Concept

The funded part of the pension is savings formed through contributions from the place of work, voluntary contributions, and maternity capital funds.

Persons born before 1967 could decide before 2015 how their pension would be formed: whether all employer contributions would go towards insurance payments, or a certain portion would be invested monthly to replenish a savings account to increase pension payments in the future.

For those born after 1967, this type of pension can only be formed from personal contributions or maternity capital.

REFERENCE! Unlike a labor pension, these accruals increase due to the investment of funds in securities and shares, which is carried out by a fund chosen by a person.

You can find out more about what the funded part of a pension is and what is needed to receive payments here.

How to restore SNILS if lost

If SNILS is lost by a child under the age of 14, then parents or legal representatives must contact the Pension Fund for its restoration; and if the child has reached 14 years of age, then he goes there on his own, not forgetting to take his passport with him.

SNILS is a citizen’s insurance number in the pension insurance system. It is individual and cannot be transferred to another person. You can see the SNILS number on your pension certificate - a green plastic card issued to you by the Pension Fund.

We recommend reading: Sample apartment rental agreement

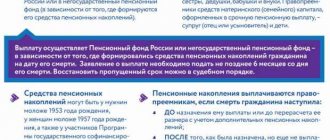

What happens after the death of the owner of the savings?

Money accrued for the entire period of validity of the accumulative part agreement can be transferred by the relatives of the account owner (for details about who will receive the accumulative part of the deceased’s pension and what the terms of payment are, read this article). What does the law say about this?

- According to Art. 1183 of the Civil Code of the Russian Federation, unpaid amounts as a result of death (salaries, pensions, benefits, etc., provided to a person as a means of subsistence, can be inherited by family members (read more about the features of inheriting the funded part of the deceased’s pension here).

- In accordance with Art. 2 Federal Law No. 360, several options for paying out the funded portion are possible. In addition to the one-time, fixed-term and lifelong pensions that are provided for the owner of this pension, the law also establishes payments to the owner’s successors.

The deceased’s pension can be received by other persons if:

- during his lifetime, the account holder applied for a lump sum payment, but in fact did not receive it;

- he has not reached retirement age;

- an urgent payment was made - in this case, the heirs will receive the remaining portion (how to receive the funded part of the pension of a deceased person?).

The rules and procedure for payments are described in Government Decree No. 711 of July 30, 2014. According to the law, the funded part can be transferred to legal successors on two grounds:

- in law;

- upon application.

If the owner of the accruals left a statement in the Pension Fund, which stores his savings, about the distribution of his funds to specific individuals, then it is these citizens who will inherit the money.

In the absence of an application, the money is inherited in order of priority. The first stage includes:

- parents;

- spouses (we talked about when and how to receive the funded part of the pension after the death of the husband in a separate article);

- children.

To the second:

- brothers;

- sisters;

- grandmothers;

- grandfathers;

- grandchildren.

IMPORTANT! According to clause 4, PP No. 711, the funded pension formed from maternity capital funds goes to the spouse or minor children.

The order of succession is as follows:

- money is distributed among priority family members in equal shares;

- relatives of the next priority can receive accruals only if the deceased does not have a first-degree family member.

What will happen to the funded part if the deceased did not have legal successors? In this case, the accumulated funds will be considered escheatable property and, in accordance with Art. 1151 of the Civil Code of the Russian Federation will become the property of the state. In ch. 4 of PP No. 711 specifies that in the absence of a deceased relative or in the event of refusal of inheritance, the money is transferred to the reserve of the compulsory insurance fund.

How to receive the funded part of a pension for a deceased relative?

Many citizens of the Russian Federation ask the same question - if a relative of retirement age dies, is it possible to receive the funded part of his pension or not?

This issue is regulated by Federal Law No. 173 “On Labor Pensions,” which was adopted on December 17, 2001.

The funded part of the labor pension began to form as part of the pension reform of 2002 for men born in 1953 and younger and for women born in 1957 and younger.

The amount of insurance contributions for the funded part of the labor pension for them ranged from 2 to 6% of their wages at different times. For this category, the funded pension was formed for only three years: in 2002, 2003 and 2004.

Since 2005, for all citizens born in 1966 and older, contributions to the funded part of the labor pension are not paid.

However, during the period from 2002 to 2005, this category of citizens accumulated a certain amount in the individual personal account of the insured person.

There is also a funded part for individual entrepreneurs who independently paid insurance premiums in the period from 2002 to April 2005 (regardless of age), as well as for those individuals who entered into the state pension co-financing program and voluntarily made payments.

Until 2014, contributions of six percent were transferred only for citizens born in 1967 and younger. This transfer is now frozen until 2021. The amount of contributions transferred until 2014 is stored in the personal account of the insured person in the Pension Fund or transferred, at his request, to a non-state pension fund.

Heirs can claim payment only for the funded part.

In the event of the death of a person participating in the funded pension insurance program, immediate relatives (or other people in a separate case) have the right to receive the funded part of his pension.

This part can be managed either by a state management company in the Pension Fund of the Russian Federation or by a non-state pension fund, there is no difference, the right to receive money still remains.

It is important to note that inheritance of the funded part of the deceased’s pension is possible only in the following scenarios:

-the death of a citizen occurred before the first payment (recalculation of pension);

- when a citizen was assigned a fixed-term pension and he did not receive the entire amount due to him (the balance is paid);

- a one-time payment was assigned, but due to death it was not paid.

Remember, if a citizen took out lifelong payments and then died, the heirs will not receive a single ruble. Transfer by inheritance of such payments is not provided for by law.

Who can receive the funded pension remaining after death?

There are two fundamentally different cases.

-If a deceased person previously left an application in his pension fund for the distribution of savings after death, then the money will be received by the persons specified in the application. It could be anyone, not just relatives.

-If there is no such statement in the fund, the money is distributed among the closest relatives in equal shares. In the first place are children (including adopted children), parents (including adopted ones) and spouses.

If there are no relatives in this category, then in the second place payments will go to brothers and sisters, grandparents and grandchildren.

What to do to receive savings?

A mandatory part of the procedure is submitting an application to any branch of the Pension Fund of Russia (closest to the applicant) or to a branch of the Non-State Pension Fund, if the deceased kept money there.

If you don’t know where to apply, apply to the nearest branch of the state pension fund, where, if anything happens, they will tell you where to go next.

Please note: filing an application is required even if the fund knows about the death of the policyholder.

Payment is not an “automatic” action; the fund must have a basis for this payment, that is, an application from those wishing to do so.

In principle, the territorial body of the Pension Fund of the Russian Federation, upon receiving information about the death of the insured person, must itself send messages to the legal successors about the possibility of receiving funds.

But it’s better not to wait: if you think that you have the right to receive money, go to the territorial office of the Pension Fund of the Russian Federation, fill out an application and submit certified copies of your documents

In general, this is an identity card, confirmation of family ties with the deceased (marriage certificate, birth certificate indicating parents, etc.), death certificate and confirmation of the pension insurance number of the deceased (his pension card or a territorial fund document indicating the number of the individual personal account). In more complex cases (adoption, guardianship, acting under a power of attorney, etc.) additional documents will be required; find out their list from the Pension Fund.

In addition to the personal data of the legal successor, the application indicates the method of payment of money (through the post office or to a bank account) and a list of relatives of the deceased known to the applicant - this will help the pension fund quickly determine the circle of legal successors.

An application with additional documents must be submitted within 6 months after the death of the insured person.

Later - it is also possible, but only by a court decision, which will confirm that the applicant could not for objective reasons

submit such an application (was away or did not know about the death, etc.) and will restore this period.

Within five days after receiving the documents, the territorial body of the Pension Fund considers the application and makes one of the decisions:

-returns documents to the applicant if something was done incorrectly (and explains what exactly);

- returns the documents to the applicant if it turns out that the deceased kept money in a non-state fund, and informs which non-state pension fund to apply to;

- forwards the application to the Pension Fund of Russia body in which the deceased was “registered”;

- accepts the application if the applicant and the deceased lived within the boundaries of the same PFR body.

In case of return due to the existence of an agreement between the insured and a non-state pension fund, the legal successors will have to apply with the same set of documents to this non-state pension fund.

Next, you will have to wait until the end of the period of 6 months after death so that all potential successors have time to submit their applications.

Then, no later than the last working day of the month in which this period expires, the Pension Fund finally determines the list of those entitled to receive the payment, the amount of the payment and the shares in which it is distributed, and sends the decision to future recipients. Finally, no later than the 20th day of the month following the month of the decision, the money is paid.

If, after the payment has occurred, another legal successor applies to the Pension Fund with a court decision to restore the application period, this will not affect those who received the money: payments to him will be made from the pension fund reserve.

It is important to highlight the procedure for inheriting funds allocated for the formation of a pension from maternity capital.

The following points stand out:

- if the mother died, only the baby’s father or legal adoptive parent can receive such money;

-if the child is an orphan, the payment is due to a minor citizen, as well as to adults if they were studying in an educational institution at the time of the parent’s death, but not older than 23 years.

When there are no such successors, the money accumulated from maternity capital is transferred to the pension fund. The remaining amount is inherited according to the general principle.

How to receive the INSURANCE part of a pension after the death of a pensioner

According to clause 1, part 1, article 25 of Federal Law No. 400 “On Insurance Pensions,” the Pension Fund of the Russian Federation cancels the payment of the insurance pension and additional payments to it from the 1st day of the month following the date of death of the user.

So, if a pensioner died on October 9, 2017, then the termination of insurance pension payments will be dated November 1, 2017.

The accrued amounts of the insurance pension that were due to the pensioner and were not paid to him will be transferred to family members who at the time of death were constantly living with the pensioner

Article 26 of Federal Law 400 provides a complete list of persons who may qualify for payment:

-at the time of death they were constantly living with the pensioner;

-family members recognized as disabled;

- users who applied for the unreceived amount of pension no later than before the expiration of 6 months from the date of death of a relative.

If several citizens apply for an insurance pension, the payment amount will be distributed among them in equal proportions.

As for such a process as inheriting the insurance part of a pension, this is impossible.

It is a priori impossible to inherit the insurance part of the pension, therefore no one can claim to receive it.

The only payment that will be available to relatives is the unpaid pension of the deceased, as well as additional payments to it.

However, if the deceased was dependent on a disabled close relative, for whom the only source of income was the financial support of the deceased, then there is the option of applying for a survivor’s pension.

How to find out about the finances of the deceased?

To receive funds, legal successors, first of all, need to find out where the funded pension of the deceased relative is kept.

PP No. 711, Chapter 1, Clause 9 states that the fund, which has received notification of the death of the owner of the pension, must take measures to notify the legal successors for further processing of inheritance funds. The institution must send a registered letter to relatives within 10 days. It is from this letter that you can get all the information about the name of the fund and the amount of payments.

However, institutions do not always inform heirs, which creates many problems with finding information about where the money is kept.

If the account owner did not enter into an agreement with the Non-State Pension Fund, then its funded part remained in the Pension Fund of Russia. To find out the amount in the account, you need to contact the FIU at the place of residence with the documents of the deceased. You will need to take with you your passport, SNILS number of the deceased, and death certificate. Based on these documents, a fund employee will provide the information of interest.

In addition to the Pension Fund, the funded pension may be located in a non-state fund. Until 2020, accrual owners could transfer their funds to NPFs no more than once a year. How to find out which fund the money is kept in? The first thing you can do is look for the agreement with the NPF in the documents of the deceased.

If you cannot find it, you need to contact the Pension Fund with a request to provide information about the account owner’s transfer of the savings portion to another fund.

How can you find out at least the SNILS number of a deceased relative?

Dear Svetlana! According to Article 69 of the Family Code of the Russian Federation, when dividing the common property of spouses and determining shares in this property, the shares of the spouses are recognized as equal, unless otherwise provided by the agreement between the spouses. The court has the right to deviate from the beginning of equality of shares of spouses in their common property based on the interests of minor children and (or) based on the noteworthy interests of one of the spouses, in particular, in cases where the other spouse did not receive income for unjustified reasons or spent the common property of the spouses to the detriment of the interests of the family. 3. When dividing the common property of the spouses, the common debts of the spouses are distributed between the spouses in proportion to the shares awarded to them. .

The question is how to establish the right of claim of the debtor of a minor child and the share of the child’s father; you do not have joint property. Inheritance is possible later because he has a residence permit. You can challenge the will and justify its share without terminating the contract. Therefore, there is no reason to scare your daughter without a daughter (if the former spouse refuses to privatize) for her share in the father’s property for her children. Good luck to you! If you would like to receive an individual paid consultation, please contact us by phone. 89112606854 or -76.

Deadlines

Legal successors must submit an application to the fund within six months from the date of death of a relative. The funds will be paid no earlier than 7 months from the date of death. If one of the heirs submits an application to the fund for payment, then the funds are frozen until 6 months have passed or more heirs appear. After 6 months, funds are distributed to all applicants within 30 days.

REFERENCE! If the 6-month deadline for filing an application was missed, then the heir can restore it on the basis of Article 12 of Federal Law 424. The restoration procedure is carried out only through the court.

The process of receiving the pension savings of a deceased person

To receive money for a deceased person, you must write a corresponding application to the fund, which was previously responsible for storing these funds. You can get any additional information:

- when contacting the bank or partner offices in person;

- through the online services of the State Services portal and partner organizations using the SNILS of a deceased relative.

Important! It is worth remembering that immediate relatives or persons recognized as legal heirs can count on these funds. You can count on payments six months after the death of the account owner. In practice, payments are made after 7 months. This involves carefully checking the identity of the recipient and his rights to the money.

Return of the financial share of the deceased

Let's consider the procedure for receiving funds from the deceased's funded portion.

Applying to the fund with an application

An application will need to be submitted to the institution where the funds are kept. The form is issued on site. What you need to indicate:

Full name and SNILS of the deceased;- grounds for receiving money (if the successor applies on the basis of an application left by the deceased, then the corresponding item must be checked on the form; if inheritance occurs according to law, then the order of succession and the degree of relationship must be indicated);

- your details:

- passport;

- residence address;

- FULL NAME;

- details of the second document;

- identification document;

- SNILS;

- contact number;

- details for transferring funds (the applicant can indicate one of the transfer methods - to a bank account, through a post office, in cash);

- further, if desired, the applicant can provide information about the available first and second degree relatives of the deceased.

Documentation

A number of documents are attached to the application:

- applicant's passport;

- documents confirming family ties with the owner of the pension (marriage certificate, birth certificate, etc.);

- death certificate (at the request of the successor);

- insurance certificate of the pension owner.

If the inheritance occurs on the basis of a statement written during the lifetime of the owner of the funds, then you will need to take with you an identification document.

Procedure for consideration

Within 5 days, the fund carries out work to review and register the application:

- checks information and documents;

- checks data on pension accruals and the possibility of withdrawing them;

- in the absence of certain papers, returns the application to the heir;

- if all requirements and conditions are met, registers the application and issues a receipt to the assignee for acceptance of documents.

Within 6 months, the fund accepts applications from heirs, determines the amount of the funded part, and determines the shares. After six months, the funds are transferred to the applicants’ accounts.

After death, the funds from the savings portion are transferred to the heirs of the deceased in a lump sum. The account is then closed.

Procedure for registering pension savings as an inheritance

Regardless of how the rights to a citizen’s pension savings arose (according to the application, due to family ties), it is possible to inherit funds only upon the application of the heir.

If the successor does not independently apply to the pension fund within 6 months from the date of death of the testator, then the funds are transferred to the fund’s reserve. However, if the deadline is missed for a good reason, the heir has the right to restore it through the court.

In court, it is necessary to prove that the reasons are valid (long-term illness, long business trip, lack of information about the death of the testator).

Reference! If a citizen did not know that pension savings can be inherited, this is not considered a valid reason.

Registration procedure:

- Contacting a pension fund.

- Providing an application and documents.

- Receiving payment.

Reference! The pension fund cannot establish payments and fees from the heirs of the deceased’s savings.

Moreover, heirs of pension savings do not pay personal income tax on the inherited amount.

Where to contact?

The application must be submitted to the pension fund with which the testator entered into an agreement during his lifetime. You can find out in which organization the funds are stored as follows:

- from the testator;

- at the Pension Fund branch;

- upon notification from the non-state pension fund with which the agreement was concluded.

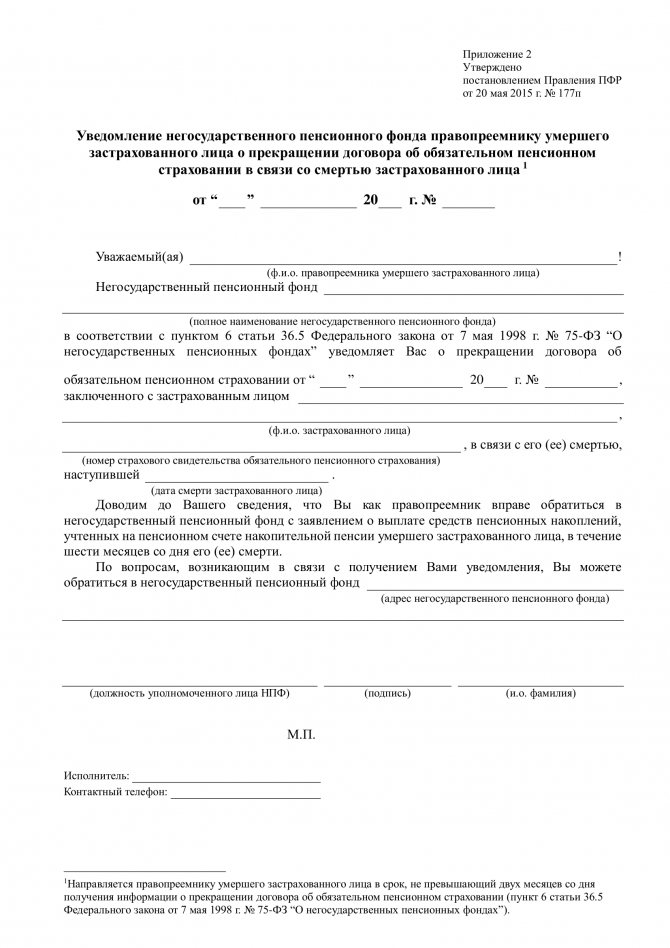

In accordance with clause 8 of the Decree of the Government of the Russian Federation of 2014 No. 710, the fund is obliged to notify the heirs of the deceased about the availability of pension savings within 2 months from the moment of receiving information about his death. A document on termination of the contract is sent as notification.

The form of notification is established by Decree of the Government of the Russian Federation of 2015 No. 177p.

Sample notification

List of documents

To receive funds, heirs must submit an application. The document must include the following information:

- name of the pension fund;

- document's name;

- date of;

- request for transfer of funds;

- testator's data;

- account number;

- information about the heir;

- list of documents attached to the application;

- signature.

The application form is provided for by Decree of the Government of the Russian Federation of 2014 No. 710.

Along with the application for inheritance of pension savings, the applicant must submit:

- passport;

- documents confirming the powers of the legal representative of the minor heir (birth certificate, order appointing guardianship, agreement on creating a foster family);

- a document confirming the relationship;

- SNILS;

- death certificate;

- information from the Pension Fund about the personal account number of the deceased;

- court decision to restore the application period (if any).

As well as a notarized power of attorney if documents are submitted through a representative.

When will they be paid

The funds are paid to the applicant 6 months after the death of the testator. The applicant himself chooses the transfer method:

- via mail;

- to a bank account.

The transfer must be transferred no later than the 20th day of the month following the expiration of 6 months from the date of death of the testator.

If the funds have not been transferred, you must contact the pension fund with which the deceased had an agreement.