Mortgage loan from Otkritie Bank from 9.3% → Apply

The encumbrance of an apartment means that third parties have rights to the property. With mortgage lending, the bank has a claim to the property. In order to obtain permission to remove the liens from the apartment, you must fully repay your obligations to the creditor.

The procedure in Rosreestr does not take much time, nor does collecting documentation. And often the list of papers for a government agency includes a power of attorney. It can be issued in the name of the owner or the creditor, so we will consider all situations.

Current offers

| Bank | % and amount | Application |

| Alfa Bank Mortgage | 6.5% Up to 45 million rubles. | Direct application |

| Rosbank Quick solution | 6.39% up to 25 million rubles. | Direct application |

| Bank Otkritie Large amount | 6.5% Up to 150 million rubles. | Direct application |

Loan without refusalLoan with arrearsUrgently with your passportCard loans at 0% Installment cardsEarning money from home

Types of encumbrances on an apartment

An encumbrance is understood as a certain legal condition that limits the rights of the owner of a property. This means that the owner of the apartment loses the opportunity to dispose of it at his own discretion: transactions with it will require the consent of a third party.

If the apartment is sold, its new owner receives the property with an encumbrance. To prevent concealment of information about existing restrictions, such information is entered into the certificate of ownership and reflected in the extract from the Unified State Register of Real Estate.

Important! Currently, the following types of encumbrances are distinguished:

- mortgage. If a person who owns a mortgaged apartment does not repay the loan under the concluded agreement, he loses the right to dispose of it without the consent of the bank; it is the bank that gets the opportunity to determine the terms of further transactions with the apartment;

- rent. Disposal of the residential premises in which the rent recipient lives is permitted only with his consent; the rent payer cannot dispose of it at his own discretion;

- easement. This encumbrance means the right of third parties to use the property. At the same time, the owner of the property does not have the right to dispose of it without their consent;

- arrest. If utility debts exceed the established limit, the residential premises may be seized. In this case, the owner will not be able to dispose of the housing until the debt is fully repaid;

- emergency condition of the house. The sale of apartments located in such buildings is unacceptable;

- hiring The tenant and his family members occupy the residential premises for a certain period of time. During such a period, the owner of the premises does not have the right to dispose of it without the consent of the tenant and members of his family;

- the presence of residents who are registered in the residential premises. If the owner of an apartment intends to sell it, all persons registered in it are required to leave it within the appropriate period. If there is no voluntary deregistration on their part, the owner has the right to go to court to force a compulsory deregistration.

We can come to the conclusion that the sale of residential premises in a house that is recognized as unsafe is unacceptable. If the property is seized, the residential premises can be sold only after the debt is repaid. In other cases, the consent of third parties to carry out transactions will be required.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Application for removal of encumbrance from an apartment

The sale or any other disposal of the apartment in which the rentee lives can be carried out by the payer only after receiving the consent of the first; Arrest.

The apartment is seized if there are excessive debts to pay for housing and communal services. Such real estate cannot be sold until the debt is paid in full; Hiring. The tenant does not have the right to claim housing, however, they can live there exactly until the expiration of the lease agreement.

Accordingly, the owner sells the property together with the people living there, whose right to reside, according to the lease agreement, will not be canceled; Availability of registered residents. If the owner sells a home, all registered residents must go to the passport office to register.

If they do not want to do this, the owner can forcefully evict them through a court order.

Application for removal of encumbrance

If real estate is the subject of a mortgage, then all actions to dispose of it must be agreed upon with the bank. This is due to the fact that the bank has a direct interest in the outcome of the transaction with the mortgaged property. To do this, you need to draw up an application for removal of the encumbrance and submit it to the bank branch.

The application must contain the following information:

- information about each of the parties (full name, passport details, residential address, as well as the name of the credit institution that provided the loan, full name of the relevant employee);

- information about the subject of pledge (real estate);

- details of the mortgage agreement (number and date of signing);

- grounds for mortgage withdrawal;

- Date and signatures of each party.

An apartment with an encumbrance - what does it mean?

Read here what documents to check when buying an apartment on the secondary market.

When you can sell an apartment after purchase in order to avoid paying tax, read the link:

Application for Termination of Encumbrance on the Apartment Death of the Seller

Korotkova E.V. filed a lawsuit against V.S. Frantsuzov. and I.E. with a request to remove the restriction (encumbrance) of the right in the form of a mortgage by force of law on the apartment. In support of the requirements, she indicated that on August 18, between her and Zherebtsova Z.E., acting on behalf of Frantsuzova I.E. and Frantsuzova V.S. By power of attorney, a contract for the sale and purchase of an apartment was concluded. Clause 4 of the agreement stipulates that settlement between the parties will be made at the expense of the Certificate for Maternity (Family) Capital. The Office of the Federal Service for State Registration, Cadastre and Cartography has registered the purchase and sale agreement and the transfer of ownership to the buyer, and also made a record of the encumbrance - a mortgage by force of law. The obligation to pay the total cost of the apartment has been fulfilled, which is confirmed by the payment order. However, the sellers of the apartment, after receiving the funds, avoid submitting to the body that carries out state registration of rights an application for the fulfillment of the obligation secured by the mortgage in full. Referring to paragraphs 1 clause 1 art. 352 of the Civil Code of the Russian Federation on the termination of a pledge with the termination of the obligation secured by the pledge, specifying the requirements in accordance with Art. 39 of the Civil Procedure Code of the Russian Federation asked to recognize the restriction (encumbrance) of the right in the form of a mortgage on the apartment by force of law as terminated in connection with the fulfillment of the obligation to pay the cost of the apartment.

This is interesting: Can Bailiffs Seize Property Again?

The mortgage is terminated on the basis of an application for the removal of encumbrances from real estate objects submitted to the Rosreestr Office. The application is submitted by two parties: the pledgor and the pledgee. If the mortgagor dies, the mortgage is extinguished based on a court decision. An interested person can apply for repayment unilaterally.

Letter to the bank

At the bank, the process of removing the encumbrance is carried out as quickly as possible.

Important! To do this, do the following:

- contact the bank branch, presenting the employee with an identification document and a copy of the loan agreement;

- with the help of a bank employee, draw up an application;

- within 7 to 14 days you will receive a notification about the need to appear at the MFC to take further actions. At the MFC, fill out an application for mortgage repayment;

- if required, the applicant has the right to obtain a new certificate confirming ownership of the property. Information about the encumbrance will be excluded from it.

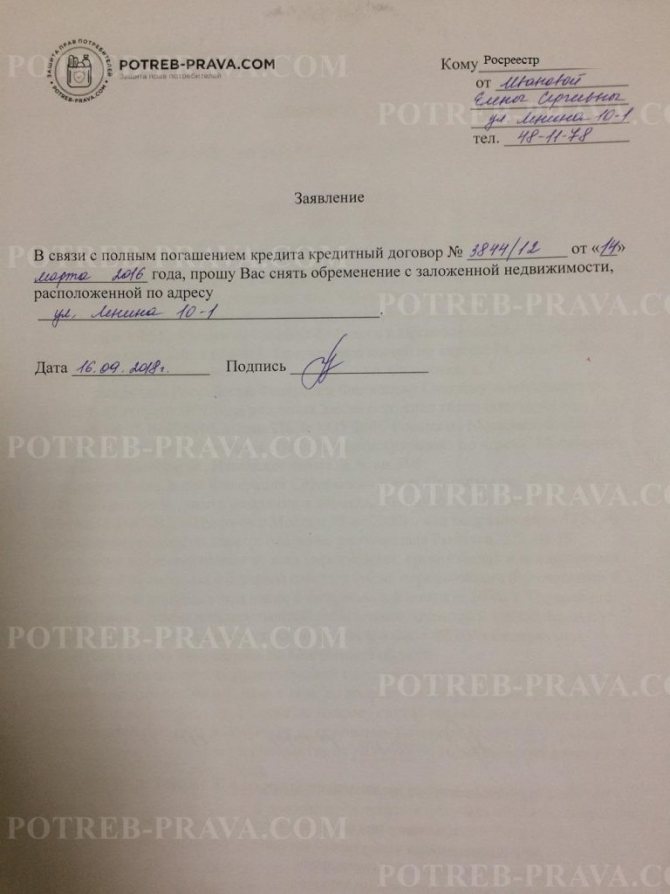

ATTENTION! Look at the completed sample application for the removal of encumbrances on real estate to the bank:

Penalty percentage when the bank delays removing the mortgage encumbrance

Good afternoon. I paid off my mortgage at Sberbank ahead of schedule.

At the bank branch I submitted an application (oral) to remove the encumbrance from the pledged property. According to the agreement, Sberbank must do this within 30 calendar days. After 30 days, the encumbrance has not been lifted; a bank specialist at the branch says another 30 days are needed.

This question has already been asked on this forum and the answer was even: “Submit a written complaint. If the encumbrance is not lifted within 10 days, then you can sue and collect a penalty for each day of delay, compensation for moral damage and a 50% fine of the amount collected.” I would like to clarify: the complaint was submitted through the online form to the official.

Is the bank's website considered a written complaint?

And what exact penalty percentage can you expect and from what amount?? Thank you. March 23, 2020, 10:51, question No. 1944005 Anton, Samara Collapse Online legal consultation Response on the site within 15 minutes Answers from lawyers (2) 9.6 Rating Pravoved.ru 23513 answers 8886 reviews expert Chat Free assessment of your situations Lawyer, Mr.

Ekaterinburg Free assessment of your situation

- 9.6 rating

- expert

I would like to clarify: the complaint was submitted through the online form to the official. Is the bank's website considered a written complaint?

And what exact percentage of the penalty can you expect and from what amount?? Thank you. Good evening, Of course, it is better to send this claim to you by registered mail with a notification and a list of the attachment, if the amount of the penalty is not indicated in the contract (you need to check it), then you can ask them for 0.1% for each day of delay.

March 24, 2020, 19:02 0 0 7.0 Rating Pravoved.ru 6356 answers 2556 reviews expert Chat Free assessment of your situation Lawyer Free assessment of your situation

- 7.0 rating

- expert

Anton, hello! In case of full repayment of the loan, the pledge is terminated in accordance with the provisions of Art. 352 of the Civil Code of the Russian Federation. In this case, the borrower has the right to request a mortgage from the lender by contacting the bank at the place where the loan was received. Upon receipt of the application, the bank prepares a properly executed mortgage within two weeks. Due to the fact that the mortgage, by virtue of the instructions of Art.

339.1 of the Civil Code of the Russian Federation is subject to mandatory state registration, then the repayment of such an entry must also undergo state registration through the Unified State Register of Real Estate (USRN). If the bank evades fulfilling its obligations (look at the loan agreement - what is the period for repaying the mortgage entry?), then you have the right, within the framework of protecting consumer rights, to go to court. It is better to send the claim in writing by registered mail with acknowledgment of delivery and a list of attachments.

All the best! March 25, 2020, 18:55 0 0 All legal services in Moscow Best price guarantee - we negotiate with lawyers in every city on the best price.

Similar questions 01 March 2020, 06:14, question No. 1162265 14 May 2015, 22:31, question No. 837710 26 February 2020, 07:39, question No. 741294 05 January 2020, 17:10, question No. 1862673 06 April 202 0, 13:18, question No. 1210124 See also

Application for removal of encumbrance from an apartment or letter to the bank: sample, power of attorney

If the apartment was purchased with borrowed funds from the bank, then it will have the final decision on the sale of the property. It will be impossible to carry out any transactions with housing without the knowledge of the responsible bank employees, except in situations where the loan is fully repaid.

Rent. In recent years, it is increasingly possible to encounter situations where elderly people who do not have close relatives are ready to bequeath their property to strangers who will care for them and financially support them. Ownership rights will be transferred only after the death of the owner, and until then, any transactions with real estate will be possible only with the consent of the annuitant.

Easement (trust management). Sometimes owners delegate some of their powers to outsiders. The legislator will define such citizens as trustees who are not considered apartment owners.

Application to Rosreestr

There is no strict form for the application. This means that you have the right to present information in the text of the document at your own discretion, adhering to business style. At the same time, certain requirements are imposed on the content of the application, which must be taken into account when drawing it up.

Please note! In particular, you will need to indicate the following information:

- information about the applicant (who is the owner of the property): full name, registration address;

- information about the mortgagee;

- information about loan obligations (amount of debt, dates of payment of funds, term of the agreement);

- request to remove the encumbrance;

- indicate that there are no mutual claims or obligations.

ATTENTION! Look at the completed sample application for the removal of encumbrances on real estate in Rosreestr:

Required documents

In order for Rosreestr to pay off the mortgage record, you will only need an application to remove the mortgage.

It should be noted that the application must be accompanied by the presentation of a passport. If a representative submits an application on your behalf, he must present an appropriate power of attorney certified by a notary. For his part, the bank employee presents a passport and the corresponding power of attorney.

Watch the video. We remove the encumbrance from the property:

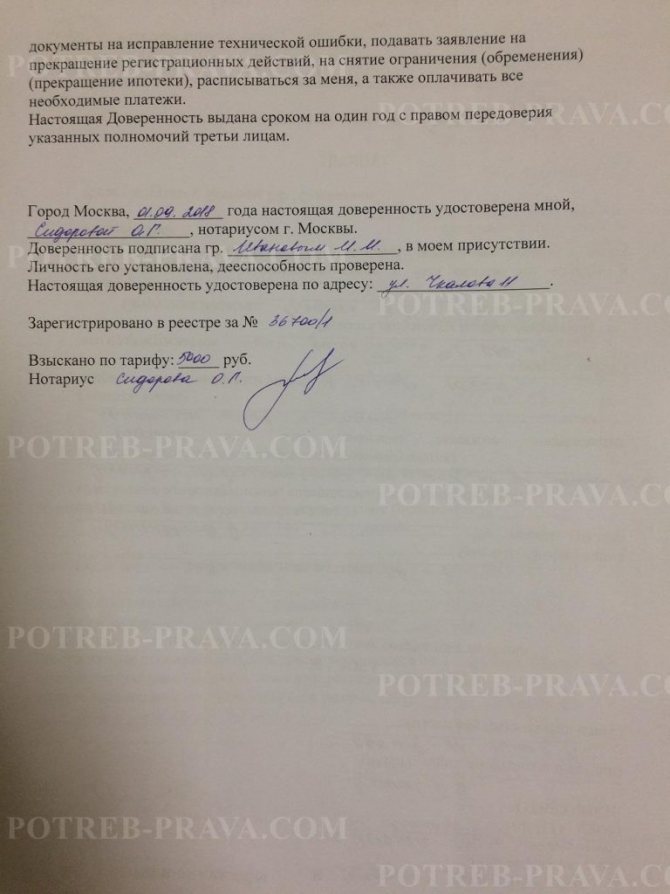

Is it possible to remove the encumbrance by power of attorney?

If a person who is the owner of real estate cannot personally decide on the issue of removing the encumbrance, he has the right to transfer the corresponding powers to his representative by drawing up a power of attorney.

In accordance with Article 185.1 of the Civil Code of the Russian Federation, a power of attorney giving the authority to carry out transactions for registering property rights must be certified by a notary.

Consequently, current legislation allows the removal of encumbrances from real estate by power of attorney.

Power of attorney to remove encumbrances from real estate under mortgage and in other situations

A power of attorney is a document whose format and content are subject to strict requirements. If they are violated, the document may be declared invalid.

According to the provisions of the law, a power of attorney is required to carry out actions to interact with government bodies and participate in the procedure for registering property rights as a representative.

Remember! Actions for which a representative receives authority through a power of attorney are associated with material values. For this reason, the power of attorney must be certified by a notary.

When carrying out the procedure for certifying a power of attorney, the presence of the owner of real estate (principal) and the person to whom he transfers the authority to complete the transaction (trustee) will be required.

The principal and the authorized representative will have to present to the notary documents proving their identity and the relevant documents for the property.

ATTENTION! Look at the completed sample power of attorney to remove encumbrances from real estate:

Features of selling an apartment with an encumbrance in 2020

Purchasing an apartment with registered tenants for the buyer is fraught with problems with their registration. Registered residents who are not owners cannot apply for an apartment, but they have every right to live at their place of registration.

Of course, such deception on the part of the seller is a sufficient reason to terminate the transaction. But the “search for justice” will be accompanied by lengthy litigation and it is not a fact that the buyer’s losses will be compensated.

07 Aug 2020 lawurist7 1187

Share this post

- Related Posts

- What kind of subsidy is available to a Veteran of Labor in Moscow?

- Chief of the House How to Find out His Phone Number

- Grants Educational Institutions

- Benefits for housing and communal services for families with many children in Kirov

Removal by court order

If the parties have disagreements regarding the fulfillment of contractual obligations, and attempts to reach a compromise are unsuccessful, the encumbrance can only be lifted in court.

Attention! To do this, carry out a number of actions of the following nature:

- draw up a claim, indicating in it the grounds for removing the encumbrance;

- collect the necessary documents that make up the evidence base, confirming the facts you have stated, attach them to your claim;

- wait for the court's decision. If the court satisfies your requirements, proceed to the next step;

- After receiving the court decision, send the necessary documents to Rosreestr. Within three days you will receive a new certificate of ownership, which will indicate the absence of encumbrances imposed on the property.

Power of Attorney for Encumbrance of an Apartment

- statement

- a document confirming the identity of the owner of the premises encumbered with a mortgage (that is, a passport)

- mortgage or mortgage agreement, that is, a document that confirms that the borrower has fulfilled his obligations to the bank

- a letter from the bank about the fulfillment of the assumed conditions for providing mortgage lending to the borrower.

We recommend reading: List of VAC Magazines 2020 New Requirements - statement

- title documents for the apartment (sale and purchase agreement, certificate of ownership, etc.)

- mortgage

- a letter from the bank confirming your fulfillment of obligations under the mortgage agreement

- copies of the constituent documents of the creditor bank, certified by a notary.

Statement of claim

It is permissible to draw up a statement of claim in free form, but there are a number of requirements for its content.

The document must contain the following information:

- the name of the court in which you are filing the claim;

- details of the applicant and mortgagee, contact information;

- information about the property;

- information about debt repayment (date of payment) and its amount;

- documents confirming rights to real estate;

- grounds for filing a claim, demands put forward.

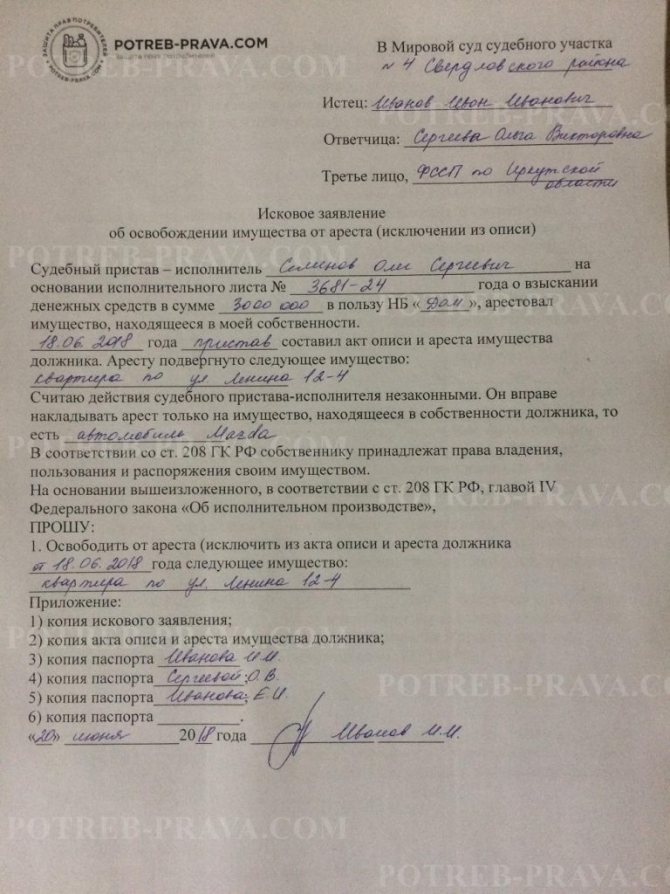

ATTENTION! Look at the completed sample claim to the court to remove the encumbrance from the property:

Removal of encumbrance through court due to the death of the seller

Good afternoon The encumbrance (mortgage by force of law) is removed at the request of the buyer and seller with the provision of evidence of mutual settlements. Since the seller cannot come to the Registration Service to submit an application, you need to apply to the court to recognize the fact of full payment of the purchase and sale agreement and the removal of the encumbrance by a court decision. Involve the Pension Fund and Rosreestr as interested parties. You need a purchase and sale agreement, a certificate of ownership, the Pension Fund will provide documents on the transfer of funds from the seller (maternity capital) to the buyer. During the process, all interested parties can declare the court decision to enter into force immediately after it is made (if not, then entry into force is 1 month). The time frame is approximately 2 months, depending on the workload of the court (the timing of appointments).

This is interesting: Maternal Capital Is Possible If Twins Are Born

Good afternoon! Your situation is elementary. The burden will definitely be lifted. You must submit all documents regarding the transaction: purchase and sale agreement, proof of full payment. In addition, it is necessary to involve the heirs of the deceased in the case, otherwise the claim will not be accepted. There are a lot of procedural subtleties here. I've dealt with similar things many times. Cost - 1,500 rubles. Execution - one day from the date of provision of the full set of documents