully implement the program.

In the Bryansk and Tula regions, pensioners who are over 80 years old must pay for major repairs, but the entire amount will be reimbursed. The corresponding legislative act was adopted, albeit belatedly.

In the constituent entities of the Central Black Earth region, the authorities independently determine the standards for the size of housing that are eligible for benefits. For example, if a grandmother lives alone, then she is entitled to compensation for 33 sq. m., if an elderly pensioner lives together with her peer, then they are entitled to a deduction of 21 sq. m. for everyone. For 3 family members, compensation will be determined based on 18 sq. m. per citizen. The calculation takes into account the total area of the apartment, which includes non-residential premises.

In some regions there are still problems with financing or the work of the administrative apparatus, but compensation will be paid to all categories of beneficiaries. Today, according to Rosstat, there are approximately 3 million people in the country who are entitled to compensation for major repairs.

Features in different regions

Depending on the region, the conditions for issuing benefits and also its percentage may differ, since they are different in each region. Therefore, before applying, make sure whether your region offers benefits for capital repairs for pensioners after 80 years of age.

Moscow and Mo

Since the capital has the highest prices for utilities, the number of pensioners applying is much higher than in the regions. Every day, thousands of retirees apply for benefits.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Residents of Moscow and Mo who are over 70 years old are given a 50% discount on the cost of major repairs.

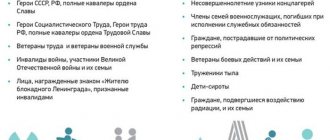

Also, benefits are provided not only for people over 70 and 80 years old, but also for veterans and disabled people of all groups.

Novosibirsk region

Starting this year, pensioners of the Novosibirsk region are also exempt from payments and receive compensation for the costs of paying a contribution for major repairs.

Kuban

In Kuban, pensioners over 70 and 80 years of age have also been given a number of benefits under which they will be exempt from payments for major repairs or will have to pay part of the assigned amount.

How to apply for a benefit and get your money back

After the 80th birthday, the owner of the apartment cannot count on an automatic mechanism for the emergence of preferential rights.

To apply for reimbursement for major repairs, you must submit an application.

It must be supported by a certain list of documentation, which is established at the legislative level.

In addition, the applicant for the benefit must liquidate all existing debts for received utility services.

A complete list of conditions for providing assistance to pensioners over 80 years of age when paying for major repairs can be found on the pages of the official web resources of the regional government. It is also worth visiting the management company to clarify information about the planned major renovation of the house - whether the object is included in the program.

Benefits for pensioners after 80 years of age: what do you need to know?

Reading time: 4 minute(s) In the Russian Federation, pensioners are entitled to certain benefits or monetary compensation. For persons over eighty years of age, the list of privileges has been expanded. Let us examine in more detail what benefits are available to pensioners after 80 years of age.

What benefits are entitled to a pensioner at 80 years old?

Upon reaching 80 years of age, a pensioner is entitled to several categories of benefits:

- medical;

- transport;

- utilities;

- tax.

Let's look at each group separately.

Medical

A citizen who has reached the age of eighty has the right to the following benefits in the field of medicine.

- Compensation for half the cost of purchased medicines that are essential drugs . The list of such drugs is established by the authorities of the constituent entity of the Russian Federation.

- Compensation for expenses associated with paying for travel to the place of treatment , if such treatment must be carried out in a locality in which the pensioner does not permanently reside.

- Free issuance of vouchers for sanatorium treatment once every two years.

- Partial compensation for the cost of prostheses . What specific prostheses are paid for is determined by the regional authorities. In some areas, they even reimburse the cost of dentures. The amount of compensation also depends on the region. In most regions of the federation, only part of the cost of prostheses is reimbursed. However, in some regions the compensation is full (for example, in Moscow).

Transport

In addition to full payment for travel to the place of treatment, citizens over eighty years of age can be compensated for travel on public transport (with the exception of taxis) for other purposes (for example, to move around a populated area).

The procedure for receiving and the amount of payment is determined by regional authorities. In some regions, only half of the money spent is returned, in others - all the money spent, including for paying for a taxi (this is what happens in Moscow).

Utilities

Additional benefits for pensioners after 80 years of age are also provided in connection with the payment of housing and communal services. These include the following.

- Benefits for major repairs . Citizens who are owners of residential premises and live alone, who have reached the age of eighty, have the right to receive a subsidy that completely exempts them from paying contributions for major repairs of common property in an apartment building to the appropriate fund.

- Subsidy for utilities . Persons who spend more than the share of income established for such expenses by the legislation of the constituent entity of the Russian Federation on paying for housing and communal services (taking into account the standards of area allocated for living to each person registered in an apartment) have the right to receive a subsidy that will fully or partially relieve them from the obligation to pay for housing and communal services. Not only the owners of residential premises have the right to a subsidy, but also those who live in an apartment on the basis of a social rental agreement concluded with the local administration. The size of the subsidy, as well as additional conditions for its provision, are determined by regional authorities. For example, in St. Petersburg for pensioners it is 50%. In other subjects of the federation, this value may differ, sometimes quite significantly.

- Compensation for utility bills . The main difference between compensation and a subsidy is that it is not sent to the management company to exempt the pensioner from payment, but is issued directly to the citizen. Before receiving it, he is obliged to pay housing and communal services for a certain time (most often this period is six months or one year). Then, after providing payment receipts, he is reimbursed for part of the money spent. The condition for providing compensation is the absence of housing and communal services debts. The procedure for providing this benefit is determined by regional authorities.

Tax

The Tax Code of the Russian Federation provides tax breaks for persons over eighty years of age. These include the following.

- Complete exemption from personal income tax . This rule applies not only to those who have reached the age of eighty, but to all pensioners in general. At the same time, not only a citizen’s pension is not taxed, but also material benefits received by him in other ways - from the sale of property, a gift, and so on. The exception is wages - working persons who have reached retirement age are required to pay personal income tax.

- Full or partial exemption from property tax . The extent to which a citizen will be granted relief from the obligation to pay this fiscal payment is determined by the subjects of the federation. This is due to the fact that it goes to the regional budget.

- Tax deduction for land tax . The amount of such a deduction is 10,000 rubles. In other words, when calculating land tax, 10,000 rubles are subtracted from the value of the property that is the tax base, and only after that the fiscal payment due for contribution to the budget is calculated.

The authorities of a constituent entity of the federation may establish additional tax benefits for pensioners over eighty years of age regarding the payment of other taxes. For example, in Moscow there are transport tax breaks for them. However, in most other regions there are simply no additional measures to support this category of people.

Other

Both federal and regional legislation provide for a number of other privileges for citizens over 80 years of age. These are the privileges.

- Compensation for caring for an elderly person . A non-working, able-bodied citizen has the right to arrange care for another citizen over 80 years of age. In this case, the latter will receive a pension benefit in the amount of 1,200 rubles.

- Pension recalculation . After 80 years, the Pension Fund recalculates the elderly person’s pension. According to its results, the fixed pension supplement increases by 100%.

- Services for the elderly by social workers . Persons over 80 years of age, if they cannot independently support their livelihoods, have the right to free assistance from an employee of the social protection authorities.

- Receiving a set of products or a discount on their purchase . This benefit is established by regional or municipal authorities, so in different areas it can be provided under different conditions.

- Obtaining a place to live in the event of his absence, in other words, the right to be placed in a nursing home . For such placement, the citizen gives part of his pension to the social organization. The size of this part depends on the organization itself, as well as on the region in which it is located.

How to apply?

Where to contact?

To receive benefits at the federal level, you must contact the social security authorities at the pensioner’s place of residence. Separate privileges in the field of payment for housing and communal services are issued by the management company. Each of the benefits can be obtained by contacting the nearest branch of the MFC or submitting an application using the government services website.

The process for receiving regional assistance may vary. Most of it is also provided by social security authorities, but some support measures are issued by the local administration.

You can find out what a pensioner is entitled to in the region of his residence and where it can be applied for, at the social security department or municipality. Also, in most cases, detailed information about this is contained on the State Services website.

What documents are needed?

To obtain assistance you will need the following documents:

- identification document (passport of a citizen of the Russian Federation);

- pensioner's ID;

- for housing and communal services benefits - a certificate of family composition confirming the place of residence and family composition of the beneficiary;

- other documents confirming the circumstances giving the right to assistance (for example, to pay for travel to the place of treatment - a referral from a local clinic for such treatment).

From this video you can learn about the increase in pensions due to citizens over eighty years of age:

Pensioners who have reached the age of eighty are entitled to social benefits and additional payments. Some of them are determined by federal legislation, some by regional and municipal legislation. To receive benefits, you must contact the social security authorities, the MFC or the municipality. They can also be issued on the State Services website.

Did this article help you? We would be grateful for your rating:

16 4

Where to contact

To apply for benefits due to a pensioner, you can use the following methods of submitting documents:

- come to the nearest MFC;

- take the papers to social security representatives;

- send documentation using the electronic government services service.

Expert opinion

Mironova Anna Sergeevna

Generalist lawyer. Specializes in family issues, civil, criminal and housing law

To return the amounts paid, you can use a bank account, a pensioner’s plastic card, or the money can be sent by postal order. Payment of compensation continues monthly, until the 26th.

Before contacting government agencies you will need:

- cancel all existing debts and penalties;

- pay the current receipt for major repairs;

- if previous payments were made on time, you will need to attach everything in the receipt to the application;

- prepare the required documentation;

- You will need to write an application at the government agency where the documents will be submitted; this procedure will not take more than 5-10 minutes;

- After checking the package of papers, a decision will be made on granting benefits.

Overhaul fee after 80 years in 2020

The end of 2012 was marked by amendments to the Housing Code.

Federal Law No. 271 introduced a new line in the structure of fees for residential premises for owners - “major repairs”. In 2015, a bill was approved that allowed older people to receive privileges under this expense item. Many pensioners may no longer be able to wait for such a grandiose transformation of their home, so State Duma deputies decided to abolish fees for major repairs for them. Benefits for pensioners over 80 years of age are provided without exception. Later, this bill came into force and gradually, in the regions, this line in the receipt began to be abolished.

Required documents

Due to their age, it is quite difficult for some pensioners to collect documents confirming their preferential rights. Close relatives or another person can collect papers and process the due payment if they have a power of attorney certified by a notary.

Pensioners must confirm their right to compensation for major repairs with the following documentation:

- application (the form will be issued on site);

- civil passport;

- certificate of absence of debts for housing and communal services;

- paid receipts for major repairs;

- certificates proving ownership of the apartment (house);

- a pensioner's ID or other document proving the legality of using the benefit;

- an extract from a personal account;

- information about income;

- if other persons who fall into the preferential category live with the applicant, their income certificates and certificates of incapacity for work will be required.

In the text of the application to process a refund, you must indicate your full name, registration address, type of benefit used, etc. If a pensioner has difficulties in writing it, then you can turn to specialists from the government agency where the documents are being submitted for help.

What documents will be needed

— passport or other document proving identity and confirming place of residence (copy);

— insurance certificate of compulsory pension insurance (SNILS);

— a copy of the document confirming the ownership of housing, or a copy of the title document if the ownership is not registered in the Unified State Register of Rights to Real Estate and Transactions with It;

— an extract from the personal account or a copy of the house register (completed pages) with data on all registered;

— documents confirming the lack of work activity of the citizen and family members living with him (copies of work records, extracts from the individual personal pension account issued by the Pension Fund, etc.);

— a statement of bank details and the account where the compensation will be credited;

— copies of documents confirming the accrual of the contribution for major repairs for the month preceding the month of applying for compensation, and a receipt for payment.

Benefits for major repairs for pensioners after 70 and 80 years of age

Chapter 15 of the Housing Code reveals the main provisions of the legislation regarding the overhaul of apartment buildings. It also states that the powers to ensure the operation of the Federal Law are vested in the subjects of the Federation; they develop their own regional programs.

We recommend reading: Ministry of Internal Affairs Trainee Certificates 2020

When the owner spends more than 22% (according to the federal standard) of his income on paying receipts, the funds will be returned to him - they will compensate for the difference between the maximum established and actual payments. The pensioner's income matters here. Regional interest rates for seniors are significantly lower than federal ones. Thus, Muscovites are applicants for a subsidy or compensation if their expenses exceed the 10 percent threshold.

Categories of citizens

The first of them is non-working pensioners over 70 years of age, without any debt on contributions. Such people will receive compensation in the amount of 50% of the payment for repairs, which in principle is not bad.

The second category is people over 80 years old, again unemployed and without housing debts. They are the luckiest ones, as their compensation increases to 100% of the contribution. On the other hand, this does not relieve them of the obligation to pay for other items, so consider them exempt from major repairs, but not from other items in the receipt.

Thus, we can state the unpleasant fact that the plan to exempt these groups of citizens from paying receipts could not be fulfilled, but it’s a pity they already have a hard time, be it in Moscow, in Tyumen, in Krasnodar or in some Vologda, it doesn’t matter .

What benefits for paying for major repairs are available to pensioners over 70 years of age?

Rates vary in the constituent entities of the Federation. In St. Petersburg, this coefficient is set at 3-4 rubles per m 2 depending on the type of house, Krasnodar region - 5.32 rubles, in the Rostov region they pay 7.17 rubles, Orenburg region - 7.92 rubles, Sverdlovsk region - 9 rubles . The Moscow government has set the highest tariffs, since the percentage of citizens applying for government assistance and receiving it according to the law of the Moscow Government is quite high here. Muscovites pay 17 rubles per m2. For elderly people over 70 living in the central regions of Moscow, the amount paid with a 50% discount is displayed directly on the receipt. The rest receive compensation from the amount already paid.

We recommend reading: Reviews About Receiving a Housing Subsidy in Tver 2020

Disabled groups I and II who are homeowners will also receive a 50% discount. If pensioners live together with disabled people, they lose the right to benefits. Since 2020, this injustice has been eliminated by the legislator. Thanks to new amendments made to the Housing Code of the Russian Federation, such families become recipients of compensation to pay for major repairs in an apartment building. If members of such families have reached 70 years of age, they are entitled to a 50% benefit, and from 80 to 100% compensation.