The balance in utility bills is the debt of the payer of housing and utility services at the beginning or end of the period for which the receipt was generated. In the previous article, we became familiar with the concept of balance and the algorithm for calculating this indicator. Today we will look in detail at how to calculate the current debt, taking into account the balance in the receipt for housing and communal services and how this balance is calculated. We will also tell you what errors there are in rent calculations and in what cases penalties may be charged.

What is the balance in the receipt for housing and communal services?

Utility payments are a mandatory expense for each month and are taken into account when planning your monthly budget. Often the payer does not understand what the balance on the receipt is and where this strange amount came from. And the main question is how much you need to pay: what is accrued for the billing period, or taking into account the balance?

The opening balance in the housing and communal services receipt is the consumer’s debt as of the 1st day of the billing period, which is included in the payment document regardless of when the payment was made. In the management organization, a personal account is opened for each payer, which is assigned a unique number. This number is usually indicated in the upper right corner of the payment document. For each account, a balance of income and expenses is maintained. So, the opening balance is taken from this balance sheet. Having a debt at the beginning of the month does not mean that it needs to be paid. It is enough just to raise the previous payment and check the amount, payment date and details.

The opening balance in the receipt is the balance of the debt at the end of the period, taking into account the opening balance and accruals. You should not assume that the opening balance is the amount due. You must take into account how much you have already paid this month.

The payment document for housing and communal services contains a list of housing and utility services. The housing service provider can be a management company, a housing cooperative, a homeowners association, or a government organization that manages residential buildings. Housing services include:

- property maintenance;

- cleaning common areas and local areas;

- maintenance and repair of elevator equipment;

- garbage removal, etc.

As a rule, the cost of such services is expressed as a fixed amount, which is periodically indexed. Indexation can occur every six months or year.

Utilities are variable expenses, the cost of which is calculated by multiplying the tariff rate by the expense. Expenses are determined by meter readings. Such testimony must be submitted by the consumer within a certain period. This can be done by phone, through the official website or the management company’s form.

Utility providers are resource organizations that issue bills directly or through a management company. Utilities include electricity, water supply, landline telephone communications and gas supply (if the house is equipped with gas stoves or water heaters).

All of the above organizations keep records of debt at the beginning and end of the current period and include the incoming and outgoing balance of payments in the receipt, which is usually generated in the first days of the month.

Balance: what is it on the receipt?

In most cases, suppliers indicate all the information using completely understandable column names:

- amount of payment;

- debt (overpayment) at the beginning of the month;

- rates;

- volume of services consumed;

- benefits (compensation), etc.

But at the legislative level, only an approximate form of the receipt has been approved, so suppliers at the regional level have the opportunity to change it at their own request and discretion. This gives rise to many questions among citizens, and our readers ask for clarification on what the opening balance in a receipt is, what this term means, why some consumers always have negative numbers, while others always have zeros.

Typically, the term “balance” is used in the accounting and economic environment. It means the difference between the amount received (receipt amount) and the expense amount. However, utility providers sometimes use this term as well.

In simple terms, what a balance is on a receipt for electricity or other utility service is the difference between what the consumer paid and what he should have paid. Since this difference can be both in favor of the consumer and in favor of the supplier, the indicators can be positive or negative. They can also be null.

Zero indicators indicate that the amount accrued for the services consumed was fully paid. Positive (with a plus sign, although very often it is not given according to the rules of mathematics) means that the homeowner paid less for electricity than the supplier charged. This is debt. If you see a number with a minus sign in the corresponding column, it means that the consumer has overpaid.

Please note that often the data in the payment order does not reflect the real situation. For example, a consumer paid for electricity later than the due date: according to the law, you can pay for housing and communal services until the 10th day of the month following the reporting month, and the person transferred the money on the 12th. In such a situation, an indication of a debt may appear, since the notice of payment was generated before the money arrived in the personal account, and the supplier did not take it into account.

If you paid late, it's important to check the numbers on your next receipt: as long as the money is accounted for, there's nothing to worry about. If the debt persists, you should contact the supplier or settlement center.

Why enter the balance on the receipt?

The balance in the receipt is indicated in order to inform the consumer about the status of his personal account, including debt at the beginning and end of the period according to the service provider. To calculate how much you need to pay, you need to subtract from the opening balance the amounts you have already paid in the current month.

If, for example, the balance on August 1 is equal to the amount that you paid on August 7, this means that at the time you receive the payment document you have no debt for previous periods. You only need to pay what is accrued for the current month.

What is a balance in accounting (in simple words)? How to determine it?

Balance is a term adopted in economic theory. It involves certain calculations. Used in foreign trade relations, within the framework of accounting. Necessary for tracking the dynamics of the company's activities. Allows you to reflect the success of the organization. The balance is determined based on accounting information.

What is a balance?

Balance is the difference between income and expenses calculated for the reporting period.

The balance can be positive, that is, greater than zero. This indicates that the enterprise's income exceeds its expenses. The balance can also be negative - less than zero. This indicates that expenses exceed income.

Balance is used in many areas. Its characteristics differ from the area in which it is used. The balance is relevant when calculating the following indicators:

- Trade balance.

- State balance of payments.

However, the indicator is mainly used in accounting. Its total value must be reflected in the amount of the funds balance at the beginning and end of the period that is the reporting period.

Functions

The balance is extremely important for analyzing the activities of an enterprise. It is required to find out the current financial condition of the company. Based on the indicator, the following points can be determined:

- profitability of the enterprise;

- stable functioning of the company;

- analysis of the organization's profitability for different periods.

For example, an enterprise recorded balance indicators throughout the entire period of its activity. The company has opened a new direction. Previously, the balance was closer to zero, but after the introduction of the new direction it began to grow sharply. This indicates that the innovation increased the profitability of the enterprise.

Example

On March 30, the organization received 500,000 rubles. On the same day, funds were spent on renting premises in the amount of 100,000 rubles. The opening balance on April 1 will be 400,000 rubles.

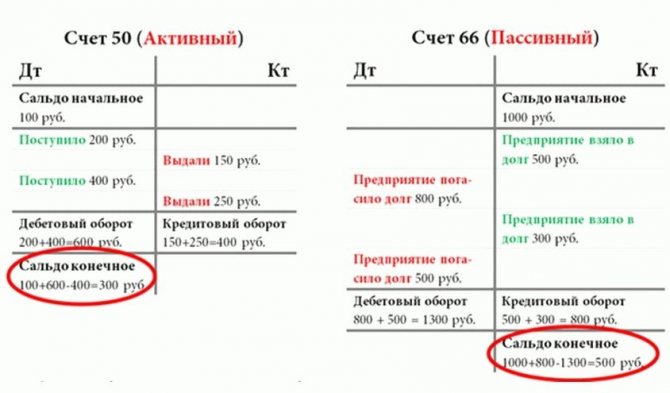

Accounting balance

The account balance will be the indicator under consideration. The difference between debit and credit will be the balance of the following types:

- Debit balance. Formed in a situation where the debit is greater than the credit. Displayed in the balance sheet asset.

- Credit balance. Formed in a situation where credit exceeds debit. Records the status of the sources through which funds are received. Displayed on the passive.

The difference between debit and credit (that is, between income and expense) can be zero. In this case, the account will be closed. In some cases, accounting has accounts that have both debit and credit balances.

When considering accounting for the reporting period, the following can be noted:

- Opening balance. Another name for it is incoming. This is the account balance. Calculated at the beginning of the reporting time. The calculation is made based on those transactions that were performed by the enterprise before the time in question.

- Debit and credit turnover. For calculations, only those operations that were performed at the time in question are taken.

- Balance for the period. It represents the total result of the enterprise’s actions during the reporting period.

- Closing balance. The second name is outgoing. Represents the balance available in accounts at the end of the month or other reporting time.

The reflection of the balance depends on its type. Calculations must be made regularly. This is important for tracking dynamics.

Balance in foreign trade relations

The indicator is calculated based on relationships with foreign companies. The calculations take into account the following operations:

- Export indicators.

- Import amount.

- Cash receipts from foreign structures.

- Payments to foreign structures.

The trade balance is distinguished, as well as a similar indicator of the balance of payments.

Trade balance

Export and import are the basis of foreign trade. The difference between exports and imports is considered the balance. It must be calculated within the established time frame. The trade balance is divided into different types:

- Positive. This is relevant if the state sells more than it acquires. The balance will be positive if exports are greater than imports.

- Negative. This is relevant when imports are greater than imports. The balance will be negative if the government acquires more than it sells.

Let's take a closer look at the negative balance in the context of the state. This indicator means that the country has a lot of foreign products, but few goods of domestic producers.

Balance of payments

Typically this term is used in trade transactions between states. Almost all countries trade with each other. Relationships involve monetary transactions. The balance of payments is the difference between remittances received from abroad. Payments sent to other countries are also included in the calculation.

The balance can be either positive or negative. Let's consider the features of two varieties:

- Positive. The balance can be called positive if there is an excess of payments received from other countries over payments sent to other states.

- Negative. The indicator is called negative if there is an excess of payments from the state over receipts to the state.

That is, the division of the balance into positive and negative is accepted regardless of its type. Determining the type of balance occurs after deducting expenses from income.

How to determine the balance?

An accountant is required to keep records of the receipts and expenditures of funds at the enterprise. The specialist also conducts appropriate accounting. This is an extremely responsible job. A small omission can lead to problems during tax audits.

On topic: Complaint against debt collectors sample

Transactions are reflected through accounting entries. Indicators are recorded using the double entry method. To do this, you need to open a special account.

Accounting accounts are distinguished by two columns: debit or credit. Double entry allows you to track the movement of funds.

Important!

There is a certain law of the balance sheet. The sum of all indicators in the accounts is equal to zero. That is, the difference between debit and credit indicators is zero.

As a result. Balance is a term that is relevant for any organization. Balance displays the remaining balance after deducting all expenses.

That is, this indicator allows you to determine the unprofitability or profitability of the enterprise. The balance is used both in domestic trade operations and in foreign trade manipulations.

When making calculations, the accounting period is important. The length of the period depends on the policy of the particular enterprise.

Source:

Due date

The payment document always indicates the due date for payment. Most often, this period is set on the 10th day of the month following the billing month. In some cases it may be the 20th or 25th. It should be noted that the payment deadline is the date of the actual transfer of funds, and not their crediting to the supplier’s details.

Example. The payment deadline for the payment document is no later than the 10th. The payment was made on the 10th at 23.59, the money will be credited on the next banking day, but the payment deadline will not be violated.

How to pay the balance on your electricity bill

The opening balance for electricity services is as follows: you need to add accruals (the cost of consumed electricity) to the debt balance at the beginning of the month and subtract the amount of payments in the current period.

Usually the receipt is paid the following month. If you have already paid some amounts this month, they must be deducted from the opening balance.

Example. The balance at the end of April in the electricity receipt was 750 rubles. ($10 or 290 UAH). On May 7, a payment was made in the amount of 300 rubles. ($4 or 116 UAH). Therefore, you still have to pay another 450 rubles. ($6 or 174 UAH).

Sometimes a consumer wonders: is a balance with a minus an overpayment or a debt? Returning to theory, let us remember: for the service provider we are a debtor, i.e. debtor Receipts for payment are always generated “on behalf of” the supplier. A negative debit balance means you overpaid. Perhaps some payment was made twice, for example: you paid the amount of charges for the month and in the same period the balance on the electricity receipt was paid. Or you had an automatic payment set up, the bank wrote off the payment yourself, and you forgot about it and paid again. Sometimes the consumer pays for utilities in advance, i.e. pays the amount several months in advance. This happens, for example, when you need to leave for a long period. This creates an overpayment that can be offset against future payments.

What is the balance in utility bills 2020

The receipt for payment for consumed electricity has several main columns, including the “balance” as of a certain date. What does this column mean?

The concept of “balance” is most often used in accounting. The word itself came into the Russian dictionary from Italian. Its literal translation is “remainder” or “calculation.” The first use of this term in the field of accounting was recorded in the nineteenth century. At that time, it was understood as a certain amount of finance that still remained in the account balance.

The modern term "balance" has a broader meaning. It can be found not only in the field of accounting, but also in the field of international trade relations.

In the field of accounting, with the help of balances, specialists reflect the state of finances of a company as of a certain date. The main purpose of this term is to show the difference between the amounts that were credited to the company’s accounts and those that were written off from its accounts. In other words, it is the numerical value of the difference between the income and expenses of the company in question.

To calculate such a digital value, qualified specialists use a specific document - a balance sheet. Such a statement should record all transactions (both financial and business) for the time period for which the calculations are made.

The peculiarity of the formation of the balance sheet lies in the type of accounts from which the digital difference indicator is calculated.

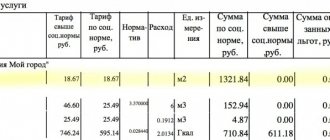

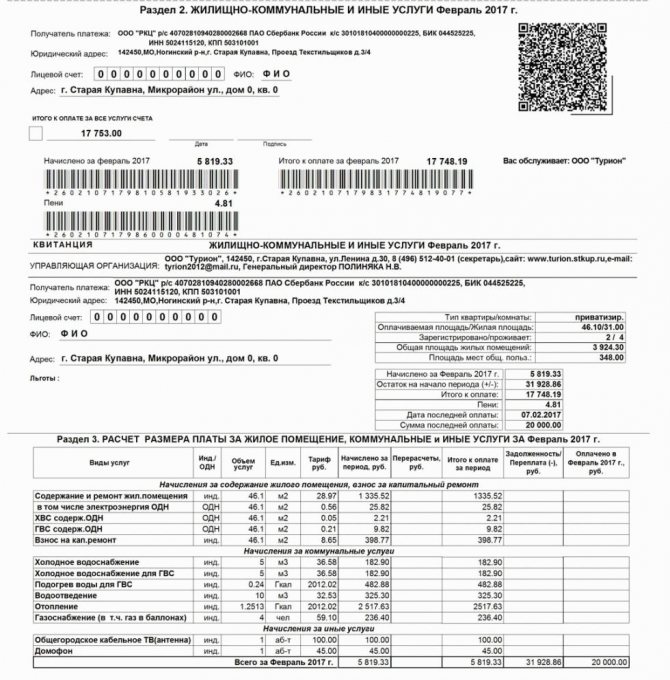

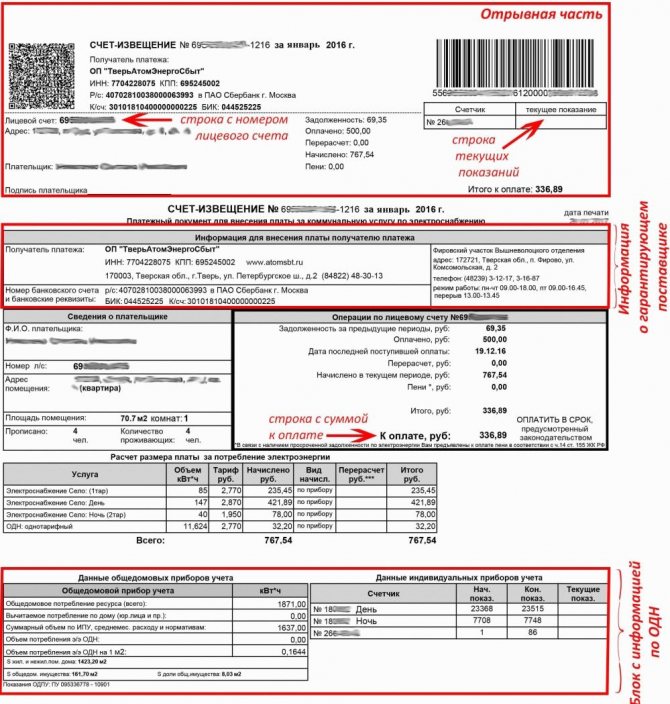

A standard receipt for payment for consumed electricity contains information for the consumer, located in the following columns:

- No. 1 “Name of service” (for example, residential premises);

- No. 2 “Metering point number”;

- No. 3 “Balance at the beginning of the previous month” (in rubles);

- No. 4 “Initial PU reading”;

- No. 5 “Final reading of PU”;

- No. 6 “Consumption” (kW/h);

- No. 7 “Tariff” (in rubles);

- No. 8 “Accrued” (in rubles);

- No. 9 “Paid in the previous month” (in rubles);

- No. 10 “Recalculation” (in rubles);

- No. 11 “Balance at the beginning of the current month” (in rubles);

- No. 12 “Initial reading of PU at the beginning of the current month”;

- No. 13 “Current PU reading”;

- No. 14 “Consumption” (current month, in kW/h);

- No. 15 “Tariff” (current month, in rubles per kWh);

- No. 16 “Cost” (current month, in rubles);

- No. 17 “Paid in the current month before the check date” (in rubles);

- No. 18 “Total payable” (in rubles).

As you can see, the receipt for payment for used electricity has two columns with balances:

The digital indicator of column No. 11 is calculated by calculations using the digital indicators of the following columns:

- No. 3 (balance at the beginning of the previous month) + No. 8 (amount for the previous month, accrued in rubles) – No. 9 (amount for the previous month, paid in rubles) + No. 10 (amount for the previous month, received as a result of recalculation).

The resulting digital value in column No. 11 will show:

- the user’s debt in the case of a positive result (that is, with a “+” sign), which means that the payer has a debt, the amount of which is equal to the digital indicator of the resulting balance;

- overpayment for consumed electricity in case of a negative result (that is, with a “-” sign), which means that the payer paid a larger amount of money than the utility service provider required.

The correct balance should be “zero”. This will indicate that the payer is a responsible tenant.

As already mentioned, the balance figures on the receipt for payment for consumed electricity are the difference between the amount of money that the payer paid and the amount of money that was charged to the consumer by electricity suppliers.

The balance indicator will be “zero” in the case when the consumer transferred an amount of money equal to that accrued by the company supplying electricity.

If a certain amount is indicated in the “balance” column on an electricity payment receipt, it may mean the following:

- monetary debt of the consumer to the electricity supplier;

- the fact of an unaccounted amount of money that was contributed in the previous reporting period;

- if instrument readings for the previous reporting period are not taken into account (in this case, the supplier company makes charges based on average monthly electricity consumption).

The paid amount may not be taken into account only if the user made the payment after this notice was generated.

If the payer has already paid a certain amount for the use of electricity, but it was not taken into account in the receipt, then when filling out this document the user takes it into account independently when calculating the total amount that will be paid in the current period.

People often hear the word “balance,” but not many know its meaning. The term is used in accounting and finance. Many people often encounter it when paying utility bills. Owners of apartments and houses should know what the balance in utility bills is.

Hello, dear portal visitor! Unfortunately, the article reveals only a typical answer to the question you are interested in. To consider a specific problem, write it to us online consultant

.

One of our lawyers immediately and completely free of charge

.

The concept of “balance” came from Italy; in Russian it began to be used in the financial sector since the 19th century. From Italian the word is translated as “residualism”, “calculation”.

In the economic sphere, this word used to denote the discrepancy between the amount of debit and credit. What “saldo” is in a utility bill is not always similar to what it means in another area. This word has now acquired a broader meaning. Types of concept differences:

- Credit. A credit balance is a situation where a credit exceeds a debit. The debt will close when the discrepancy becomes 0.

- Debit. Here, on the contrary, debit is greater than credit.

- Initial or incoming. The initial difference is the residual figure. It occurs when the accrual was not made at the beginning of the month, on the established dates.

- Final or closing balance. What it is is a person’s residual balance at the end of the quarter or month.

There are also other types of residue, but they are extremely rarely used in the housing sector.

Residents who own or use real estate receive payments. The bills indicate the services provided and their cost. They also contain different definitions that may not be clear to everyone. And people often wonder what “saldo” is on a receipt.

Not everyone can decipher this concept, since it is a widespread concept and determine exactly what the difference in the bill for electricity and other utilities is.

In housing and communal services documents, this term means 2 terms:

- Insufficient funds or depositing excess funds over the past period.

- The total amount of payment for the resources provided.

This is interesting: Certificate of absence of debt on utility bills 2020

Both incoming and outgoing differences appear in situations where the user has made an advance or a smaller amount. The final balance appears when part of the amount is deposited. The overpaid or missing figure is added or subtracted from the next payment. Typically, the debt arises due to the fault of the payer who missed the deadline or reported incorrect information.

There is no particular difference in what this word represents in the bill for electricity, gas and light. Therefore, you need to know what the discrepancy is in the total bill for providing the apartment with communal servants.

Ideally, the difference between the payment made and the actual expenses should be equal to 0. To achieve the ideal indicator, it is necessary to reconcile the accrued money and the actual cost. Thus, the difference for gas arises when you deposit insufficient money or there is a delay.

You can pay the management company for the service as follows:

- Transfer money via mail or bank. The person needs to provide the bank employee with a receipt or provide the personal account number. The employee will tell you the exact amount of funds needed to pay off the debt. With such payment, a balance with a minus or plus sign does not appear. But people don’t have time to visit the bank, which results in arrears for electricity, gas and other resources. Therefore, it is better to give preference to other methods of depositing money.

- Transfer funds through the terminal. In this case, there is mainly an incoming difference for electricity, because the terminal does not give out change. Or an outgoing cut may occur if the contribution is not enough. The method is quite convenient and practical, but people will also have to pay for the translation. Banks charge a commission for transferring funds.

- Through the Internet. People's lives have become easier; payments are often made via smartphone. You can transfer money to housing and communal services through Internet banking, the City portal or State Services. On the Internet resource you can find out the exact figure and size of the balance for gas, water or electricity for the previous period.

On the 1st day of the month, employees are required to send receipts to users; a separate column indicates the resource provided and its price. And citizens are required to transfer money by the 10th, or else a debt will arise.

You can find out how the balance arose by contacting the company's employees. It is better to make a written request. The application must clearly indicate which balance requires explanation: for major repairs, for the safety of common property, for water supply and electricity. In a written response, the performer will describe how and for what reasons the discrepancy arose.

In payment documents for utility bills there are several different columns that explain what exactly the payment is for. However, not everyone understands what the balance in utility bills is in 2020.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

To avoid possible conflicts with government agencies, citizens need to know how and where they can pay money for the use of public services. For each service, tariffs are set by the executive authority, the energy commission and the local administration.

The latter, in turn, should not go beyond the current Russian legislation. Based on these documents, payment is collected from persons evading this payment.

At this point in time, there are several different ways to pay for housing and communal services. The main ones are:

- postal or bank office;

- ATMs;

- payment terminals;

- electronic resources.

Nowadays, a standard receipt for payment of electricity contains information for consumers placed in 18 columns.

It reflects:

- meter readings;

- consumed amount of electricity;

- current tariff;

- balance accrual amount;

- total amount to be paid.

A sample receipt for payment for housing and communal services is here.

This document has two columns indicating the balance:

- No. 3 - balance at the beginning of the previous month;

- No. 11 - balance at the beginning of the current month.

In order to calculate the indicator in column No. 11, you will need to add column No. 3 with No. 8 (accrual of the amount for the previous month) - No. 9 (amount paid in rubles for the previous month) + No. 10 (obtained by recalculating the amount for the previous month).

The resulting value will show how much debt the user has if the result is positive, or how much the citizen overpaid for consumed electricity if the result is negative.

If a person made all the calculations correctly, that is, the amount of money paid for this payment corresponds to the accrued amount, the balance should be equal to zero.

The main documents regulating the payment for premises and public notification services are:

- Section 7 of the RF Housing Code;

- Decree of the President of the Russian Federation “On federal standards for payment of housing and utilities;

- Decree of the Government of the Russian Federation “On the provision of utility services to owners and users of premises of apartment buildings and residential buildings.”

Having wondered what the balance in utility bills is and what it means, you need to know that this term is most often used in accounting. The word originally appeared in this industry back in the 19th century.

Then it meant a certain amount of finance remaining in account balances. In the modern world, the term balance extends to large sectors of activity.

At this point in time, accounting specialists note with these indicators the state of the financial security of a company in relation to a certain date.

This term shows the difference between funds received and spent on company accounts. Those. we can more simply say that the term balance denotes the difference between the income and expenses of a particular organization.

When will the utilities increase? See here.

To calculate this indicator, specialists use a special document - a balance sheet, which records all transactions performed during the estimated period of time.

In relation to a receipt for payment of electricity, the balance in the payment document will mean the difference between the amount paid by the citizen and the amount accrued for this payment. The balance indicator will be equal to zero if the consumer transferred funds, the amount of which is equal to that accrued by the organization that supplies electricity.

Indication of a numerical value in the balance column on a payment receipt may mean the following:

- the consumer has a monetary debt to the company supplying electricity;

- the citizen paid excess funds when making a previous payment;

- instrument readings for the previous reporting period were not taken into account; in this case, energy suppliers will calculate the payment amount based on average monthly electricity consumption indicators.

This is interesting: Benefits for disabled people of groups 1, 2 and 3 for payment of utility services 2020

The amount will not be taken into account towards the payment for this reporting period if the citizen contributed funds to pay for this payment after the payment document was generated.

Provided that a person pays the amount for consumed electricity as an overpayment, but does not include it in the receipt, the person is recommended to independently take it into account when calculating the next payment. However, for this you will need to have official confirmation of the fact of making the payment.

Receipts requesting payment of utilities usually come along with similar rent documentation.

The payment documents indicate:

- details for paying for housing and communal services;

- the amount required to be transferred for these services.

If a citizen has officially registered benefits, their availability will also be displayed on the receipt. If for any reason the receipt does not reach the citizen within the period established by law, he is recommended to contact the Housing and Communal Services Department himself, or by phone or online.

According to paragraph 1 of Art. 155 of the Housing Code of the Russian Federation, payment for utility services must be made no later than the 10th day of the month following the date of accrual.

As a rule, all utilities are supplied to citizens before payment. However, in order not to lose them, a citizen needs to pay money for the consumed resources on time and in full. This system is the most rational for users and utilities.

Every month it is recommended to take readings from metering devices and submit this information to the appropriate institutions. This can also be done in the online account of the bank, which is most preferable to the citizen. Often, if a citizen simply forgets about the payment deadlines, a notification from a mobile bank saves him from this oversight.

If a person, fully using the utilities provided to him, refuses for some reason to pay money for them, he may face a number of troubles:

- Accrual of penalties. The penalty is a certain percentage of the rate of the Central Bank of the Russian Federation, which can change and be accrued every day. The amount to be paid for this penalty depends on the date on which the payment was received. When paying a debt within 31 to 90 days, the penalty will be 1/300 of the Central Bank key rate, after 91 days 1/130.

- After a certain period of late payments, the citizen's utilities will be disconnected. Employees have the right to turn off electricity, gas, water supply and sewerage. After paying off the debt, the amount to reconnect to utilities often exceeds the total amount owed.

How to pay for housing and communal services through State Services? Instructions here.

How are penalties calculated for late utility payments? Details in this article.

In order to avoid all of the above, you should deposit funds on time into the accounts of companies that provide utility services that largely provide warmth, coziness and comfort for most modern citizens.

Before applying the above measures, the management of the company providing resources to the citizen will repeatedly send him notifications demanding repayment of the debt.

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- Regions

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

Balance - this accounting term is used in business accounting, economics, and foreign trade operations. It is included in any receipt for payment for services. In simple words, the balance is the remainder.

The first printed publication on the accounting of trade operations is considered to be the Treatise on Accounts and Records (1494). It is the work of medieval Italian mathematician, professor and monk Luca Pacioli. He applied his knowledge to commerce.

The scientist is considered the founding father of modern accounting. To reflect business processes in the book, accounts and double entry are used. The concepts of “debit” and “credit” are not named, but are explained.

Saldo translated from Italian means “balance, calculation, balance.” Defined as the difference between revenues and expenses. It became an accounting term at the end of the 19th century.

All business transactions of the enterprise are reflected in the accounting accounts. Property and property rights are recorded on active accounts, while sources (capital and borrowed funds) are recorded on passive accounts. Balance is the account balance as of a specific date.

For active accounts, a debit is the receipt of assets (property, property rights, cash), a credit is a decrease (write-off) of assets.

In passive accounts, a credit is an increase in capital or borrowed funds (debt on loans, to suppliers, employees), a debit is a decrease in them (reduction of capital, repayment of debt).

The principle of double entry is applied in accounting. Any business transaction is reflected simultaneously as a debit to one account and a credit to another. The accounting entry contains two parts - debit and credit.

There are beginning and ending balances. The opening account balance at the beginning of the period is equal to the ending balance of the previous period.

To calculate the final balance, the difference between the turnover of debit and credit (in active accounts) or credit and debit (in passive accounts) is added to the initial balance.

Active accounts have a debit balance, and passive accounts have a credit balance.

In active-passive accounts it can be both debit and credit (settlements with various debtors and creditors, the budget).

In accounting, the balances of all accounts for the reporting period (year, quarter, month) are calculated.

In modern accounting programs, when entering primary documents, not only postings, but also totals for any date are automatically generated. For current accounting, daily cash balances, current account balances, and accountable persons are required.

Every month, all homeowners and tenants pay bills for housing and communal services (HCS). Payment documents are drawn up according to a single principle and must comply with the requirements of the Russian Ministry of Construction. The forms differ depending on the type of paid services and the recipients of the payment. Utility bills may include payments for cold and hot water, electricity and heat, gas, wastewater disposal, and disposal of municipal solid waste.

This is interesting: How to post payments? — Forum Calculation of housing and communal services 2020

A single payment document is provided for Moscow. In Bashkortostan, ESKB LLC has developed a form to pay for electricity. The document contains a balance at the beginning of the previous month and at the beginning of the current month. The term raised questions among the population.

The heads of local branches of the company had to answer what the balance in the receipt for electricity is. They explained that it was a debt (positive value) or an overpayment (negative value).

All receipts for utility services must contain:

- barcode;

- payment period;

- last name, first name, patronymic or name of the payer;

- his personal account number;

- real estate data;

- details of the contractor (management company, HOA) or supplier;

- payment details;

- calculation of the fee.

When calculating the fee you must indicate:

- type of service;

- rate;

- unit of measurement;

- volume of service;

- accruals for the billing period;

- recalculations;

- information about debt (overpayment) at the beginning of the period;

- last recorded payment;

- total amount to be paid;

- due date.

Any receipt must be verified before payment. In a correctly drawn up document, if timely payment for the service is made in an amount equal to the debt on the 1st day of the billing month, the final balance is the amount of accruals, taking into account recalculations.

The balance on the receipt is the debt (positive balance) or overpayment (negative) for services as of the date the document is generated. You need to add accruals and recalculations to the initial balance (equal to the final balance for the previous month) and subtract the recorded payment.

Payment for electricity can be made either through the management company or HOA, or directly to the supplier. Receipts must indicate the debt for previous periods, the amount and date of the last payment received, and accruals in the current period.

The balance in receipts for electricity is calculated in the same way as in any receipt: accruals and recalculations are added to the debt on the 1st day of the billing month and the payment taken into account on the day the payment document is generated is subtracted.

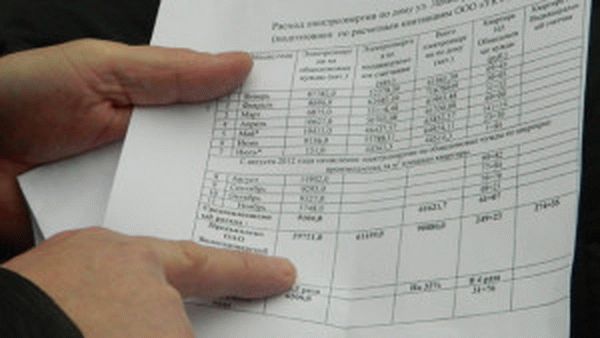

The figure shows a payment document for electricity. The form complies with all legal requirements. Based on meter readings (individual and communal), the amount for consumed electricity in the billing period is determined.

The line with the amount payable is calculated using the formula: debt for previous periods (69.35 rubles) + accrual amount in the billing period (767.54 rubles) + recalculations (0) - received payment (500 rubles) = 336.89 rub.

Regulated by the Housing Code of the Russian Federation (LC RF). Article 153 of the Housing Code of the Russian Federation establishes the obligation for owners and tenants to pay for housing and utilities from the moment of registration of ownership or contract.

Clause 1 of Article 154 of the Housing Code of the Russian Federation regulates payment for the tenant of the premises. Paragraph 2 of Article 154 of the Housing Code establishes the procedure for payment for residential premises, major repairs and utilities for the owner.

According to Part 3 of Article 30 of the Housing Code of the Russian Federation, the owner of an apartment bears the burden of maintaining not only his premises, but also the common property of the owners in an apartment building. Based on this, the receipt includes the payment for the maintenance of common property.

According to Article 155 of the Housing Code of the Russian Federation, payments for housing and communal services must be paid before the 10th day of the month following the month of consumption of the service. The term can also be established by an agreement concluded with the management company, or by a decision of the general meeting of the HOA. The payment deadline is indicated on the receipt for services.

Clause 14 of Article 155 of the Housing Code of the Russian Federation provides for the accrual of penalties for housing and communal services from 31 days after the due date for payment and determines their amount.

If the debt is repaid within 90 days from the date of maturity, the penalty for each day of delay is considered to be 1/300 of the refinancing rate on the day of actual payment. Starting from 91 days, the penalty for each day of delay is considered to be 1/130 of the refinancing rate.

Clause 14.1 of Article 155 of the Housing Code of the Russian Federation provides for the accrual of penalties for major repairs for each day of delay from 31 days after the establishment of a fee in the amount of 1/300 of the refinancing rate on the day of actual payment.

Decree of the Government of the Russian Federation No. 354 provides for the suspension or restriction of utility services if the debt on it exceeds 2 months. A written notice is given in advance and 20 days are given to repay the debt.

For failure to pay housing and communal services, the management company, homeowners association or service provider may file a claim in court against the debtor.

Shows the value of a country's exports and imports over a specified period (usually a year). The active part reflects the export of goods produced or processed in the country. Passive - import of goods for domestic consumption or processing.

The trade balance is the difference between exports and imports. Positive when exports exceed imports and negative when imports exceed exports.

The trade balance is part of the balance of payments.

All foreign economic transactions of the country are reflected. Shows the ratio of payments made abroad and received in the country. The balance of payments is compiled using the double entry principle. The credit shows transactions that bring currency into the country (recorded with a “+” sign), the debit shows transactions that result in the consumption of currency (reflected with a “-“ sign).

The balance of payments consists of 4 sections:

- current account;

- movement of capital;

- foreign exchange reserves;

- errors and omissions.

Section 1 consists of the trade balance and balances of services, net investment income, and current transfers.

The balance is calculated as the difference between the current account and capital account balances. Positive when foreign exchange receipts exceed expenses (surplus) and negative when foreign exchange expenses exceed earnings (deficit). Covered by changes in foreign exchange reserves.

The indicators of foreign trade of different countries are taken into account. They are calculated based on balance of payments data and characterize the country's solvency and its capabilities in international trade.

The result indicators are the balance:

- trade and payments balance;

- balance of services;

- balance of goods and services;

- current account.

This video talks about balances in accounting.

»

Payments

Amnesty for utility bills 2020

Read more

Payments

How to post payments? — Forum Calculation of housing and communal services 2020

Read more

Payments

utilities in non-residential premises - Forum Housing and communal services calculations 2020

Read more

Payments

Payment of utilities after a change of apartment owner 2020

Read more

Great article 0

Methods of paying for utilities to avoid differences

Ideally, the debt at the beginning of the period should be equal to the accruals for the previous period, and the ending debt should be equal to the accruals for the current period. If you pay exactly what was charged and do not violate the payment deadline, then you will not have problems with the balance.

If in any period you violate the payment deadline, the service provider may charge a penalty. On the receipt, the amount of the penalty is usually highlighted as a separate line, and is sometimes not paid attention to. The penalty is calculated for each day of delay, is included in the opening balance and must be paid as soon as it is charged to you.

Many banks offer mobile applications for paying for housing and communal services, where you can set up automatic payment. This will be useful for those who are not used to remembering payment terms. However, even if you have such a function configured and use it, it would be a good idea to check your opening balance every time.

How to calculate the fee taking into account the balance

The amount to be paid is calculated using the formula:

Ref. balance = accruals for the period +/- input. balance – payment.

If the opening balance in the payment order (receipt) is positive, then it must be added to the accruals, if negative, it must be subtracted.

Example. At the end of May, the balance in the gas receipt is 225 rubles. ($3 or 87 UAH) with a minus sign. This indicates that an overpayment occurred in April or earlier. Accruals for May amounted to 300 rubles. ($4 or 116 UAH), there was no payment. Thus, 75 rubles remain for payment. ($1 or 29 UAH) (4-3).

How to avoid balances

To avoid deviations in calculated payments and payments made, consumers of utility services need to be disciplined and attentive when making payments to resource suppliers. This requires:

- Report in a timely manner, in the prescribed manner, the actual readings of individual metering devices.

- No later than the date indicated on the receipt, pay the invoices received, paying the amount exactly as indicated in the document, taking into account the presence of debt or overpayment.

- Correctly calculate the amount of payments if the amount to be paid is determined independently.

- Please indicate your payment details accurately to avoid the possibility of sending money to the wrong account.

We recommend: What are VDGO and VKGO in the housing and communal services receipt

If payment is made on time and accurately, there is no need to fear that the amount paid will differ from the actual cost of the resources consumed.

It is necessary to keep receipts of payments made to prove the fact of payment in the event of disputes. There may be technical failures during banking operations or errors by utility company personnel, as a result of which paid funds are not accounted for properly. If there is appropriate documentary evidence, the misunderstanding can be resolved.

To avoid possible problems, owners need to regularly contact resource and service providers to recalculate the current amount. In this case, it will be possible to timely identify the fact of deviation from the required payment amount in one direction or another and understand the reasons for its occurrence.

The balance column in the utility payment receipt allows the owner to accurately represent the current picture regarding payment for housing and communal services in order to prevent the occurrence of debts or overpayments.

Errors in receipts for housing and communal services payments - what to do

The appearance of errors in payment documents for housing and communal services is a fairly common phenomenon. Almost every consumer has encountered a situation where amounts were charged for non-existent services or the cost of utilities was greatly inflated. Such errors occur for several reasons:

- Dishonesty or incompetence of management company employees. Unfortunately, there are cases when the receipt includes services that were not actually provided. For example, you pay for cleaning common areas, but there is not even a cleaner on staff. Or the receipt contains the line “payment for the maintenance and operation of the waste collection chamber,” but in fact the room allocated for the waste collection chamber is closed and not in use. Or you live on the ground floor and are charged for the elevator.

Here are the most common reasons for overcharges on receipts:

- In almost every apartment building there are residents who do not consider it necessary to pay bills. Often, management companies, instead of going to court to collect debts, “scatter” them according to receipts from bona fide payers. Therefore, you need to know the rates for each service. Thus, tariffs for electricity, gas and water can be found on the official websites of resource supply organizations. There are services for which tariffs depend on the area of the residential premises or on the number of registered residents;

- It is impossible to check metering devices for common areas. For example, in winter there are temperatures above zero from time to time, and the heating in apartments can be regulated independently. At the same time, radiators in elevator halls operate at full capacity. As a result, residents pay for energy that is actually wasted;

- paid services are not provided at all or are provided improperly: premises are cleaned or garbage is removed rarely, elevators do not work for several days, while charges for these days are made as usual.

- Technical glitches. Sometimes the programs that generate receipts crash. Here's an example: residents moved into a new house in June. By that time, there was already a certain number on the heating meter that should not be included in the receipt. However, heating for June was charged due to a failure in the system.

- Human factor. An operator or accountant is a person who can make a mistake: set the tariff incorrectly or incorrectly reflect your expenses.

Thus, you should not rely on the honesty and correctness of the actions of the management company’s employees. Each line on the receipt must be checked carefully. If you do not agree with the charges, submit a statement to the Criminal Code, and they should recalculate you. If refused, go to court. It is also possible to resolve issues of charging fees for housing and communal services at a general meeting of owners.

What is the liability for non-payment of the balance?

For late payment of housing and communal services, a penalty is charged. The calculation is made based on the Central Bank refinancing rate:

- for debt with a period of overdue from 30 to 90 days - in the amount of 1/300 of the refinancing rate;

- for debt overdue over 90 days – 1/130 of the refinancing rate.

In addition, the organization making the accruals may go to court. After this, the bailiff service sends a resolution to collect the debt to the defendant’s place of work, and the accounting department makes deductions from wages. The amount of withholding can range from 25 to 50% of the debtor's income. To determine the place of work, the bailiff sends a request to the Pension Fund and tax authorities, where deductions from wages are made.

If the debtor has no income or it is impossible to determine the place of work, then foreclosure can be applied to other property that is owned: a car, real estate, shares in a business, etc.

If the debt for housing and communal services exceeds 500 thousand rubles, collection is possible only through the bankruptcy procedure of an individual. Such a procedure can be initiated by the management company or resource supply organization.

Sometimes the consumer pays only the charges on the receipt, and the opening balance (debt at the beginning of the month) remains. In this case, the payment amounts of the current period are transferred to previous periods, and the delay is counted from the day following the due date of the last receipt. Therefore, check that the opening balance does not exceed the accrual of the previous period.

Responsibility

Clause 14 of Article 155 of the Housing Code of the Russian Federation provides for the accrual of penalties for housing and communal services from 31 days after the due date for payment and determines their amount.

If the debt is repaid within 90 days from the date of maturity, the penalty for each day of delay is considered to be 1/300 of the refinancing rate on the day of actual payment. Starting from 91 days, the penalty for each day of delay is considered to be 1/130 of the refinancing rate.

Clause 14.1 of Article 155 of the Housing Code of the Russian Federation provides for the accrual of penalties for major repairs for each day of delay from 31 days after the establishment of a fee in the amount of 1/300 of the refinancing rate on the day of actual payment.

Decree of the Government of the Russian Federation No. 354 provides for the suspension or restriction of utility services if the debt on it exceeds 2 months. A written notice is given in advance and 20 days are given to repay the debt.

For failure to pay housing and communal services, the management company, homeowners association or service provider may file a claim in court against the debtor.

An example of calculating the balance in a receipt for housing and communal services

Let's consider an example of calculating the balance in a receipt for water with a payment due date of July 10.

As of July 1, the payer's debt is 600 rubles. ($8 or 232 UAH). This debt includes:

- accruals for June - 450 rubles. ($6 or 174 UAH);

- debt for previous periods - 113 rubles. ($1.50 or 44 UAH);

- penalty – 38 rub. ($0.50 or 15 UAH).

On July 9, a payment was made in the amount of 450 rubles. ($6 or 174 UAH). The meter readings were submitted on time - July 20.

Accrued for July:

- cost of consumed cold water – 225 rubles. ($3 or 87 UAH);

- the cost of consumed hot water is 300 rubles. ($4 or 116 UAH);

- sewerage fee - 75 rubles. ($1 or 29 UAH)

Total payment is 600 rubles. ($8 or 232 UAH).

So how much should the consumer pay?

The calculation will look like this: from the opening balance we subtract the amount of the payment made in July and add the accruals on the receipt:

8-6+8=750 rub. ($10 or 290 UAH), incl. penalty 38 rub. ($0.50 or 15 UAH).