From a legal point of view, the gift of a dacha is an agreement in which two or more parties participate, one of which is called the donor and acts as the direct owner of the property, which it transfers free of charge to the person/s called the donee party. According to current legislation, this transaction must be formalized in 2020 by an agreement concluded in simple written form (in accordance with the provisions established by Article 574 of the Civil Code of the Russian Federation).

It should be remembered that since the country house is located on a plot of land, and the law does not separate these real estate objects from each other, they are transferred by deed of gift only together! Simply put, the donor cannot give, and the donee cannot accept, only a plot of land or just a house. Otherwise, the transaction will be considered invalid!

Since the dacha (together the plot and the building/structures) refers to real estate, then, based on the rules established by the legislator for real estate transactions, ownership from the present to the new owner can be transferred only after state registration of the dacha donation agreement in 2020 !

Now, let's take a closer look at the main nuances of donation and the most common mistakes leading to the invalidity of the transaction.

How to properly register a deed of gift in 2020

According to Russian legislation, the term “dacha” means a plot of land with trees, beds, as well as corresponding buildings, the main of which is considered to be a residential dacha house. At the same time, both described objects are included in the category of real estate, as enshrined in paragraph 1 of Article 130 of the Civil Code of the Russian Federation.

Thus, requirements must be applied to the execution of such a deed of gift, as well as a number of rules relating to any gift transactions whose object is real estate. The main condition in the transaction is still the presence of title documents on the part of the donating party, which confirm the right of ownership of this person to the object transferred free of charge to the donee.

How to register real estate - an apartment, house or cottage - for a minor child

Currently, the law provides for the right of a minor citizen to own real estate at absolutely any age. Caring parents, trying to provide their offspring with living space, register apartments, houses and summer cottages for their children, and they can provide their baby with housing even from birth. To register bequeathed property, a representative of a minor is obliged to enter into inheritance rights on behalf of the heir, that is, the child. To do this, you should contact a notary office. After confirming the legality of the documents, the notary issues a certificate of inheritance in the name of the young heir, which is the basis for transferring the right to the new owner. Next, you need to apply with this certificate to Rosreestr for registration.

21 Dec 2020 marketur 187

Share this post

- Related Posts

- Calculation of UTII for individual entrepreneurs in 2020

- Notice of sale of a room in a communal apartment

- When can a procurement notice be posted after the schedule plan has been posted?

- Sample application form for employment

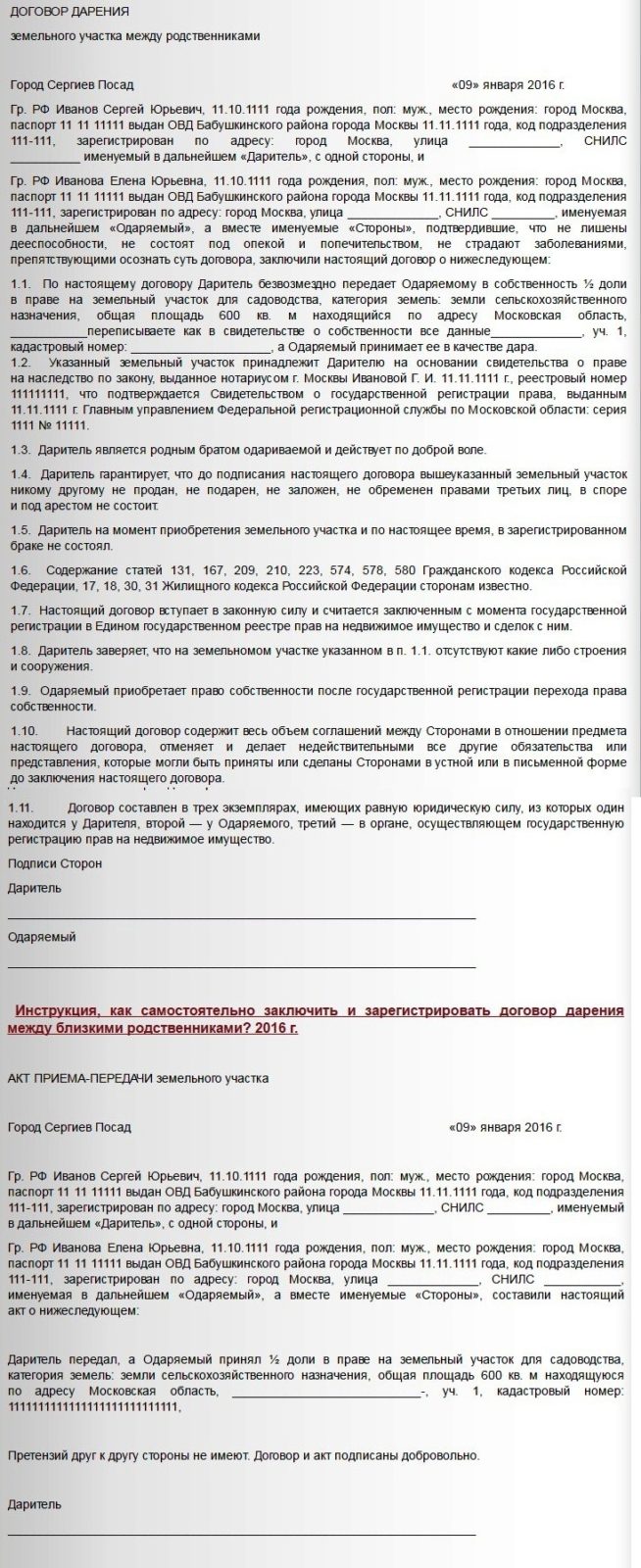

The procedure for drawing up a dacha donation agreement

As we have repeatedly noted in previous articles on the Legal Ambulance website, since an agreement of this type requires mandatory state registration - the agreement must be drawn up in writing! At the same time, the legislator allows the donor and the recipient to notarize the document drawn up by the parties, recommending that transactions be notarized due to their high cost.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

Since the deed of gift regulates the conditions and procedure for the actual transfer of a country house and land, the success of the transaction, in general, will depend on the correctness of the agreement. Therefore, the parties must specifically, clearly and unambiguously state each point of the document!

However, lawyers note that an agreement can be challenged in 95% of cases if its content does not contain the following information:

- The intention expressed by the donor to transfer the dacha free of charge into the ownership of the donee or group of persons;

- the expressed consent of the recipient to accept the gift and assume all responsibilities associated with it;

- information about the parties to the transaction, including their passport details and actual residential addresses at the time of drawing up the dacha donation agreement;

- a detailed description of the properties and characteristics of the object of the donation, including data on the land plot, the address of the dacha, cadastral numbers of the house and plot, as well as the technical characteristics of all premises that distinguish the gift from among similar objects;

- list of grounds for termination of the deed of gift;

- instructions on the current legal capacity of the donee and the donor;

- indicating the period for transferring the object into ownership of the new owner;

- a list of obligations and rights of the parties, as well as their responsibility for violating the terms of the agreement;

- information about the absence of encumbrances or similar restrictions on the use of real estate;

- signatures of the parties.

EVERYONE NEEDS TO KNOW THIS:

Donation agreement to a budgetary institution in 2020 - current sample, errors, rules

The next step in concluding a dacha donation agreement after drawing up and proofreading the main agreement is its mandatory state registration, or more precisely, the re-registration of ownership from the donor to the donee. All the parties need to do is go together to the registration authority, where they will have to write a corresponding application (from both the donor and the donee), hand over a package of necessary documents and receive a receipt from the organization’s employees with an approximate completion date of the procedure.

After employees of the Rosreestr bodies have carried out an examination and analysis of documentation, as well as verified the legality of the completed donation transaction (the legislator has given them 10 days for this), the parties to the deed of gift receive a copy of the donation agreement with a special registration mark. In addition, the donee (the new owner of the dacha) receives a certificate of entry into ownership of the property donated to him.

Registration of a dacha as an inheritance after death

» Inheritance disputes October 10, 2020

Dacha as an inheritance. How to register property after the death of relatives

07/30/2017 07/30/2017 Veronica Stepanovna

Often people find friends on vacation, and if they are older people, then at their own dacha. Unfortunately, many of them, for various reasons, take the registration of country real estate lightly. In this case, can the heirs obtain ownership of the land?

Lyudmila Odintseva always spends her weekends at the dacha; her family has owned the plot in the Omsk region for more than 20 years. After the death of her parents, Lyudmila Viktorovna was supposed to inherit country real estate. But suddenly it turned out that there were no documents for the plot - my father did not have time to do them. He registered the plot, did land surveying, but was not registered; he died and did not have time to register ownership of the dacha.

According to lawyers, such situations happen often, and the law in this case is on the side of the heirs.

Any property that belonged to or was used by the deceased. He was allocated some plots, even if they were not registered as property - in any case, they were included in the inheritance mass.

Lyudmila Odintseva appealed to the district court - in full confidence that her, as an heir, would be recognized as the owner of the country real estate. But the woman was refused on the grounds that the notorious 8 acres were not registered in the cadastral register. And the horticultural non-profit partnership, on whose territory the site is located, ceased to exist.

The regional court agreed with this formulation of the refusal. This means that Lyudmila Viktorovna could only use the dacha, but had no right to sell it or bequeath it to her children. The woman had to go to the Supreme Court, and they recognized that the inheritance dispute was resolved incorrectly.

Moreover, based on the article of the Civil Code, which clearly states that the property remaining after the death of the testator can be accepted by his heir if it was received by the testator legally. This legal basis, as a rule, is a resolution of the local administration to grant a person ownership of a plot of land. In addition, if close relatives take care of the plot and pay all the bills, then they, in fact, accept the inheritance, and this should also be taken into account in court.

But the fact that the gardening partnership where the plot is located has been liquidated cannot interfere with the order of inheritance. After all, the land is not going anywhere.

Because if there was SNT and SNT is gone, then it doesn’t matter, this territory went to someone. Usually to a local authority - this is either a town or a village.

The only problem that can really prevent the heir from registering ownership of the land is if the land is not registered in the cadastral register, and therefore does not exist as an object

rights. But not everything is so hopeless - according to the law, all interested parties, including the heirs themselves, can complete the land surveying procedure.

It is necessary to register this land plot with the cadastral register and apply to the court for recognition of the right to a specific land plot, with a specific area and a specific cadastral number.

But as the Supreme Court explained, even if the heirs have not completed the land surveying procedure, this cannot be a basis for non-recognition of their property rights in the order of inheritance. It remains to be hoped that lower courts will learn these nuances and, in the future, when considering inheritance disputes, will be guided by the law, and not by personal considerations.

Post navigation

How to inherit a dacha

The procedure for registering a dacha as an inheritance depends on whether the heirs register it after the death of the testator or whether the testator wishes to dispose of the property during his lifetime. In all cases, it is necessary to prepare a package of documents and contact a notary.

- application to a notary - personal documents of the heirs or testator - documents for the dacha - death certificate - documents confirming relationship with the testator.

Sponsor of the placement P&G Articles on the topic “How to register a dacha as an inheritance” How to re-register an apartment after death How to register your share of an inheritance How to enter into inheritance rights How to conclude a gift agreement How to sell an apartment to heirs

If you are registering a dacha after the death of the testator, contact the notary at the location of the property with an application. Present your passport, title documents for the dacha, death certificate of the testator, documents confirming your relationship, a copy of the marriage certificate if you or the testator changed their last name.

The notary will open the inheritance case. If the dacha is not willed, then all heirs by law will receive equal shares of the property 6 months after the death of the testator. If there is a will, the notary will announce the last will of the testator to all heirs and the dacha will pass to the person to whom it was bequeathed. If a will is written indicating several people, the dacha will belong to the heirs in equal shares. If disputes arise regarding the division, they are resolved in an arbitration court or in a court of general jurisdiction.

After receiving the certificate of inheritance, contact the FUGRC, present your passport, title documents for the dacha, certificate of inheritance, fill out the application, pay the state fee for registration. After 1 month, you will be issued a certificate of ownership, and you will be able to dispose of the inheritance at your own discretion.

If you want to inherit a dacha during your lifetime, then you need to contact a notary with a passport and documents for the dacha. To the notary's office, present an extract from the cadastral passport and a copy of the cadastral plan for the land plot, a certificate of ownership, an extract from the cadastral documents for the country house, which you can obtain from the BTI. It is also necessary to present a certificate of the cadastral value of the land plot and the country house.

The notary will draw up a will in which you can indicate one or more heirs and the share of each, so that after your death there will be no disputes or litigation.

You can revoke the will or create a new document at any time during your lifetime. The last will in date will be valid.

How to enter into an inheritance An inheritance case is opened after the death of the testator at the request of the heirs. You can become an heir by law if there is no will. If there is a will, then all property will go to the specified persons. Exceptions are cases when, during the life of the testator, he was dependent on

How to open an inheritance An inheritance is the property left after the death of the testator, which is divided between the heirs according to the law in equal parts or passed on by will. To open an inheritance, you need to collect a number of documents and contact a notary office located in the area of the last place

How to claim rights to an inheritance Based on Article No. 527 of the Civil Code of the Russian Federation, you can become an heir by law or by will. The application period for accepting an inheritance is limited to 6 months after the death of the testator. If this deadline is missed and the inheritance is divided between the heirs, then you can only declare your right

How to register your share of the inheritance You can become an heir by will or by law. For any right of inheritance, it is necessary to submit an application to the notary regarding the desire to accept the inheritance within 6 months from the date of death of the testator. If there is a will for the inheritance, then each heir receives his share according to the will. If

How to register a house if the owner has died A house whose owner has died is part of the estate and is passed on to the heirs by law or will. If the house belongs to the municipality and has not been privatized, then if one tenant is registered, the housing is transferred to the municipality. To register an inheritance, you will need

What is needed to enter into an inheritance According to Chapters 62-65 of the Civil Code of the Russian Federation, you can become an heir by law if there is no last expression of the testator’s will in the form of a will. To receive and open an inheritance, you will need a list of documents that must be submitted to the notary at the place of residence of the testator or at

How to register a house as an inheritance If an irreparable event happens - the death of a loved one, then people do not think that they need to go somewhere and register something.

Unfortunately it is so. Whether a person left a will or not, the heirs need to declare their rights to the inheritance. You will need a death certificate of the testator

How to re-register an apartment after death Heirs by law can re-register an apartment after the death of the testator, if during his lifetime this right is not changed by a will, according to which the property is transferred to those indicated in it. To obtain a certificate, you will need to declare your rights and accept the inheritance. You will need an application

How to register a house if it was inherited A house that has been inherited must be registered as a property, but to register ownership, you first need to become an heir and receive a certificate of inheritance. To do this, you should contact a notary with a package of documents. You will need - an application to a notary -

How to register an inheritance for an apartment under a will Chapter No. 62 of the Civil Code of the Russian Federation is devoted to inheritance under a will. Persons specified in the last will of the testator, drawn up in simple written form with mandatory notarization or from a notary, can enter into inheritance under a will. You will need - passport - application -

How to register an inheritance for a dacha after death

How can I transfer the dacha to myself after the death of my wife? 4 years have passed since death. the cottage is in gardening.

1 answer. Moscow Viewed 61 times. Asked 2013-01-24 09:38:06 +0400 in the topic Civil law After the death of my wife, how to re-register? — After the death of my wife, how to re-register the inheritance. Further

1 answer. Moscow Viewed 139 times. Asked 2013-07-15 13:29:14 +0400 in the subject Inheritance law After the death of the grandmother, an apartment was registered in her sons' name by way of inheritance. How to register a dacha, 6 years have passed? — After the death of the grandmother, the apartment was registered in the name of her sons by way of inheritance.

How to inherit a dacha and garden plot?

Firstly, when donating, you take ownership immediately and it is not necessary to inform other relatives (if you or your father want only you to be the owner),

Secondly, after 3 years, none of the so-called second-degree relatives (brothers, sisters, your aunts and uncles) will be able to apply (when making a gift, only the spouse’s consent is required, and only if the land was purchased during marriage).

1) come to the Office of the Federal Service for State Registration of Cadastre and Cartography, to which the registered plot belongs (this must be written in the registration document)

If your father is able to leave or you can take him out and he can endure the trip, then of course it’s better with him.

How to inherit a dacha

In order to consider the issue of registering a dacha, we need to define the concept of “dacha” and what this concept represents from a legal point of view.

In the generally accepted sense, a dacha is a building located outside the city limits and intended for recreation. In the recent past, a dacha was intended for gardening and cultivating a plot of land in order to get a harvest from their beds.

How to register an inheritance for a dacha after death

6 months are established by law for accepting an inheritance. You have actually accepted, and this is one of the ways to accept it, along with turning to a notary with an application for acceptance (not to be confused with an application for issuing a certificate of inheritance!).

It is recognized, until otherwise proven, that the heir accepted the inheritance if he performed actions indicating the actual acceptance of the inheritance, in particular if the heir:

As for the tax, there is a letter from the Federal Tax Service of the Russian Federation dated February 22, 2006.

How to register an inheritance

First method: Application for the right to inheritance: choose a notary to open an inheritance case. As a rule, a notary is determined by the place of residence of the testator, but in Moscow there is a single database, so you can contact any notary. Then submit an application to the notary for the issuance of a Certificate of Inheritance. IMPORTANT. The application must be submitted within six months from the date of opening.

Second method: Actual acceptance of the inheritance: You exercise the rights of ownership of the inherited property, bear the costs of its maintenance, etc.

Inheritance of a house

However, in order to enter into inheritance rights to a house, you must correctly go through the stages of registration of acceptance, as well as obtain a certificate.

According to state registration, the heir must pay a state fee for the transfer of ownership rights and for the registration procedure itself - 2000 rubles. However, an additional fee of 700 rubles is also paid for obtaining technical documentation from the BTI.

Quite often, when registering an inheritance for a house, some operations may require the help of lawyers or notaries.

Inheritance. country house

Visitors to the legal consultation asked 38 questions on the topic of Inheritance. country house . On average, the answer to a question appears within 15 minutes, and to a question we guarantee at least two answers that will begin to arrive within 5 minutes!

I registered a will with a notary, an inheritance of an apartment, 3 years ago, I still have a dacha, I haven’t formalized it yet, can I register the same with a notary, they should keep it in the archives? Call 06/06/2014

Register an inheritance for a dacha

There is a summer cottage, left to my husband and his brother as an inheritance from their parents, the owner (husband’s father) died in 2005. My husband and brother tried to apply for it themselves and join, but there are inaccuracies in the documents and the natary drove them to the Dmitrovsky district, but while some certificates are being issued, the rest become overdue. As a result, things are still there. I would like to formalize the inheritance and sell this plot.

Registration of inheritance for a dacha, features and procedure of the process

Is it possible to register a dacha plot under a will?

Reply from 02/15/2014 01:54

If you are registering a dacha after the death of the testator, contact the notary at the location of the property with an application. Present your passport, title documents for the dacha, death certificate of the testator, documents confirming your relationship, a copy of the marriage certificate if you or the testator changed their last name. The notary will open the inheritance case. If the dacha is not willed, then all heirs by law will receive equal shares of the property 6 months after the death of the testator. If there is a will, the notary will announce the last will of the testator to all heirs and the dacha will pass to the person to whom it was bequeathed. If a will is written indicating several people, the dacha will belong to the heirs in equal shares. If disputes arise regarding the division, they are resolved in an arbitration court or in a court of general jurisdiction. After receiving the certificate of inheritance, contact the FUGRC, present your passport, title documents for the dacha, and certificate of inheritance. fill out the application and pay the state registration fee. After 1 month, you will be issued a certificate of ownership, and you will be able to dispose of the inheritance at your own discretion. If you want to inherit a dacha during your lifetime, then you need to contact a notary with a passport and documents for the dacha. To the notary's office, present an extract from the cadastral passport and a copy of the cadastral plan for the land plot, a certificate of ownership, an extract from the cadastral documents for the country house, which you can obtain from the BTI. It is also necessary to present a certificate of the cadastral value of the land plot and the country house. The notary will draw up a will in which you can indicate one or more heirs and the share of each, so that after your death there will be no disputes or litigation. You can revoke the will or create a new document at any time during your lifetime. The last will in date will be valid.

Didn't find the answer? Ask a question!

and get an answer in 1 minute!

Please provide the required information to submit a question.

Attention! There was an error sending! Check your Internet connection and click on the “Get answer” button again.

Data is being sent. Do not close the page until you see a message about the submission result.

Your application has been successfully accepted!

A lawyer will answer your question over the phone. This will significantly speed up the process. Please provide your contact phone number.

Attention! There was an error sending! Check your Internet connection and click on the “Get answer” button again.

Your application has been successfully sent! Expect a call from a lawyer.

We arrange a dacha as an inheritance

Ending. For the beginning, see “Your Home,” June 23.

HOW TO SHARE THE “HAZENDA” IN A BROTHERLY WAY

Our father has a plot and a house, there are three of us heirs. How will the house and land be distributed among us?

— We usually advise the heirs to enter into a division agreement: someone may receive, for example, a certain part of a house or an entire dacha, someone else may receive another part of the inherited property, someone may receive monetary compensation.

If it was not possible to come to an agreement on your own, then the notary, taking into account the rules of the current legislation, formalizes the common property of the heirs in equal shares. That is, in the case of Mikhail, everyone is issued a certificate of inheritance for a one-third share in the ownership of the house and plot.

By the way, keep in mind: in such a situation, if you subsequently want to dispose of the dacha - for example, sell or mortgage it - then the participation of all heirs-co-owners will be required so that the buyer receives the entire property. Therefore, in order to avoid possible disputes in the future, it is advisable to voluntarily agree in advance on a reasonable division.

WHAT AND HOW MUCH YOU HAVE TO PAY FOR

According to my aunt's will, I inherited a dacha - a house in the village. Now I want to start processing it, tell me: what expenses await me?

— The total amount may vary depending on what documents you have on hand, the degree of relationship with the testator and other factors. On average, you need to focus on the following numbers:

— opening a inheritance case with a notary — from 500 to 1500 rubles.

- cadastral passports of the house and plot, certificates of the value of real estate - from 2,000 to 15,000 rubles. (depending on whether such documents are available in the BTI and the state real estate cadastre, whether it is necessary to measure the house, etc.)

— fee for issuing a certificate of inheritance: 0.3% of the value of the inherited property, but not more than 100 thousand rubles, if the heirs are children, including adopted children, spouses, parents, full brothers and sisters of the testator 0.6% of the value of the inheritance, but not more than 1 million rubles for the remaining heirs

— fee for technical and legal work when preparing a certificate of inheritance — 5,000 rubles. (for Moscow. in other regions may differ depending on the decisions of the notary chambers of the constituent entities of the Russian Federation).

Please note: today the heir himself chooses how the property will be valued - at market value or according to the BTI assessment or at the cadastral value

- fee for state registration of ownership of real estate received by inheritance - 1000 rubles. for the house and 200 rubles. per plot.

Important: inheritance tax is not levied in the Russian Federation today.

fb vk tw gp ok ml wp

Rice. Nikolai VORONTSOV Photo: Fig. Nikolai VORONTSOV

“I WROTE A REFUSAL, AND NOW I WANT TO GET MY SHARE”

After my mother’s death, I signed a waiver of inheritance in favor of my brother. Later it turned out that I did this in vain and part of my mother’s inheritance - the country house - should belong to me, especially since my brother does not want to deal with the registration. Can I now take back my refusal, cancel it and how to do it? If not, what other options are possible?

— Refusal of inheritance cannot be taken back. Therefore, if your application for refusal is already in the inheritance file, you have only one option - to go to court.

At the same time, if you are ready to help your brother and register an inheritance in his name (and later receive a part, for example, by donation), then your brother can give you a power of attorney, and according to it you will receive a certificate of inheritance without his participation.

Grandfather drew up a will for the dacha, but did not show it to anyone. Then he had a stroke, he speaks and understands poorly. Tell me: how can I find out where and in whose name a will was made? Is there a unified database of wills?

— Today there is no unified database of wills in our country. Therefore, we advise heirs, in the event of the death of a relative with a passport and death certificate, to contact first of all notary offices near the place of residence and work of the deceased - as a rule, this is where wills are most often drawn up and there is the greatest chance of finding them.

It is advisable to submit an application for acceptance of inheritance as soon as possible, maximum no later than 6 months from the date of death of the testator.

Heirs need to contact the notary office at the last place of residence of the testator (i.e., where the “registration” was issued). At the same time, in Moscow there is now a system of “inheritance without borders”: if the testator lived and had permanent registration (“registration”) in the capital, then you can apply for registration of inheritance to any Moscow notary.

“In principle, after filing an application for acceptance of an inheritance, the time for collecting the remaining documents to obtain a certificate of the right to inheritance is not limited by law,” notes notary Nikolai Repin. - At the same time, we advise the heirs not to delay too much and try to collect all the necessary certificates within 2 - 3 months. Because in the context of rapidly changing legislation, new requirements for documents and procedures may appear, and as a result, the heirs will have extra trouble.

Listen to expert advice on how to competently defend your rights in a variety of everyday situations in the program “I am a consumer!” every Tuesday and Thursday at 14.35 97.2FM

Sources: efimovna.ru, dokak.ru, lawyersfree.ru, rossovet.ru, www.msk.kp.ru

Next:

- Registration of an apartment as an inheritance without a will

- Registration of inheritance with a notary, documents are issued by a notary

No comments yet!

Share your opinion

You might be interested in

The time for entering into inheritance has expired

Opening an inheritance case with a notary, price

After entering into an inheritance, when can you sell a house without tax?

Definition of inheritance, order and main stages of inheritance

Popular

Father married for the second time inheritance (Read 32)

Sample of filling out form p14001 upon entering into inheritance (Read 15)

How to register an inheritance if there are several heirs (Read 14)

Inheritance under a will to a non-relative tax (Read 13)

What documents are needed to donate a summer house in 2020?

In 2020, most of the documents for registering a gift dacha, which were previously included in the list established by the legislator, are not needed. However, since the registration authority has the legal right to require the parties to the transaction to donate any of the documents, we recommend that you prepare in advance all the papers listed below:

- cadastral passport for the donated real estate;

- a receipt for successful payment of the state fee established by the legislator (without this check, your documents will simply not be accepted 100%!);

- passports of the parties to the deed of gift for further identification of their identities;

- gift agreement in three copies (also, sometimes another, fourth copy may be required - if the transaction was accompanied by a notary);

- title and title documents for the property being transferred as a gift;

- power of attorney (if a legal representative of one of the parties participates in the transaction);

- written, notarized consent to donate the dacha of another owner (for example, if the dacha is part of the property jointly acquired by the spouses);

- written consent to conduct the transaction from employees of the guardianship and trusteeship authorities, if the donated property is the property of a minor (under 14 years of age), or a similar written consent of guardians or parents if the child is already 14 years old, but not yet 18 years old.

Donation agreement for a dacha with a plot of land

It is worth remembering that, first of all, donating a dacha means alienating a plot of land and a house! Thus, in order to carry out a transaction, the donor must legally own this property and have the appropriate title documents, the absence of which leads to the nullity of the gift transaction.

Example of lawyers from the website “Legal Ambulance” No. 1

Citizen O. considers himself the legal owner of a dacha (a country house located on a small plot of land). At the same time, this person did not take care of the mandatory registration of ownership of the objects listed above - and, therefore, he does not have title documents to carry out any transactions with this property. However, he himself can continue to use the dacha.

EVERYONE NEEDS TO KNOW THIS:

Donation agreement with a notary - cost in 2020

Example of lawyers from the website “Legal Ambulance” No. 2

No less rare are cases when the owner of a dacha registered only a plot of land, without legally registering the house built on it. In such cases, theoretically, the donor can formalize the donation of the land plot, and the registration of the building will fall on the shoulders of the party receiving the dacha in the future.

Not everyone will agree to accept a gift under such conditions, because there is a chance that when re-registering land ownership, Rosreestr employees will require a certificate stating that there are no buildings on the site!

Expert opinion

Lyudmila Kim

Invited expert: author of the “Child Support” blog, practicing family lawyer, 7 years of experience.

Remember that when drawing up an agreement, the donor is obliged, in addition to a detailed description of the house, to give the same detailed description of the site on which it is located with the obligatory indication of the boundaries of its land survey, the purpose of using the land and its category of purpose.

Today, the document of title for the land plot mentioned in the donation agreement can be an act of granting land for perpetual possession, as well as a lease agreement and a certificate of ownership of the plot.

After mandatory state registration of ownership of the new owner, the donee receives 2 separate certificates of ownership for:

- residential property;

- land plot.

Is it possible to register a plot of land for a minor?

Most modern parents who have received maternity capital are wondering whether it is possible to register a plot of land acquired for construction not for themselves, but for their minor infant child, in order to be able to spend their children’s funds on this particular plot and house. The question is asked whether it is possible to register a plot of land in the name of a minor, especially if this minor cannot write or speak.

- Certificate of ownership of land - an act of donation, purchase and sale, transfer of land by inheritance, exchange;

- Birth certificate of the child, children;

- Passport of both parents, or one of them with the written consent of the other;

- Cadastral passport and extract from it.

Please note => Queue for land in St. Petersburg for large families 2019

How to give a dacha to a relative in 2020

Since the main characteristic feature of donation, which distinguishes it from other methods of alienation of property, is the gratuitous nature of the transaction, gift agreements in our country, as a rule, are concluded between close people (relatives, friends, etc.).

At the same time, the legislator does not impose any additional conditions when registering deeds of gift between relatives, and the process of concluding and registering a transaction is completely similar to that described above:

- the parties draw up a deed of gift, if desired, having it certified by a notary;

- collect a package of necessary documents;

- submit documents to the registration authority;

- receive certified contracts and a certificate of transfer of ownership of the dacha from the donor to the donee.

However, when drawing up an agreement, lawyers recommend additionally indicating in the content the fact that the gift agreement is concluded between close relatives, indicating a list of documents confirming this fact (Rosreestr employees may request them). I think you have already guessed why this is needed.

The thing is that when concluding a gift agreement between close relatives, the recipient is completely exempt from paying income tax (clause 18.1 of Article 217 of the Tax Code of the Russian Federation).

According to Article 14 of the Family Code, the legislator has defined a category of close relatives that fits our case. In 2020 it still includes:

- grandchildren, grandparents;

- parents, as well as children (natural or adopted);

- sisters and brothers (both full and half).

The remaining relatives who are not included in this list are considered distant and must pay personal income tax within the period established by the legislator.

Inheritance of several real estate objects

You can inherit any real estate: dachas, cottages, apartments, land plots. An exception to the rule established by law, according to which, for example, country real estate, land and water (ponds and lakes) are inherited, is only something that is determined by the personal characteristics of the one who transfers the inheritance. As an example - plans, religious beliefs, the need to pay alimony.

But the rights of the heir or heirs regarding membership in commercial and non-profit associations may well be inheritable. Let's say we are talking about a garden plot - real estate here is most often small country houses - you can inherit it, and the process of transferring rights does not take much time.

The plots for construction (individual housing construction) purchased by the testator are also inherited - the problem is only by whom and to what extent (share). In cases where difficulties arise in determining who should inherit a particular piece of real estate, it makes sense to turn to the Civil Code of the Russian Federation. It spells out in sufficient detail all the instructions on the right of priority in the matter of receiving an inheritance in the form of real estate.

However, it should be taken into account that there are some restrictions on the inheritance of country real estate: they are stipulated either by the charters of commercial and non-profit organizations, as well as by special legislative acts - created precisely to describe special cases of inheritance.

Thus, problems may arise when trying to transfer the land around the house to children by will, if it was only leased and not owned. In this case, if the owner had other relatives besides the heir, you should be prepared for the fact that registering an inheritance could turn into a real headache.

Therefore, before you start registering an inheritance for a dacha or plot of individual housing construction, SNT or private subsidiary plots, it is worth carefully studying the Civil Code, in the part where inheritance issues are considered.

What is the best material to build a house for permanent residence (permanent residence) from? Comparison of materials

We insulate the dacha. How to turn a country house into a cottage for winter living?

How to choose the right townhouse? What to look for when choosing?

Gas services want to be allowed to enter apartments without the consent of residents

Distant dachas in the Moscow region. What surprises can buyers expect?

We create a new lawn on our site. Right place, type and time

In which areas of the Moscow region are the most expensive and cheapest land plots?

How does transport accessibility affect the choice of suburban real estate?

In one language: Dictionary of basic business terms in real estate

Rust on the fence, gate and railings. How to get rid of it?

Taxation of a dacha donation agreement in 2020

Based on the information contained in Article 207 of the Tax Code of the Russian Federation, real estate donation transactions are subject to tax, the amount of which currently amounts to 13% of the total value of the transaction, that is, the cost of the dacha.

The cadastral value of real estate, in accordance with paragraph 1 of Article 402 of the Tax Code of the Russian Federation, is included in the tax base for the mandatory payment of personal income tax. At the same time, this value cannot differ greatly from the real market value of the same object (or the gift itself after an appropriate assessment) and be lower than it by more than 20%!

EVERYONE NEEDS TO KNOW THIS:

Responsibility for deed of gift

Also, it is worth noting that if a close relative, exempt from taxation, decides to sell the dacha within three years from the date of transfer of ownership to him, he will have to pay 13% of the cost of the property.

Donees who are distant relatives, like strangers acting in this role, must pay personal income tax in full, without any special deductions. The Tax Code of the Russian Federation establishes the deadlines within which such recipients should prepare and submit a declaration to the tax office (until April 30 and until July 15 of the following year, which follows the year of the donation transaction).

An example from the practice of lawyers on the website “Legal Ambulance”

Citizen Ryzhikova O. wanted to give her nephew a dacha - a small house with a plot of land, the cadastral value of which was 1,500,000 Russian rubles. Since the aunt and nephew, according to the above rule, are not considered close relatives, the donee had to pay income tax according to the following formula:

1,500,000 Russian rubles x 13% = 195 Russian rubles

Moreover, if these citizens formalize the purchase and sale (provided that the dacha has been owned by the donor for more than 3 years), there will be no need to pay personal income tax. If this property was owned by Ryzhikova for less than three years, you will have to pay an amount that will still be less than when registering a deed of gift:

1,500,000 Russian rubles - 1,000,000 Russian rubles (tax deduction) = 500,000 Russian rubles x 13% = 65,000 Russian rubles