11

You can inherit any property that belonged to a deceased person and has not been withdrawn from circulation. One of these types of property is a plot of land - an area that is used for construction, gardening, gardening, travel, passage and earning money. If the deceased owned such an allotment, the heirs will be able to inherit it. At the same time, inheritable ownership may be transferred to successors for life.

The question arises: how to inherit a plot of land after the death of a relative? In what cases will you have to prove your rights in court? Let's look at the step-by-step instructions and dwell on the nuances of design.

Features of land inheritance

A plot of land is a landscape of land that has special characteristics and purpose. Depending on its size, the territory may be indivisible and subject to division.

If a plot of land does not exceed the minimum size, it can be inherited as a whole - splitting into parts is impossible. If the plot is subject to division, the heirs can register it as shared ownership. If the division becomes impossible, the plot goes to the applicant, who has a priority right to receive the land on account of his share of the inheritance (clause 2 of Article 1182 of the Civil Code of the Russian Federation). The remaining applicants are entitled to compensation for the cost of their share in the inheritance.

The transfer of property rights to a land plot occurs in two ways:

- by will - the written will of the owner about the fate of his property (Article 1118 of the Civil Code of the Russian Federation);

- according to the law , the wife, children and parents of the deceased will be the first to inherit, then brothers and sisters, etc.

Please note that along with the land, the heirs may also receive a piece of real estate - a dacha, a garden house, outbuildings. If the deceased managed to draw up documents for the buildings, there will be no problems. If the documents have not yet been completed or are missing altogether, litigation cannot be avoided.

The basis for receiving an inheritance is the existence of property rights by the testator. In other words, the deceased leaves not only the land plot, but also the title documents - a certificate of ownership or a new extract from the Unified State Register of Real Estate.

Inheriting land plots is not much different from the usual procedure. There are also restrictions related to the status of heirs - unworthy applicants are eliminated from the “race” for the inheritance (Article 1117 of the Civil Code of the Russian Federation). For example, if the heir is deprived of parental rights, made an attempt on the life of the testator, did not provide him with lifetime support, etc.

Example:

After the death of the head of the family, the inheritance was opened. This included an agricultural land plot with a total area of 0.222 hectares. The claimants to the property are the heirs of the first line of kinship: the spouse, father and son of the deceased man. Land regulations of SanPiN do not allow for the allocation of shares, therefore, division of property is impossible. Later it turned out that the testator’s wife participated in the use of the land plot - she planted flowers, looked after the beds, and collected fruits from the garden trees. According to paragraph 2 of Article 1182 of the Civil Code of the Russian Federation, a woman had a preferential right to land. Ultimately, the plot went to her - the remaining applicants received compensation commensurate with their shares.

Land property transferred by inheritance was called

» Payments and processing costs October 10, 2020

Rules for inheritance of certain types of property

The peculiarities of inheritance legal relations that may arise during the transfer of the rights of one person to another are characterized by a certain order and form of the object of inheritance. The relations of citizens in this matter are regulated by the legal norms of the Civil Code of the Russian Federation.

Among the various objects are the transfer into ownership of other persons of land and enterprises, awards and limited negotiable things, inheritance of various rights, indivisible things and certain types of property.

Inheritance is understood as the right of succession from the grantor, otherwise called the testator, to a legal predecessor, otherwise called the heir. All relations between participants can be regulated with the help of laws.

Legislative acts and certain aspects of transfer

According to the law, receivers are distributed in order of acquisition of property rights: first, subsequent, third parties. There is a special group called heirs by right. But whatever the successors, there are uniform norms for everyone, determined by the state and they are called laws.

The main legislative act regulating legal relations in this area is the Civil Code of the Russian Federation. We draw your attention to the document Chapter 65 entitled “Inheritance of certain types of property”.

The remaining documents are regulating the legal actions of bodies that consider issues or disputes about inheritance between participants in legal relations. These may be letters of recommendation or explanations regarding the performance of certain actions to notary offices, courts, insurance companies, banks and other institutions that are in one way or another related to the settlement of issues.

Transfer of land plots by inheritance

- Land Code of the Russian Federation.

- Article 1181 of the Civil Code of the Russian Federation.

The subject of the right of inheritance is the citizen to whom the land or the right to own it is transferred.

The testator must have legal grounds and supporting documents of ownership of the land, which he can transfer to someone else. In addition, the grantor, who by law can dispose of the land plot for life. And also, who acquired it by inheritance is able to grant this right to another.

The land plot must be part of the inheritance, and it or the right to own it must be part of the property.

If this condition is met, ownership is inherited on a general basis. Then you do not need special permission to accept the inheritance.

Objects located within the boundaries of the site will also be inherited.

Entry into inheritance occurs after the death of the testator.

The peculiarities of the transfer of the right to lifelong ownership of a land plot are that after the adoption of the Land Code in 2001, a certificate of the right to inherit land plots is not issued, and land plots cannot be transferred into private ownership or inherited by anyone.

Business inheritance

This issue is regulated by the Civil Code in the following articles:

Clause 1 of the above article discusses objects of inheritance, and clause 2. – character and conditions.

In this case, the enterprise is inherited. referred to as a property complex - real estate. It must carry out business activities. Then the enterprise is recognized as an object of inheritance, and the complex is recognized as real estate.

In order to inherit an enterprise, the heir must be registered as an individual entrepreneur of the enterprise. Such an action must be completed at the time of opening the enterprise itself and documented.

If the heir is a commercial organization. then the division of the inheritance occurs in shares. If neither an individual nor a legal entity can act as an heir, and otherwise is not provided for by reason of the agreement, then the inheritance of the enterprise occurs in shares.

Awards

- Article 1185 of the Civil Code of the Russian Federation.

- Decree of the President of the Russian Federation dated September 7, 2010 No. 1099.

- Decree of the President of the Russian Federation dated March 29, 2013 No. 294.

According to the above decrees, these awards are not included in the list of inherited things. Their transfer is carried out in accordance with the legislation on state awards to the heirs of the first priority for storage or as a memory. If there are no heirs, then the awards are transferred to state ownership by law. At the request of government agencies, these objects can be transferred for storage to state museums.

Badges of honor, commemorative medals, awards, for which this legislative act does not apply, can be inherited.

Limited negotiable items

- Article 129 clause 2.

- Article 1180.

Clause 1 indicates which things will be classified as limited negotiable objects. Paragraph 2 defines the legal framework.

To transfer to heirs, it is necessary to include these things in the inherited property.

Some items, such as weapons or special substances, require special permits. A list of such objects has also been approved. Until they receive them, the heir does not have the right to have the donated property. If he does not want or cannot obtain permission for limited negotiable items, then the right of ownership is lost. In this case, these objects can be sold, and financial resources returned to the former heir minus expenses.

Aspects of inheritance of participation in shares and other forms of legal entities

- Articles 1176 – 1179.

- Articles 253 – 255.

- Articles 257 – 259.

Legal entities are enterprises and firms, private societies or farms, cooperatives and other organizations: LLC, OJSC and CJSC.

To receive such an inheritance, the heir of the specified legal entities must be a share of the authorized capital or have a share, shares of the enterprise, or be a member of this organization. If such special conditions are not met, the heir has the right to contact the governing body with an application to grant him such a right. This can happen with the consent of the other participants.

If the heir does not receive rights, then in some cases he can count on the allocation of a share in monetary terms, in other cases he loses the rights to inherit membership, in third cases, entry into the inheritance occurs between all heirs, and the property is redistributed in equal shares.

Shares of a partnership, cooperative or community are transferred with the consent of the participants of these enterprises. In case of refusal, the inherited share is paid.

The share of the heir of a member of a peasant farm is transferred on a general basis in accordance with the documents specified in clause 3. If the heir has never been a member of this enterprise, then he enters into another right, namely, compensation commensurate with that corresponding to the inherited part, expressed in monetary form. Compensation will be paid in case of agreement at a time to be agreed upon. If there is no such agreement, then the payment terms are determined after court hearings.

Points of contact when inheriting indivisible things as separate types of property

- Article 133.

- Article 1168.

The documents of the first paragraph indicate the concept of an indivisible thing, and the second - the order of their inheritance. Such property includes that which cannot be divided without causing damage to the objects. Either it will be residential or industrial real estate, also not subject to division. For example, a dorm room with an area smaller than that required by law for one person to live in.

The heir who already owned this property together with the testator who was still alive has the priority right to inherit an indivisible thing. This right arises regardless of whether he used this thing or not.

The heir who exercises both of the above rights together has the primary right to such a thing. If the inherited object is not subject to division, and the heirs did not have rights to it, then the object is inherited by those who lived together with the testator.

Special types of property that can be inherited include: cash in any form, transport and means of transportation, various property, real estate, land ownership, shares of enterprises.

These objects are defined by law, and the order of inheritance is regulated by the Civil Code. For all objects, the testator must have state documents confirming ownership rights. A person who wants to transfer his property to loved ones must write a will. which must be notarized, then it will have legal force.

According to the above circumstances, the heirs enter into the inheritance after the death of the owner. If these conditions are met, inheritance occurs by will.

If the person who owns the property or rights did not take care to decide on those to whom the objects will be transferred, then the inheritance is transferred by law.

Thus, legal norms are regulated by legislation, and moral norms are regulated by human relations.

For information on the rules of business inheritance, watch the following video:

Still have questions? Find out how to solve exactly your problem - call right now:

Inherited property: land ownership

Inheritance, in accordance with Article 1110 of the Civil Code of the Russian Federation, provides for the process of transferring the property of a deceased person (inheritance) to the heirs (persons who acquire such succession status in accordance with the law or a will). Article 1112 of the Civil Code of the Russian Federation states that the inheritance may include:

- Property,

- Property rights,

- Property responsibilities.

- Natural and artificial water bodies,

- Trees and plants,

- Surface soil layer.

- The inheritance tax in the Russian Federation is

- Inheritance dispute over the marital share in the apartment; targeted loan

Thus, we can conclude that the inheritance can include almost any property, except that which is excluded from civil circulation. At the same time, certain types of property are subject to a special legal regime.

Hereditary land ownership is an issue regulated by Article 1181 of the Civil Code of the Russian Federation. Thus, it says that the land plot that was owned by the testator, as well as the so-called right of lifelong inheritable ownership of the land plot, is considered an inheritance. When it comes to inheritance, the general procedure is applied, which is enshrined in the Civil Code of the Russian Federation. The legislator himself emphasized that no additional documents are required for this type of inheritance.

Since this issue is also regulated by land legislation, water legislation and other regulations, it should be emphasized that there are possible additional nuances. In accordance with the Federal Law on the Introduction of the Water Code of the Russian Federation, together with the land plot or the right of lifelong ownership of the land plot, the following are transferred to the heir:

if they are within the boundaries of the ancestral territory. This provision does not apply only if it is expressly stated in the law.

Hereditary land ownership

Before the new codified Russian land legislation came into force, citizens had the opportunity to take advantage of lifelong inheritable ownership. That is, in accordance with established norms, citizens received some municipal or state land on the right of lifelong inheritable ownership. Despite the fact that there was an actual owner of this land plot, he could not control the fate of such property, since the legal owner of the land plot remained the municipality or the state. At the same time, the citizen was assigned the right to transfer such a plot of land as an inheritance.

Hereditary land ownership occurs according to a general procedure. established by law. In the future, in order to be able to dispose of such land, it is better to try to re-register it as private property.

Professional legal assistance

An inheritance that includes land has some legal subtleties that are established by current legislation. An example is the process of dividing a land plot, if it was received by the right of common ownership by several heirs at once. A qualified legal specialist will not only be able to help prepare the necessary documents for registering an inheritance. but will also provide professional advice in order to correctly resolve various situations related to inheritance. Such assistance will be able to prevent disputes on this basis, which often end in complex legal proceedings.

Article 21. Lifetime inheritable ownership of land plots

1. The title of the right to lifelong inheritable ownership of a land plot was first enshrined in the Fundamentals of Legislation of the USSR and Union Republics on Land in 1990 (Article 5), and then in the Land Code of the RSFSR. This title is actually a veiled form of limited private property rights.

According to the Decree of the President of the Russian Federation of December 24, 1993 N 2287 On bringing the land legislation of the Russian Federation into conformity with the Constitution of the Russian Federation, the title of the right to lifelong inheritable ownership of a land plot was excluded from the Land Code of the RSFSR. However, it continued to be applied, since it was provided for in the Law of the Russian Federation of December 23, 1992 N 4196-I On the right of citizens of the Russian Federation to receive private ownership and sale of land plots for running personal subsidiary and dacha farming, gardening and individual housing construction, and later - in Art. 216, 265 Civil Code.

The said Law provided that land plots for these purposes, which were in the use of citizens, were transferred to them as private property within the established norms for the provision of land plots free of charge. Citizens who had land plots whose size exceeded the maximum norms, in all cases retained the right to lifelong inheritable possession or use of that part of the land plot that exceeded the established maximum norms. Citizens had the right to purchase this part of the land plot as private property from the local administration at a negotiated price.

The principle of privatization of land plots by citizens enshrined in this Law was confirmed in Decree of the President of the Russian Federation of October 27, 1993 N 1767 On the regulation of land relations and the development of agrarian reform in Russia. According to paragraph 3 of the Decree, citizens who received plots of land for lifelong inheritable possession or perpetual (permanent) use, or who leased them, except for rent from individuals, had the right to provide and purchase these plots of ownership in accordance with current legislation.

Decree of the President of the Russian Federation of March 7, 1996 N 337 On the implementation of the constitutional rights of citizens to land specified the above provisions of the Law. In paragraph 1 of the Decree, it was established that land plots received by citizens before January 1, 1991 and which are in their lifetime inheritable possession and use, including those in excess of the established size limits, and used by them for personal subsidiary farming, collective gardening, housing or dacha construction are retained by citizens in full. It was forbidden to oblige citizens who have these land plots to buy them or lease them. Privatization of such land plots is carried out in accordance with the procedure for re-registration of citizens' rights to land plots.

2. According to the commented article, the right to lifelong inheritable ownership of a land plot is one of the types of rights to land. Only citizens can own a land plot with the right of lifelong inheritable ownership. Article 216 of the Civil Code classifies this title as a real right. The right of lifelong inheritable ownership of a land plot in state or municipal ownership, acquired by a citizen before the entry into force of the Land Code, is retained.

After the entry into force of the Land Code, land plots on this title are no longer provided to citizens (clause 1 of the commented article). This is explained by the fact that citizens who have land plots in lifelong inheritable ownership have the right to acquire ownership of them. In accordance with clause 9.1 of Art. 3 of the Federal Law On the entry into force of the Land Code of the Russian Federation, if the land plot was provided before the entry into force of the Land Code for the conduct of personal subsidiary, dacha farming, vegetable gardening, horticulture, individual garage or individual housing construction on the right of lifelong inheritable ownership, the citizen owning the land plot on such a right, has the right to register ownership of the land plot, with the exception of cases where, in accordance with federal law, the land plot cannot be provided for private ownership.

State registration of ownership of land plots is carried out in accordance with Art. 25.2 of the Federal Law On State Registration of Rights to Real Estate and Transactions with It. No decisions are required to make such land plots available to citizens. If the land plot was provided on the basis of the right of lifelong inheritable possession, from the moment of state registration of the citizen’s ownership of such land plot the right of lifelong inheritable possession is terminated.

According to paragraph 3 of Art. 3 of the Federal Law On the Entry into Force of the Land Code of the Russian Federation, the registration of ownership of land plots previously granted to them for lifelong inheritable possession by citizens in the cases established by land legislation is not limited by the period.

3. In accordance with Art. 266 of the Civil Code, a citizen who has the right of lifelong inheritable ownership (owner of a land plot) has the rights of ownership and use of a land plot, transmitted by inheritance. Unless otherwise follows from the conditions for use of a land plot established by law, the owner of the land plot has the right to erect buildings, structures and other real estate on it, acquiring ownership rights to it. The rights of landowners are defined in Art. 41 of the Land Code (see commentary), and the duties are in Art. 42 ZK.

The landowner has the right to dispose of a land plot only by transferring it by inheritance (clause 2 of the article under comment), therefore the right of lifelong inheritable possession, as noted above, is close in content to the right of ownership. A similar rule is provided for in Art. 267 Civil Code. Disposal of a land plot that is in lifelong inheritable possession is not permitted, except in the case of transfer of the right to a land plot by inheritance.

4. According to Art. 265 of the Civil Code, the right to lifelong inheritable ownership of a land plot in state or municipal ownership is acquired by citizens on the grounds and in the manner provided for by land legislation.

The transfer of rights to a land plot in accordance with paragraph 2 of the commented article is carried out by inheritance. According to Art. 1181 of the Civil Code, a land plot owned by the testator or the right of lifelong inheritable ownership of a land plot is included in the inheritance and is inherited on the general basis established by the Civil Code. No special permission is required to accept an inheritance that includes the specified property.

When inheriting a land plot or the right to lifelong inheritable ownership of a land plot, the surface (soil) layer, water bodies, and plants located on it within the boundaries of this land plot are also inherited, unless otherwise established by law. State registration of the transfer of the right to lifelong inheritable ownership of a land plot by inheritance is carried out on the basis of a certificate of the right to inheritance.

In Art. 45 of the Land Code contains a list of grounds for termination of the right to lifelong inheritable ownership of a land plot. The right of lifelong inheritable ownership may be terminated at the will of its owner. This is a case of renunciation of the right to a land plot.

The right to lifelong inheritable ownership of a land plot can be forcibly terminated in case of violations of land legislation, seizure of a land plot for state or municipal needs, requisition of a land plot (clause 2 of article 45 of the Land Code). The procedure for forced termination of this right is defined in Art. 54 ZK.

51. Inheritance of land plots

Inheritance of land plots is carried out in accordance with the norms of the Civil Code of the Russian Federation and the Land Code of the Russian Federation, which in turn establishes the norms and rules of inheritance in relation to each type of inherited land plot. Despite the fact that the Civil Code of the Russian Federation establishes a general procedure for inheriting land plots, land plots can be transferred by right of inheritance only to the extent that this is enshrined in the law. Special rules for the inheritance of land plots are enshrined in the Land Code of the Russian Federation. Therefore, the application of the norms of the Land Code of the Russian Federation is necessary when inheriting, including the division of a land plot.

To accept a land plot on the basis of inheritance, no additional permissions are required other than granting the right to inherit. The Land Code of the Russian Federation states that there are land plots that are limited in civil circulation and withdrawn from civil circulation. Land plots cannot be granted ownership if they have the status of limited civil circulation or withdrawn from it. Various types of transactions cannot be carried out in relation to these types of land plots. The list of land plots withdrawn from circulation and limited in civil circulation is specified in the Land Code of the Russian Federation.

The inheritance may include land plots that are owned or have the right of lifelong inheritable ownership. When inheriting a land plot or the right to lifelong inheritable ownership of a land plot, the surface (soil) layer, closed reservoirs, forest and plants located within the boundaries of this land plot are also inherited.

Despite the fact that the norms of the Civil Code of the Russian Federation establish a general procedure for inheriting land plots, the Land Code of the Russian Federation establishes restrictions on the subject of inheritance. Foreign citizens, stateless persons, foreign legal entities cannot own land plots on the right of ownership of certain types of land plots, including agricultural lands.

If several heirs are called to inherit, then the land plot passes to them on the basis of common shared ownership. The division of a land plot is carried out taking into account the minimum size of the land plot.

The minimum size of a land plot is established by the laws of the constituent entities of the Russian Federation. As for land plots provided for personal farming and individual housing construction, the norms are established by regulatory legal acts of local government bodies. If it is impossible to divide a land plot without losing its intended purpose, the preemptive right of the heir is established, to whom the land plot will be transferred by inheritance on account of the inheritance share due to him. If none of the heirs has a preferential right to receive a land plot, possession, use and disposal of the land plot is carried out by all heirs on the terms of common shared ownership.

5.6. Inheritance of land plots

In Russia, land, along with buildings and structures, was considered real estate and was included in circulation. However, in 1917 the land was declared state property and excluded from circulation. With the transition to market relations, the legislator declared land to be real estate, an object of ownership and other rights (Article 1 of the Land Code of the Russian Federation of October 25, 2001 No. 136-FZ).

The Land Code of the Russian Federation establishes that land can be used only with the rights specified in the law. In order to streamline existing types of land rights, Art. 3 of the Federal Law “On the entry into force of the Land Code of the Russian Federation” No. 137-FZ provides that rights to land not provided for in Art. 15 and art. 20–24 of the RF Land Code are subject to re-registration from the date of entry into force of the RF Land Code. That is, after the adoption of the Land Code of the Russian Federation, land can be used only on the basis of one of six legal regimes: property, permanent (indefinite) use, lifelong inheritable possession, lease, gratuitous fixed-term use, easement.

The situation with citizens using land plots under the right of permanent (perpetual) use and lifelong inheritable ownership is different. After the Land Code of the Russian Federation of 2001 came into force, citizens are not provided with land plots under these legal regimes. Therefore, citizens who have been provided with a plot of land on the basis of one of the above regimes can acquire ownership of it in full, free of charge, once.

In accordance with paragraph. 2 p. 2 art. 218 of the Civil Code of the Russian Federation, in the event of the death of a citizen, the right of ownership of the property belonging to him passes by inheritance to other persons in accordance with a will or law.

The right of ownership of real estate remaining after the death of the testator passes to the heirs only if the testator's right arose and was registered earlier in the manner prescribed by law.

The procedure for inheriting land plots is regulated by Art. 1181 of the Civil Code of the Russian Federation, according to which the land plot owned by the testator or the right of lifelong inheritable ownership of the land plot are included in the inheritance and are inherited on a general basis.

Thus, citizens can acquire ownership of a land plot by inheritance, that is, by law and by will. What to do with those citizens (testators) who did not take advantage of the right to free privatization? A land plot with the right of permanent (perpetual) use cannot be inherited. In this case, the buildings located on this land plot under the right of ownership of the testator are inherited, and the land plot passes to the heir of the building after the building according to the rules of Art. 35 of the Land Code of the Russian Federation. Moreover, all rights are transferred to the heir, including the right to free registration of ownership of this plot. The transfer of rights to a land plot after the death of the testator - the owner of the building cannot be considered as an act of inheritance; this is nothing more than one of the special cases of the transfer of rights to a land plot when the owner of the building changes, which is provided for in Art. 35 of the Land Code of the Russian Federation and Art. 271 Civil Code of the Russian Federation. [155]

The same procedure applies to destroyed buildings and unfinished construction projects. The specified objects are inherited. After registration of these objects, the heir has the right to acquire ownership of the land plot in his actual use. The situation becomes more complicated if the testator has not started constructing a building on the allocated land plot with the right of permanent (perpetual) use. Judicial practice in recent years indicates an increase in disputes related to refusals. [156] The position of the heirs will change only if, notes Zharkova O.A., [157] if the testator filed an application for registration of rights to the land plot in the manner prescribed by Federal Law of June 30, 2006 No. 93-FZ “On introducing amendments to some legislative acts of the Russian Federation on the issue of registration in a simplified manner of citizens’ rights to certain real estate objects.” This law (also referred to as the “law on dacha amnesty”) names the grounds (act, certificate, extract from the household register) for simplified registration of ownership of land plots provided before the entry into force of the Land Code of the Russian Federation for running personal subsidiary plots, dacha farming, gardening , gardening, individual garage or individual residential construction.

Also, the Federal Law of November 23, 2007 No. 268-FZ “On amendments to certain legislative acts of the Russian Federation on the issue of registration in a simplified manner of the rights of heirs, as well as other citizens to land plots” is intended to simplify the procedure for state registration of citizens’ ownership rights to land plots ", according to which heirs of residential buildings have the opportunity to register ownership of the land plots on which the inherited residential buildings are located, on an equal basis with citizens - heirs of land plots.

The right of lifelong inheritable ownership, as we noted above, is inherited on a general basis.

However, there is an opinion among lawyers that, unlike the right of common ownership, the right of common ownership is not provided for by law and a plot on the right of lifelong inheritable ownership is not inherited by several persons if it is indivisible, i.e. cannot be divided between heirs. [158]

Yes, indeed Art. 1182 of the Civil Code of the Russian Federation provides for the possibility of dividing a land plot owned by heirs only on the right of common ownership, taking into account the minimum size of a land plot established for plots of the corresponding purpose. The law does not provide for the possibility of dividing a land plot when acquiring by inheritance the right of lifelong inheritable ownership. But this does not mean, notes O.A. Zharkova, [159] that there cannot be common ownership.

The right of lifelong inheritable possession is a real right, and a land plot under the right of lifelong inheritable possession, as well as under the right of ownership, can belong to several persons. And for the inheritance of such a plot, its divisibility does not matter to anyone, as for the inheritance of any property.

Law enforcement practice has also followed this path. Currently, registration authorities, taking into account Art. 21 of the Land Code of the Russian Federation, the heirs are immediately registered with the right of common shared ownership of the land plot, although the notary issues a certificate of inheritance for the right of lifelong inheritable ownership.

Inheritance of land share. As a result of the land reform of the early 1990s, the lands of collective and state farms were divided into conditional land shares without defining local boundaries and transferred to the common shared ownership of former members of collective and state farms and other categories of workers, each of whom received a certificate of ownership of the land share.

When registering inheritance rights to a land share, the following must be provided:

• decision of local government bodies on the transfer of agricultural land into common ownership with a land plot plan

• certificate of ownership of the land share

• a certificate from an agricultural organization stating that the land share was not contributed to the authorized capital

• certificate of valuation of the land share on the day of death.

After receiving a certificate of the right to inheritance and registering the right with the registering authorities, the owner of the land share in accordance with Part 1 of Art. 392 of the Tax Code of the Russian Federation is the payer of the land share tax.

Sources: propertyhelp.ru, www.nasledconsult.com, pravo.studio, www.libma.ru, www.e-reading.club

Next:

No comments yet!

Share your opinion

You might be interested in

How to register land as an inheritance if there is a mistake in the surname in the order

Documents for inheriting an apartment

If there is a will, is it necessary to enter into an inheritance before 6 months?

Notaries Elets spell inheritance

Popular

Within what period is a notary required to issue a certificate of right to inheritance (Read 698)

How to inherit a car if there are several heirs (Read 479)

Benefits for disabled people when accepting an inheritance (Read 278)

Is it necessary to pay tax on the sale of a plot received by inheritance (Read 220)

How to inherit a land plot?

Inheritance of any type of property, including land, requires contacting a notary. The first thing you need to understand is whether a will was left?

If the deceased transferred it to one of the heirs, the will will be useful when dividing the plot. The absence of a will starts the process of inheritance by law - from family members and close relatives to distant relatives.

Order and procedure

The notary is contacted at the place of residence of the testator. The heirs need to determine which office to submit the application to.

Entering into inheritance of land in 2020 - instructions:

Stage No. 1

Search for the will of the deceased. To do this, you need to contact any notary office in the city.

Stage No. 2

Contacting a notary, determining the order of inheritance. The notary will identify the heirs, check their legal capacity and offer to write applications for inheritance. Applicants submit an initial package of documents.

Stage No. 3

Registration of a land plot, resolution of disputes, agreements between future heirs. If candidates enter into an inheritance, they evaluate the land plot, pay the state fee and submit the remaining documents to the notary.

Stage No. 4

Issuance of certificates of inheritance rights is a title document with which you can register ownership in the MFC or Rosreestr.

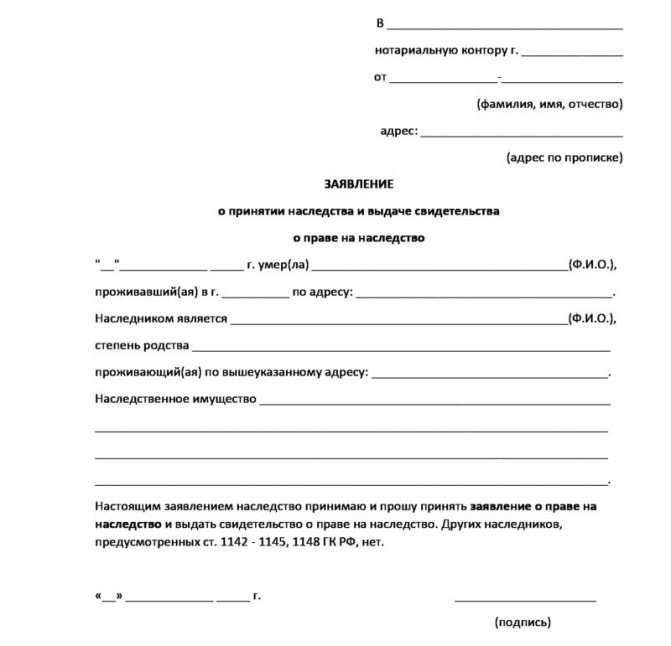

Statement

An inheritance case is opened at the request of the heir. The notary offers clients the service of filling out an application - so all you have to do is put your personal signature.

Contents of the application for inheritance:

- name of the notary office and/or full name of the notary;

- information about the heir - full name, address;

- information about the testator - full name, date of death, which is confirmed;

- reference to the presence of a relationship with the deceased subject;

- the essence of the applicant's request;

- date, signature.

Expenses

When registering documents with a notary, the heirs pay a state fee. Its size depends on the degree of relationship and the value of the property.

Tax rates:

- 0,3% – This tariff is established for close relatives of a deceased person. At the same time, the legislator has provided an extreme threshold for the amount of the fee. Regardless of the estimated value of the land plot, the amount of withholding should not exceed 100,000 rubles (if the value is higher, the heir pays this amount).

- 0,6% – This tariff is established for the remaining beneficiaries - distant relatives and strangers. The limit for collecting this category of heirs is 1,000,000 rubles.

Heirs who lived together with the testator and claim a land plot do not pay the state duty. Benefits are also available to disabled people and pensioners, provided they can prove their status.

The rest pay a standard state fee + notary services of a technical and legal nature (UPTH) - depending on prices in the region. Amounts can reach up to 3-7 thousand rubles.

Deadlines

Documents and an application for acceptance of the inheritance must be submitted within 6 months from the date of opening of the inheritance. It does not matter how the inheritance occurs: by law or by will. If the heirs do not declare their rights within the specified time frame, they may lose their inheritance to the land plot.

The exception is the actual acceptance of property - use, processing, protection from claims of third parties, payment of debts, property taxes. This fact must be confirmed by appropriate documents - certificates, receipts, receipts, invoices, checks, etc.

Missed deadlines can be restored by court decision - for this, the heir will have to justify the untimely application (he was ill, was abroad, in an emergency zone, in prison, or served in the army).

The application must be submitted no later than 6 months after the reason for absence ceases. For example, within six months from the moment of the cessation of a man-made accident in the region of residence of the heir.

Minimum and maximum sizes of land plots

The Land Code currently does not define the minimum and maximum sizes of a land plot. At the same time, Art. 38 of the Town Planning Code of the Russian Federation gives the concept of maximum (minimum and (or) maximum) sizes of land plots and maximum parameters of permitted construction, reconstruction of capital construction projects, which include;

1) maximum (minimum and (or) maximum) sizes of land plots, including their area;

2) minimum setbacks from the boundaries of land plots in order to determine the places of permissible placement of buildings, structures, structures, outside of which the construction of buildings, structures, structures is prohibited;

3) maximum number of floors or maximum height of buildings, structures, structures;

4) the maximum percentage of development within the boundaries of the land plot, defined as the ratio of the total area of the land plot that can be built on to the entire area of the land plot.

Other federal laws also indicate the legal significance of the minimum size of a land plot. So, according to paragraph 2 of Art. 63 of the Federal Law “On Mortgage (Pledge of Real Estate)”, it is not permitted to mortgage a part of a land plot, the area of which is less than the minimum size established by the regulations of the constituent entities of the Russian Federation and regulations of local governments for lands for various purposes and permitted uses.

This context means that with the adoption of the Town Planning Code of the Russian Federation, the procedure for determining such maximum and minimum sizes has changed, if only because the code has combined the determination of the maximum sizes of land plots and parameters of capital construction into a single complex.

Now these requirements will be contained not in disparate legal acts of different levels and legal force, but in urban planning regulations, which are an integral part of the rules of land use and development (municipal legal act). In turn, land use and development rules must be developed taking into account the provisions contained in the territorial planning documents of the Russian Federation, constituent entities of the Russian Federation and relevant municipalities. Therefore, it is the urban planning regulations that will determine the maximum sizes of land plots and the parameters for the construction (reconstruction) of capital construction projects.

If it is necessary to divide a land plot, the size of which is recognized as minimal, it passes to the heir who has the priority right to receive this land plot against his inherited share. According to Art. 1168 of the Civil Code of the Russian Federation, an heir who, together with the testator, had the right of common ownership of an indivisible thing, a share in the right to which is included in the inheritance, has, when dividing the inheritance, a preferential right to receive, on account of his inheritance share, the thing that was in common ownership, before the heirs who were not previously participants in the common property, regardless of whether they used this thing or not. An heir who has constantly used an indivisible thing that is part of the inheritance has, when dividing the inheritance, a priority right to receive this thing on account of his inherited share over the heirs who did not use this thing and were not previously participants in the common ownership of it, as Art. 1169 of the Civil Code of the Russian Federation. Compensation to the remaining heirs is provided in the manner established by Art. 1170 of the Civil Code of the Russian Federation.

If none of the heirs has a priority right to receive a land plot or has not exercised this right, the ownership, use and disposal of the plot are carried out by the heirs on the terms of common shared ownership.

Documents for inheriting a land plot

To enter into an inheritance, applicants must prepare the appropriate documents. The notary will ask you to provide copies with confirmation of the originals. Make photocopies in advance.

List of documents:

- citizen's passport;

- papers confirming relationship with the deceased citizen - this can be a birth certificate, marriage certificate, etc.;

- documents confirming the death of the testator - a death certificate or a copy of a court decision declaring a person dead/missing;

- documents of title for inheritance (sale and purchase agreement, land lease);

- certificate of site assessment;

- cadastral passport or extract according to the USRN form;

- a certificate from the place of registration of a deceased citizen - issued at the migration department or at the housing office;

- documents confirming the absence of debts on taxes and fees - a certificate from the Federal Tax Service;

- proof of payment of state duty.

When inheriting a summer cottage, additional documents may be required. For example, an extract from the Unified State Register of Legal Entities (USRLE).

As for the estimated value, the heir can contact a licensed organization and order an assessment of the market value of the land . It is advisable to contact trusted companies - Rosreestr also carries out assessments. It is enough to obtain an extract from the Unified State Register of Real Estate indicating the cadastral value of the land plot.

Documents for inheritance of land

As has already been said, in order to enter into inheritance rights, as part of the procedure for accepting inherited property, a potential heir, in one case or another, must submit one of the above applications to the notary. Based on one of them, the notary is obliged to certify the inheritance rights of the successor.

However, for such certification, the notary will need a list of documents that fully confirm that the successor has certified inheritance rights.

Expert opinion

Kovalev Konstantin Vladimirovich

Practicing lawyer with 6 years of experience. Specializes in criminal law. Recognized legal expert.

Based on paragraph 1 of Art. 1153 of the Civil Code, the primary document for accepting land as an inheritance is the application of the legal successor . In addition, the notary will require you to provide:

- Identification documents of the heir (passport, driver's license).

- Death certificate of the testator.

- Documents confirming the relationship with the testator (birth certificate, marriage certificate, change of surname, etc.).

- A will, if any, with a note from the notary who compiled it that at the time of opening of the inheritance it had not been changed or revoked.

- A certificate from the last place of residence (Form No. 9), indicating all those living at this address or an extract from the House Register.

- Cadastral plan of the land plot, certified by the body maintaining the land cadastre.

- Title documents for land (purchase and sale agreement, exchange, donation, certificate of ownership of land, certificate of state registration, right of lifelong ownership, etc.).

- Extract from the cadastral passport (Form B1), indicating the cadastral value of the land.

- Boundary plan fixing the boundaries of the site.

- Documents confirming the priority right to the land plot.

- Agreement on the division of a land plot or determination of its shares, etc.

Please note that from 10/12/15 , due to the entry into force of Art. 3 Federal Law No. 259 dated July 13, 2015

and according to Art. 47.1 of the Fundamentals of Legislation on Notaries, notaries no longer have the right to require heirs to submit extracts from the Unified State Register for land plots, since such information can be obtained by them independently in electronic form.

The procedure for registering ownership of a land plot after inheritance

After receiving a certificate of title, the beneficiary must register the title. The procedure is determined by law - you don’t have to look for an organization, because all actions are carried out in one body - Rosreestr.

You can also use it in the context of territorial offices (MFC).

Procedure

To register property rights, you need to contact the Rosreestr branch or the nearest branch of the MFC (starting from 2017, citizens can apply to the branch at their place of residence, without reference to their place of registration).

Step-by-step instruction:

- Choose a convenient method:

- through State Services or the Rosreestr website;

- personal visit to the MFC - you will need to take a coupon and wait your turn;

- by phone - a specialist will accept the application and schedule a free day to visit the MFC.

- Inform about your desire to register ownership of a land plot or share.

- Pay the state fee.

- Fill out the application, sign it and give it to the window specialist.

- Submit documents, receive a receipt for acceptance of the registration package.

- Wait for a second call to the MFC branch or Rosreestr.

- Visit the branch with a passport and a receipt - the registrars will issue an extract from the Unified State Register of Property Rights.

Remember that without registering land ownership, you will not be able to dispose of real estate - rent, sale, donation, will, exchange, pledge and other transactions will become unavailable. A certificate of inheritance only confirms the rights of the successor, but it does not establish ownership.

Application (sample)

Registration of property rights occurs at the request of the heir. If children under 14 years of age are involved in the transaction, the application must be filled out by their parents or guardians (grandparents, uncles, aunts).

Starting from the age of 14, the child fills out the documents himself, but with the consent of his legal representatives.

Contents of the application for registration of ownership of a plot of land:

- name of the registration authority;

- legally significant action - registration of the owner’s rights to a land plot;

- information about the applicant - full name, address, contacts;

- the essence of the copyright holder's request;

- the basis for registering property rights is a certificate of inheritance;

- type of registered property - land plot or share;

- location of the land plot - address, cadastral information, area, etc.;

- method of submitting/receiving documents - paper or electronic;

- list of attached papers;

- date, signature of the new owner of the land.

Required papers

The package of documents depends on the type of inherited property.

The application must be accompanied by:

- identification card - usually a copy of the Russian passport;

- certificate of inheritance;

- title and technical papers for inherited land;

- proof of payment of the state duty - a receipt (optional).

After checking the documents, the registrar issues a receipt to the heir - on its basis, the applicant will subsequently be able to receive documents confirming the transfer of rights.

Expenses

When registering property rights, the heirs will have to pay a state fee. Its size depends on the type of property.

Let's look at the tariffs in table form:

| Registration of rights | Amount of state duty (RUB) |

| For real estate | 2000 |

| To a plot of land for running a personal subsidiary or dacha farm | 350 |

| For plots of agricultural land | 350 |

| Registration of a share in the right of common ownership of a plot of agricultural land | 100 |

| For easement | 1500 |

Registration deadlines

Registration of a property with the state occurs within 4–14 days from the date of submission of the application.

The deadline depends on several factors:

- where exactly the applicant submits documents - applying through the MFC will take a little longer (+ 2-3 days for sending documents to Rosreestr);

- what action needs to be taken - registering the property with cadastral registration + registration of ownership will take up to 15-30 days.

One-stop services simplify the registration of real estate properties. A single electronic database contains the necessary data, so the entire process usually takes no more than a week.

Privatization of land

Having decided to privatize a plot of land, be prepared for a complex, lengthy process. City residents submit documents to the city administration, district residents to the village council. The decision is made within 14 days from the moment the package is accepted.

If the decision is positive, subsequent actions depend on the situation - the plot is transferred for a fee or free of charge. Paid – purchase and sale agreement, free – by inheritance.

Regardless of the method of receiving the loan, the next step is to contact Rosreestr. At the time of contacting the registration authority, the subject must have the following documents on hand:

- Identification.

- Contract of sale.

- Decision of the state administration.

Additionally, a receipt for payment of the tax fee, an extract from the cadastral plan, and an application requesting to register the land asset are attached. Along with the land, you can register the buildings standing on it; registration of ownership of land and house is simplified.

Important! If the structure standing on the site is the property of the village council, it is recommended not to privatize it, but to issue a buyout.

Inheritance nuances:

Right of unlimited use

The land plot may not belong to the person, but be issued from the municipal fund. The owner is the local government body, and organizations have the opportunity to use the site indefinitely (Article 39.9 of the Land Code of the Russian Federation). Ordinary citizens rarely receive such land, and if they do receive it, they are not the owners.

According to general rules, the right to perpetual use of a plot of land is not inherited.

However, there are exceptions:

- If a residential building, garden building or other construction projects were built on the land, instead of inheritance, it is possible to buy out the land.

- If the testator started registering property rights, but did not have time to complete it due to death, the heirs have the right to continue what they started - disputes are resolved in court.

Heirs or buyers will have to request a copy of the grant of the plot for perpetual use to the testator.

Common shared ownership

There is one plot of land, there are many applicants... what to do? Quite often, the land is distributed among all applicants - each of them will have to properly register ownership.

First of all, you will have to agree on the transfer of the land into common ownership. If disputes arise, litigation cannot be avoided.

If there are several heirs, the procedure will be as follows:

- Designate a plot of land.

- Draw up an agreement on the redistribution of shares.

- Draw up several copies of the agreement for all shareholders.

- Register changes with the Rosreestr authority.

It is important to stipulate the procedure for using the land and establish passages/entrances to the territory. Read more about this and more in our article “How to divide a house and land that are in common shared ownership?”.

Mortgage, lease or easement

Contractual relations that arose during the life of the testator do not always end with his death. Certain restrictions and prohibitions are inherited (Article 617 of the Civil Code of the Russian Federation).

When preparing documents, the beneficiary needs to analyze the circumstances that relate to the inheritance.

By accepting the property of a deceased citizen, the heir assumes his obligations under a lease, rent, pledge or easement . Such restrictions continue to apply even after the heirs have assumed their rights.

Example. In 2000, the testator entered into a land lease agreement for 49 years. The agreement was entered into the register of the state real estate cadastre. The man died in 2010 - the inheritance went to his adult daughter. Considering that 10 years have passed since the lease, the woman can use the land plot under the lease agreement for another 39 years. During his lifetime, the tenant managed to erect outbuildings on the land. They also become the property of the heiress. Obligations under the lease agreement are retained in full - we are talking about the intended use of the land and making payments. Failure to comply may result in the lease agreement with the new tenant being terminated.

Can a tenancy end with the death of the tenant? Yes, if the lease agreement directly states this, the presence of such a clause excludes the possibility of inheriting a plot rented by a deceased citizen. Read more about this in the article “Inheritance of the right to lease a land plot.”

Are there any restrictions on the period of entry into rights? Yes. The heir must take over as a tenant within 1 year. Missing deadlines will result in automatic termination of the contract.

If there is an easement, it is necessary to take into account the legal requirements and practices of the region where the land plot is located. The order in which the land is used plays a key role—how will the heir dispose of it?

For example, he will process it himself, rent it out, or find a buyer for the land. An easement establishes the right to use the land, and if the new owner is against this option, he has the authority to terminate the easement.

What is inheritance of allocated land plots

Inheritance is a procedure in which ownership passes from one entity to another. This can be absolutely any property. Most often, movable and immovable property, investments, and precious metals are inherited. Land plots, of course, are also included in this list.

The latter refers to a certain volume of territory that is used for its intended purpose. This site must be designed in accordance with all the requirements prescribed by the relevant law. It can be of two types: divisible and indivisible. What makes them different is the ability to distribute the land into parts without losing the target properties. Indivisible objects do not have it.

Under a land plot, in addition to the plot itself, the inheritance includes the soil, reservoirs, plants and objects that are located on it. If the site is related to the forest, then it can be accepted exclusively into federal ownership.

Is land inherited if the plot is not registered?

» Division of inherited property October 10, 2020

How is a non-privatized dacha or garden plot inherited?

The estate includes the movable and immovable property of the testator, which belonged to him during his lifetime as property. In practice, difficulties with inheritance quite often arise due to incorrectly or incompletely drawn up documents establishing ownership. Heirs should know the methods and conditions for entering into rights in order to become successors in a timely and competent manner and protect their interests as much as possible.

Basic provisions on inheritance

An inheritance case is opened upon the application of interested parties to a notary's office within six months from the date of death of the owner of the property. You can apply at the last place of registration of the testator or at the location of the inherited property. The declaration of one's rights must be accompanied by a citizen's death certificate, a certificate of residence, documents for inherited objects, a will or evidence of family ties.

An inheritance under a will can be left to any citizen or organization, not necessarily to a relative. The transfer of property without the testamentary will of the owner is carried out by relatives in accordance with the law.

There are seven degrees of kinship, starting with the first, which consists of family members, namely children, spouses and parents of the deceased. The rights of each subsequent order arise if there are no heirs at a higher level.

Any form of inheritance allows you to claim rights to preferential categories of citizens who have the right to an obligatory share of property. These include minors, disabled family members and dependents of the testator. Disabled dependents can receive their share, regardless of relationship, if they lived together with the owner for more than a year and were supported by him during this period.

The notary checks the rights of all applicants for the inheritance and may require additional information to clarify the issue. Disputes regarding the division of shares and challenging a will are possible by going to court. Claims from participants in the case may require several or a combined review procedure. The court decision is mandatory for the notarial approval of the heirs and their share in the inheritance.

After the due date, applicants receive a certificate of right to inheritance, becoming legal heirs. A legal act is the basis for re-registration of the property certificate in the name of the new owner. When opening a case, you will need to pay a state fee for notary services. The duty directly depends on the estimated value of the inherited property; it is 0.3% for family members and 0.6% for other heirs.

Inheritance of a dacha or garden plot

A dacha is a country building that is part of a garden partnership or dacha cooperative. Currently, the cost of the land allocated for the site and the home ownership itself represents significant funds. If the documents for the land and the house were drawn up during the owner’s lifetime, and there are corresponding entries in the state register, then problems with inheritance do not arise. The procedure is carried out according to the standard scheme regarding inheritance by will or law.

If there are no documents for the dacha, then you will first have to undergo a judicial review to establish ownership. An extract from the Unified State Register confirming the lack of registration will be required, then a technical passport will be taken from the BTI. The estimated cost of housing construction is established, which justifies the inheritance mass and the share division between the applicants.

Going to court with a claim to register ownership of a plot and dacha will require a strong argument. For example, all available actual payments are presented: for membership in a gardening association, for electricity or water supply. A positive court decision allows you to join a partnership by writing an application to the board addressed to the chairman. Subsequent actions will require going through the dacha amnesty procedure to register ownership.

After receiving a certificate of inheritance, the new owners of the dacha plot apply to the state registration authorities with judicial permission to privatize the property. Sometimes additional litigation may be required if the heirs are denied entry into the dacha association. If the inheritance of a non-privatized dacha is associated with indivisible property, then the right of priority registration of the object is granted to one of the participants in the division of property who lived with the testator.

The remaining applicants to whom the court refused possession must be paid the corresponding share amounts. The court sets the repayment period for the value of the share, which cannot exceed one year. If the heirs do not agree with the owner’s determination, then a compromise decision is made to force the sale of the object at auction, followed by division of the amount received.

If there is agreement between the heirs, then the land plot and the dacha can be registered as joint ownership, without allocating a share ratio. This decision allows you to use the inherited property with equal rights, accordingly choosing a responsible member of the gardening partnership.

Inheritance of a non-privatized land plot will require the provision to the court of documents according to which the plot was allocated or acquired by the testator. This may be a decision of the local administration, village council or organization in which the owner of the site worked.

In the absence of documents and the impossibility of their restoration, the court has the right to reject the claim for inclusion of the land plot in the inheritance mass and subsequent division between the heirs.

Inheritance of land plots: rules, documents and registration procedure

A land plot implies a territory with limited boundaries, the rights to which are registered in the name of a specific owner. Inheritance to land can include not only the territory itself, but also the objects that are located on it: reservoirs, various plantings. The exception is the forest, since it is federal property. Registration of inheritance to land is allowed in relation to individuals, legal entities and government agencies. If a person wishes to transfer a plot of land to a legal entity, they will have to draw up a will. The territory passes to the state if a person has no heirs at law and a will has not been drawn up.

General rules for inheritance

The land transferred by inheritance can be of any kind. For example, these are plots for vegetable growing, orchards, and inherited agricultural land shares. It is possible to inherit a land plot by law and by will. Inheritance is carried out in a standard manner. The procedure involves the following steps:

- Applying to a notary with a package of documents and an application for acceptance of property. Learn more about how to determine which notary to contact regarding inheritance here.

- Obtaining a certificate of heir.

- Registration of property rights.

However, the transfer of rights to land plots by inheritance has a number of nuances. It is advisable to know them before registration to avoid mistakes.

Having a problem? Call a lawyer:

Moscow and Moscow region (toll-free call) St. Petersburg and Leningrad region

In what cases is it possible to inherit a land plot?

Inheritance of a land plot is carried out in the presence of the following circumstances:

- the plot was owned by the testator

- the person had the right to lifelong ownership

- Death certificate of land owner

- Certificate from his last place of residence

- Documents that will confirm the grounds for inheritance (family relationship or will)

- Passport of the person claiming the inheritance

- Documents confirming that the territory was owned by the testator (paper of purchase and sale, gift)

- Certificate of registration of land ownership

- Territory Assessment Act. Only the cost at the time of opening the inheritance case is relevant. It is calculated by a professional appraiser. To determine the value, any method is used: market, cadastral.

- Certificate of heir's rights

- Those documents that were previously sent to the notary. Among them we can note the cadastral plan, papers confirming that the deceased had rights to the territory.

- The right to rent does not go to heirs if the lease agreement contains a clause providing for termination of the transaction after the death of one of the parties

- If there is no such remark in the contract, then the transaction remains valid even after a change of lessor

- The new lessor, having presented documents of inheritance, can adjust the existing agreement by creating an additional agreement, which is subject to state registration. This can only be done in court

- Inheritance of the right to lease a land plot occurs according to a testamentary document or, in the absence of one, according to law

- If the inherited lease right is not accepted, after a year the land plot goes to the state (municipality).

- According to the first, the plot can pass to the heirs and even be registered as ownership if there is a building on it, registered as the property of the testator passing to the successors.

- The second exception concerns situations where the testator began registering the allotment of property he was using indefinitely, but, unfortunately, did not have time to complete the procedure. Cases of this kind are resolved in court.

- Determining the purpose of the assessment

- Information on the most rational use of the allotment is analyzed

- Criteria are being developed to evaluate the most effective use

- Those methods are revealed that most fully correspond to rational use

- The market value of the plot is determined

- A report is generated.

- Confirmation of right to allotment

- Cadastral plan

- Land category by purpose

- Acceptable Use

- Information about existing restrictions

- Data on the presence/absence of communications

- Amount of tax or rent

- Lease agreement (if any).

- Certificate of death of the testator

- Certificate issued from the last place of residence of the deceased

- Will or documents confirming the presence of family ties

- Passport of the applicant for inheritance

- Land documents

- Papers on state registration of the right to allotment

- Report on the valuation of land for inheritance.

Rights and obligations pass to the heirs even if the deceased had the right to lease the land. They can own the property under the same conditions as stated in the original contract. However, a condition must be met - information about the agreement is entered into the UFS of registration and cadastre.

If the testator had the right to perpetual use of the territory, it cannot be transferred. The heirs receive ownership only of buildings located on the given land.

The right to perpetual use of the territory is not inherited.

What documents are needed to register the transferred land?

In the event of the death of a loved one, the heirs will have to worry about receiving the property. It is necessary to register ownership of a land plot by inheritance within 6 months. In particular, during this period you need to collect a package of documents and go with it to the notary. The list of papers is standard:

In some cases, the testator does not have a certificate of ownership. This is due to the fact that land can be obtained as a result of the privatization of collective farms and other structures. When it was carried out, no certificates had yet been issued. In this case, you can take an extract from the local government. You need to contact the institution where the decision on privatization was made.

Documents for inheriting a land plot can be divided into two categories: standard papers and those that are required specifically when transferring land. A statement of consent to accept the inheritance must be attached to the package of documents.

Soon after they are transferred, the notary will calculate the fee and determine its exact amount. The state fee for accepting an inheritance will depend on how much the land is valued at.

Property registration

How to register land as an inheritance? After the person submits all the necessary documents to the notary and pays the fee, he will receive a certificate of the heir's rights.

However, this document does not make the heir the owner. To register property, you will need to register it.

First registration option

A person needs to obtain a certificate of the heir’s rights, and then apply to the Federal Service for State Registration. After this, he receives a certificate of registration of ownership. Such registration of ownership of a land plot by inheritance is the simplest option.

The UFS is required to provide:

The certificate of ownership will be issued within a month.

Second option

It is less popular because the process is long and costly. However, in the long term, it is more advantageous. The main feature is the procedure for land surveying. defining their exact boundaries, which may not coincide with document data. This procedure will in the future make it possible to carry out various transactions with the territory without disagreements with neighbors and other persons.

To determine the boundaries of the land, you need to contact a geodetic organization. It is important to check that she has a license to carry out engineering and geodetic work. Specialists also work with neighbors to determine the size of the territory.

The results of the work must be agreed with the local administration. After this, the heir is given a land survey plan, as well as an extract from the cadastral plan. The latter is provided to the UFS. In a month you can receive a certificate of ownership.

The procedure for inheriting land plots is explained by a notary in this video:

If a person has received a certificate of heir's rights, in no case should one forget about the need for registration. Without this, no land transactions will be possible. It is problematic to even build something on the territory, since all these actions need to be coordinated with various authorities.

For additional information on this issue, please refer to the section “Inheritance of real estate” at the link.

Free legal support by phone:

Moscow and Moscow region (toll-free call)

St. Petersburg and Leningrad region

Attention! Due to recent changes in legislation, the legal information in this article may be out of date!

Our lawyer will advise you free of charge.

Features of land inheritance

People purchase and rent land with different intentions: building a summer house. gardening, agriculture (agriculture), etc. But all these aspirations serve one purpose: to improve the well-being of their family. Therefore, it is not surprising that many owners and tenants of plots are interested in the issue of transferring their rights by inheritance. This topic is complex and requires detailed consideration.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your specific problem, please contact the online consultant form on the right.

Or call us at:

+7 (Moscow) +7 (St. Petersburg) +7 (Russia) - call Free

It's fast and free!

Inheritance of a land plot in land law

The possibility of inheriting land plots, as well as the peculiarities of this process, are regulated by the Civil and Land Codes (Civil Code, Land Code), since, firstly, land is certainly a natural resource, simply necessary for human life and protected by the state, and secondly, it acts as real estate, which means it can be alienated or transferred in other legal ways.

The plot falls into the inheritance mass if it was the property of a deceased citizen, or the testator had the right to lifelong inheritable use of this land. No additional permissions are required to accept an inheritance of this kind.

Inheritance of a house and a plot of land or just land is inherited with all its components (soil layer, forests, gardens located on its territory).

Inheritance is carried out, as in other cases, by law or by will.

Some types of plots (gardening, country and garden plots) cannot be transferred by will. Inheritance here occurs only by law. Such a clause is quite contrary to the Civil Code, but still exists.

If the plot passes to several heirs, it is subject to division. However, it is impossible to allocate shares whose size is less than the norm established by land legislation.

An indivisible plot goes to one of the successors, who has a priority right when inheriting a land plot, due to the size of his share. Also, the plot can be purchased by one of the heirs by compensating other applicants for their shares with money or material assets included in the inheritance.

In other words, one heir takes the entire plot, but refuses the rest of the inheritance (for example, a share in an apartment) in favor of the others. Let us turn to some special cases of inheritance.

Rent allotment

Inheritance of the right to lease a land plot takes place because it is one of the property responsibilities of the testator. However, there are a number of features in the inheritance of this right:

Many important issues of inheritance of land after death are discussed in the following video:

Lifetime use

The transfer to the heirs of the inheritance of a land plot that was under the right of perpetual use of a deceased relative is impossible, since the legislation clearly states the cases in which the plot is subject to inheritance. This is the right of ownership and the right to lifelong and (mandatory!) inheritable use of land.

However, there are exceptions even to this rule. There are two of them.

Unregistered property

Only that property that was the property of the deceased or belonged to him under the right of lifelong inheritable use becomes an inheritance. Thus, before inheriting an unregistered land plot, you need to prove its ownership by the testator.

It can be extremely difficult to find documents confirming such a statement. Often you have to bring up the archive. If the plot was received before the RF Land Code and privatization laws came into force, it will be possible to make it the property of the deceased.

After it has been established that the allotment belongs to the testator, it will be included in the inheritance. In various situations, the case of inheriting an unregistered plot can take an unexpected turn. Therefore, it is better to take care of the documents establishing the rights to real estate in advance.

Registration of ownership

The procedure for registering a land plot as property by inheritance is labor-intensive, but doable. It includes a number of steps, which we will discuss in more detail.

An unusual case related to the sale of a land plot received by inheritance is discussed in the following video:

Site assessment

The need to evaluate the allotment arises when disputes flare up among the heirs. An estimate is also needed to calculate the amount of the duty.

Site assessment occurs in several stages:

In order for the assessment to be carried out, you need to provide the appraiser with the following documents:

Documentation