Definition

What document are we talking about? It is important to understand that in Russia there are several concepts - TIN and TIN certificate.

An individual taxpayer number is a kind of citizen identifier in the Federal Tax Service system. This is a number consisting of some combination of numbers. It is assigned to every person at birth.

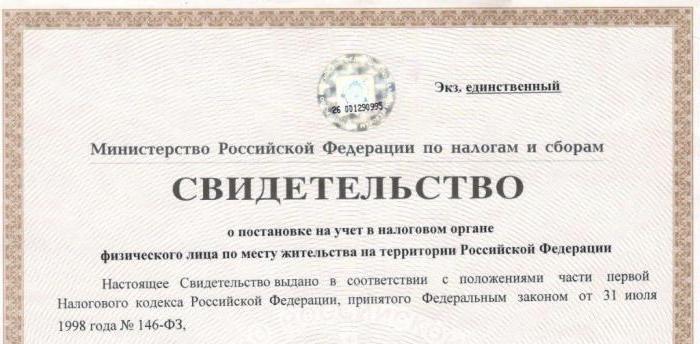

A TIN certificate is a document that contains the individual number of a person and information about the recipient. Usually it means A4 paper with relevant information and government signs. In Crimea and Sevastopol, together with the certificate, you can put a special stamp in your passport.

Reasons for replacement

Is it necessary to replace the TIN when changing place of residence or not? In Russia, many documents have to be exchanged from time to time. For example, after their expiration date or when moving to another city.

The reasons for exchanging the TIN are the following circumstances:

- change of personal data;

- detecting typos in a document;

- theft/damage/loss of old paper.

It follows that there is no need to change the standard certificate when moving. But there are exceptions.

Urgent replacement

Under some circumstances, a change of permanent residence entails the need to urgently replace a certificate with an individual taxpayer number. But not the TIN as a whole.

When is this possible? For example:

- if the recipient is a government employee and the document is needed for work;

- if you need to prepare tax deductions;

- when the old certificate is lost.

As you may have noticed, changing your TIN when changing your place of residence is not a mandatory procedure. Therefore, if there are no compelling reasons for this, there is no need to rush into implementing the idea.

An exception

Do I need to change my TIN when changing my registration? No. And if you are an individual, then you do not even need to independently notify the tax authorities at your new place of residence. As already mentioned, there are exceptions to the rules. Or, more precisely, it is one. You should only talk about changing your registration on your own if you are an individual entrepreneur. But this will not change your TIN. The tax office will require you to fill out a special application in which you will have to indicate your new place of registration. There is nothing difficult about it.

How to declare yourself? Find the tax authorities at the place of your new registration and come there with a passport, as well as a certificate of registration of individual entrepreneurs. Take your INN and SNILS with you too. Next, ask for a notification form about a change of registration. Fill it out, attach copies of your documents and leave it with the tax office.

TIN and certificate

However, sooner or later you will still have to change your TIN when changing your place of residence. A certificate of the established form is issued by regional tax services. It will indicate the city in which the document was issued. When moving to another region, you have to exchange paper. But not urgently. It's about testimony.

When changing place of residence, the TIN remains the same. As emphasized earlier, citizens are assigned an individual number once in their life. It remains unchanged throughout life. Therefore, the TIN cannot be exchanged under any circumstances. Data about the applicant will be transferred to the Federal Tax Service at the new place of registration. Accordingly, all tax notices will still reach the real recipient.

Is the TIN subject to replacement when changing place of residence?

One of the key questions when changing registration and place of residence is whether it is necessary to change the TIN when moving. The answer is clear - no. Today it is possible to automatically transfer data between branches of the Federal Tax Service and obtain all information about the taxpayer. However, there are a number of cases when changing the document containing the taxpayer number is necessary. Among them:

- changing the surname, name or patronymic of a person;

- gender change.

Registration at a new address or actual relocation are not included in the list. This raises another question: how to change the TIN when changing your last name. It is this reason that occurs more often than others, for example, in the case of marriage. This is necessary so that the document contains the details of the person to whom it was issued. In order to do this, you must proceed as follows.

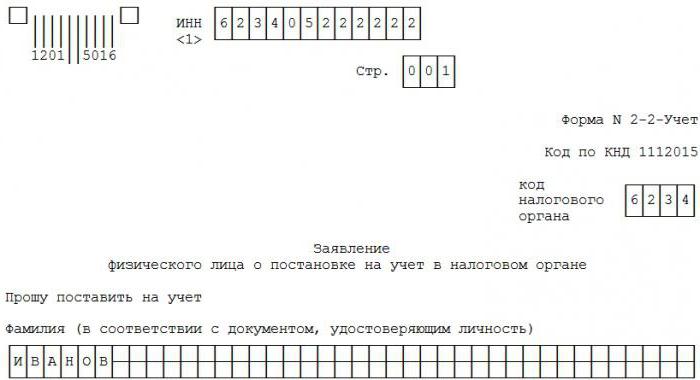

- Complete an application in the prescribed form 2-2.

- Prepare the necessary package of documents. They will necessarily include the applicant’s passport, a notarized power of attorney, if it is not the interested person himself who is applying, but his representative.

- Submit the package to the Federal Tax Service office.

- Wait until the new document is issued.

- Show up at the appointed time and receive the required paper.

If it is inconvenient to contact the Federal Tax Service office in person, you can use the help of a representative by proxy or by mail with notification. When changing your last name, you can submit an online application via the Internet.

Such services are provided through the official website of the Federal Tax Service or the State Services portal. Moreover, the interested person can receive the finished document at the Federal Tax Service office or by mail. The waiting period for a new document containing a taxpayer identification number will be up to 5 business days.

What are the differences between a certificate and a TIN

Often, by the letter combination of TIN, citizens understand not the unique taxpayer number itself, but the document in which it is reflected. Such paper is a certificate of registration with the tax authority. It has a standard form and is issued as a result of an application by a citizen or his representative to the Federal Tax Service. What is the difference between these two concepts?

The only difference is that the TIN is a specific, unique number, and the certificate is a document containing it. At the same time, the TIN itself cannot change over the course of life: neither when changing a surname, nor when moving, etc. However, citizens often talk about changing the TIN or getting a new one. It is the certificate that is necessarily changed when the surname is changed and in the presence of other reasons, but it is called differently.

So, changing the TIN when changing place of residence or registration is not required. The taxpayer identification number itself remains unchanged until the end of the individual’s life. However, the certificate containing it can be replaced if there are certain grounds: a change of surname or a change of gender. Moving is not such a thing, therefore, to the question of whether it is necessary to change the TIN when changing registration, the answer is always negative. Regardless of the location of an individual within the country, the number he previously received will be valid.

Where to change

Where is the TIN changed when changing place of residence? In Russia this issue is dealt with:

- tax authorities;

- multifunctional centers.

You can also produce or change a certificate with an individual taxpayer number by using a service called “Government Services”. No other institutions in the Russian Federation are engaged in solving this problem.

Procedure

There is no change in TIN when changing place of residence. As already mentioned, a citizen can exchange a certificate issued to him earlier, but nothing more. What does that require?

The instructions below will help you exchange your TIN under any circumstances. Citizens will have to:

- Prepare some documents to add new information to the TIN certificate.

- Pay the state fee (not always).

- Send a written request along with documents to the Federal Tax Service or MFC for registration.

- After some time, receive a completed certificate with an individual taxpayer number.

This is the procedure for exchanging TINs that is in effect on the territory of the Russian Federation to this day. This is a very simple operation that requires little preparation. In particular, regarding the provision of documents for the production of a certificate.

How can I find out my TIN?

When you urgently need to find out the number assigned by the tax office, you don’t have to run there. For this, the Internet offers two sources: the official website of the Federal Tax Service of Russia and the Internet portal of public services. The procedure is the same for both portals. You need to complete a request for registration with the assignment of a TIN.

How to check the TIN through the Federal Tax Service website?

You can check yourself for tax debts and find out the amount of taxes and fees paid on the Federal Tax Service website. To do this, it is convenient to use the electronic service. By entering your personal data, you can get the information you need.

If another person is being checked, information will be provided only about the presence or absence of a TIN. You need to contact the tax office for its number.

This is interesting: Obtaining a certificate of residence: what you need to get and where you can get it

Checking the TIN on the State Services website

It is possible to carry out the verification procedure on the State Services portal only if the taxpayer is registered. In your personal account you can get the necessary information. Without access to another person’s personal account, it is impossible to perform a check.

Without passport data, it is impossible to find out the tax registration code. The TIN is classified as personal data of a citizen of the Russian Federation and is protected by law.

List of documents for TIN

Do you need to change your Taxpayer Identification Number (TIN) when you change your place of residence? The procedure for dealing with this situation is already clear to us. The proposed instructions will help you obtain a new certificate with an individual taxpayer number not only when moving, but also in any other case.

What documents are needed to receive the service? Among them are:

- old certificate;

- passport (or other identification document);

- receipt with paid duty (300 rubles for individuals);

- statement;

- certificates indicating the citizen’s registration (not needed if the applicant has brought a civil passport).

This list of documents is not exclusive. Other papers may be useful if the recipient is a minor child.

Methods for obtaining TIN by citizens

For initial receipt, you should visit the territorial inspection and submit:

- application of the established form, the form of which is issued upon application or downloaded from the Internet. You can also see a sample filling there;

- copy of passport.

Sample application for TIN

There are several options for obtaining an identification number.

- Personally at the tax office. When applying directly, a passport and copies are provided. An application is filled out (by the taxpayer himself or by a Federal Tax Service inspector). Issuance time is 5-7 days. You can pick up the finished certificate yourself or by registered mail. At the request of the applicant, a note about the received number is made in the passport.

- Receipt at the MFC. The procedure for obtaining a code in Multifunctional is very simple. The taxpayer should contact a specialist and present his passport with a photocopy. An employee will fill out the forms. You can receive a ready-made TIN immediately after notification via SMS.

- Via the Internet. You can order the document on the Federal Tax Service website. To do this, you need to open a personal account through the “individuals” section at nalog.ru. In “electronic services”, find the column “submission of an individual’s application for registration.” After registration, a form will open that must be filled out carefully. The application will be assigned a registration number, on the basis of which the Tax Inspectorate will issue a certificate. On the site you can not only get an inn, government services offer ample opportunities for citizens to receive services.

- By registered mail. To obtain a code without a personal visit to the inspection, you will need to prepare a completed application and a notarized copy of your passport. Send to the territorial tax office by registered mail with a list of attachments, as well as notification of receipt. The completed certificate will arrive at the specified home address.

- Through intermediary companies. Obtaining a TIN is a free service. However, some companies undertake to mediate in obtaining a certificate for a fee.

This is interesting: How and where can an individual obtain a TIN at their place of residence? Is it possible to find out the assigned TIN from a passport?

TIN and minors

You can change your TIN when changing your place of residence in the shortest possible time if you follow the instructions provided. What documents do the Federal Tax Service require when exchanging a certificate of the established form for children?

Among them are:

- passport of the legal representative;

- application for TIN exchange, written on behalf of the parent;

- child's birth certificate;

- certificates indicating registration (parent and minor).

From the age of 14, children can obtain a TIN and exchange it themselves. If we are talking specifically about the reissue of paper, you will have to pay a state fee in the established amounts. Otherwise the operation will be denied.

Waiting time

Sooner or later you will have to exchange your TIN certificate if you change your place of residence. This service takes about 5 working days. This is exactly how long you need to wait before picking up the completed TIN certificate from the Federal Tax Service or the MFC.

In some cases, the waiting period increases. Usually, when a certificate with a TIN is ready, the citizen is informed of the need to obtain it. For example, by phone or mail. The operation being studied is not too long.

Let's sum it up

It is now clear whether a TIN change is necessary when changing place of residence. This operation is not mandatory, but it is advisable to carry it out. Otherwise, if you need to file tax deductions or obtain information about a person through the Federal Tax Service, problems may arise.

All of the listed nuances and features are relevant for each region of the Russian Federation. Therefore, all cities have the same rules and principles for issuing/exchanging TINs.

Tax authorities assure that the initial production of a certificate with an individual taxpayer number is the personal desire of the citizen. If he does not want to, he is allowed not to draw up the relevant paper. You can find out your TIN using a special service. It is located on “GosKnow your TIN”. With its help, it will be possible to obtain information about the taxpayer number, based on the citizen’s personal information.

Determination of TIN

For convenience, in the tax accounting system, instead of using personal data of citizens, a special identifier, TIN, is used in almost all documents. In accordance with Russian legislation, every Russian is required to register. Everyone is required to pay taxes - both citizens of the Russian Federation and organizations.

Legislative regulation

Taxpayer identification number is a unique code that is assigned to every citizen of the Russian Federation and is an identifier in the system of the Federal Tax Service.

Code

The TIN code consists of twelve digits. The first two carry information about the citizen’s region, the next two – about the tax service number. This information helps the competent authorities to carry out tax control.

For organizations

If an individual on the territory of the Russian Federation does not need to know his number and have a document confirming its availability, then for legal entities the situation is different. Any organization monitors its income and expenses and reports them annually to regulatory authorities.

To carry out tax accounting for legal entities, each organization is inevitably assigned a TIN upon registration.

Certificate

After registration, an individual or legal entity is issued a certificate of registration with the tax authority - an A4 document.

The document records:

- the TIN code itself,

- paper issue date,

- service responsible for its registration.

This video provides information on the procedure for registering with the tax authority.